- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Utilization thresholds on dirty scorecards !?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Utilization thresholds on dirty scorecards !?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Utilization thresholds on dirty scorecards !?

Does anyone know how utilization and utilization thresholds differentiate on clean vs dirty profiles? Do the thresholds apply to clean profiles only ? Is there any data to support how utilization thresholds affect dirty scorecards as opposed to clean ones ?

Experian: 671

Equifax: 666

Transunion: 673

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization thresholds on dirty scorecards !?

I do not think the threshholds are different between clean and dirty. There is tons of information on this topic throughout the forums. The big issue is that it is difficult to know 100%. here is some info for reading with references to the FICO 8 scorecards:

I'm in a dirty scorecard and do see improvements in scores as my util goes down.

JOINED 4/2020

FICO 8 = 582, 620, 589 / Mortgage = 633, 526, 581

CURRENT PEAK *Thanks to the MF Community!

FICO 8 = 715, 711, 720 / Mortgage = 688, 696, 681

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization thresholds on dirty scorecards !?

@TheKid2 wrote:I do not think the threshholds are different between clean and dirty. There is tons of information on this topic throughout the forums. The big issue is that it is difficult to know 100%. here is some info for reading with references to the FICO 8 scorecards:

I'm in a dirty scorecard and do see improvements in scores as my util goes down.

Utilization thresholds should be the same. However, the score response to changes in utilization is scorecard dependent. Each scorecard, clean and dirty, has its algorithms "tuned". Thus, depending on which scorecard your profile resides, your score can change more or less relative to someone elses for a similar change in utilization.

Crossing "thresholds" do not always result in a score change. For example, a given profile with an open installment loan (mortgage) may not experience score drops when a card crosses above 29%, 49% or 69% utilization. However, once the loan was paid off and closed, the same file at some later date now experiences changes in score at a similar change in a card's utilization. The presence of the open installment loan muted the impact of utilization.

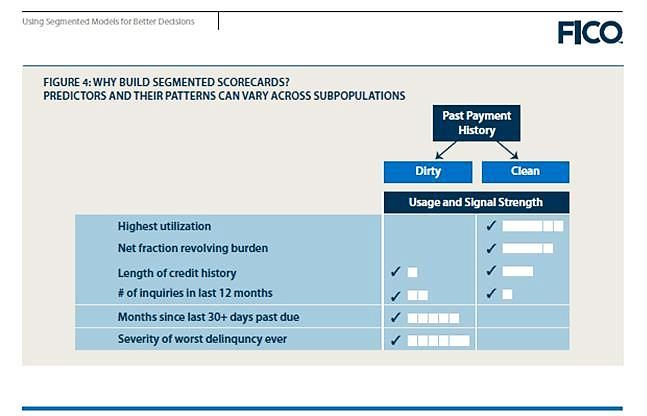

See below on signal strength. This was from a presentation for use as an illustration - not an accurate representation. Utilization, in reality, does influence dirty scorecard scores as mentioned above. However, it may be given less weight in total score.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950