- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: VS 3.0 AZEO vs AZE2 & tiny utilization?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

VS 3.0 AZEO vs AZE2 & tiny utilization?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

VS 3.0 AZEO vs AZE2 & tiny utilization?

This is probably a great question for TT that understands the VS 3.0 algorithm well, or anyone else in the know.

I find my VS 3.0 scores seem to fluctuate +13 points, -13 points rather often, seemingly always due to reported balance changes; 9 times out of 10 I see 823 --> 836 and then 836 --> 823.

For the last handful of months when experiencing this 13-point yo-yo, I'm always at AZEO or AZE2 (never AZ). The reported balance on the AZEO card or AZE2 cards is always small, (say) $5-$300 or so and always in the 1%-2% utilization range. For example, currently I'm at AZEO and that AZEO card has a $5 reported balance on a $10k limit. While my FICO scores are currently maximized with my profile in this state, my VS 3.0 scores are at the -13 (823) mark.

I guess my question here is what factor is it exactly from the VS 3.0 lens that's causing the 13 point drop? I'm thinking it's one of two things:

1 - A balance that's too small (like .0005%) is "ignored" by VS 3.0 where it's rounded up and "seen" as 1% by FICO algorithms.

2 - VS 3.0 prefers AZE2 to AZEO; maybe the times I've been at the +13 (836) score I've had 2 reported non-zero balances and haven't noticed.

Any insight here is appreciated.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: VS 3.0 AZEO vs AZE2 & tiny utilization?

Hi BBS. It would be interesting if you could execute a number of test scenarios. For example, comparing....

(1) Extremely low utilization. E.g. exactly one card with a $5 balance with that card having a 10k limit.

(2) Very low but not crazy low. E.g. total CC debt > $101 and total utilization at 0.52% and individual utilization at > 1.01%. Still AZEO as with scenario #1 above.

If #2 gave regularly gave you a significantly better score, then it would be strong evidence in favor of the rounding hypothesis (or the hypothesis that ultra tiny dollar values affect the score, which could be true apart from utilization percentages).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: VS 3.0 AZEO vs AZE2 & tiny utilization?

I find this interesting because my scores only fluctuates 2 -3 points regularly. When I report 1% UTL or less (always rounded to 1%) my score rises to 829 or 830, regardless of number of accounts reporting, never more than 5/12 (3cc & 2 loans), usually 4 reporting. Anytime I hit 2% UTL (aggregate) my score drops to 827. Never any single card over 18%. Although, since monitoring my VS3 scores and my activity this is the 1st time I had a single card report as high as 18%. But I've seen this drop previously with less than 9% on a single card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: VS 3.0 AZEO vs AZE2 & tiny utilization?

I paid the AZEO 5 buck balance to zero today and it will report in a couple of days. A few days after that I've got a couple of other cards reporting, so I'll try and get one to report in the .51-1% utilization range and see what happens. If that doesn't work, I'll go for 1.01%+ the next time.

I've never really looked into my VS 3.0 scores and what impacts them, so this will be a fun little test.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: VS 3.0 AZEO vs AZE2 & tiny utilization?

I know we're in very different bins/scorecards, but maybe this data I collected will help.

All cards with a balance was a positive change for me on VS3. Maybe it's the low utilization as well.

(That TU VS3 score actually skyrocketed +84 points to 713 with the SSL at 8.47%, before the loan reported closed and dropped 41 points.)

|

| mF 1B CK | Δ | CCT 3B | Δ | mF 3B CK | Δ | mF 3B CK CCOM | Δ | mF 3B CK |

|

|

| Loan utilization changed from 17% to 8.47%

1 new inq at TU on 12/20, now 2 under 1yr |

| 1 new inq at EX/EQ on 12/23 after the CCT 3B report |

| Loan closed!

2 new revolving accounts

1 of 2 cards reporting 2% util with 1% total util. |

| Both cards (100%) reporting 7% util with 7% total util.

1 inq aged past 1 year on TU

The -3 on EX F8 happened before any new statement balances reported. |

|

12/04 | Δ | 12/23 | Δ | 12/31 | Δ | 01/18 | Δ | 02/08 | ||

VS3 | EQ | 658 |

|

| -17 | 641 | +35 | 676 | +9 | 685 |

VS3 | TU | 634 |

|

| -5 (1 inq) | 629 | +43 | 672 | +8 | 680 |

VS3 | EX |

|

|

|

|

|

| 676 | credit.com update Feb 14 | ? |

F8 | EQ |

|

| 750 | -20 | 730 | -46 | 684 | -3 | 681 |

F8 | TU | 666 | +62 | 728 |

| 728 | -39 | 689 | +6 | 695 |

F8 | EX |

|

| 748 | -19 | 729 | -30 | 699 | -3 | 696 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: VS 3.0 AZEO vs AZE2 & tiny utilization?

@Anonymous wrote:Hi BBS. It would be interesting if you could execute a number of test scenarios. For example, comparing....

(1) Extremely low utilization. E.g. exactly one card with a $5 balance with that card having a 10k limit.

(2) Very low but not crazy low. E.g. total CC debt > $101 and total utilization at 0.52% and individual utilization at > 1.01%. Still AZEO as with scenario #1 above.

If #2 gave regularly gave you a significantly better score, then it would be strong evidence in favor of the rounding hypothesis (or the hypothesis that ultra tiny dollar values affect the score, which could be true apart from utilization percentages).

Best I can tell VS3 does not have a scoring attribute for # cards with balances. Also, not sure it has an all cards at zero balance penalty either. As I recall EW800 almost always reports AZEO with a token balance on one card and has VS3 scores of 839. So, an ultra low balance is not likely a root cause for your score drop.

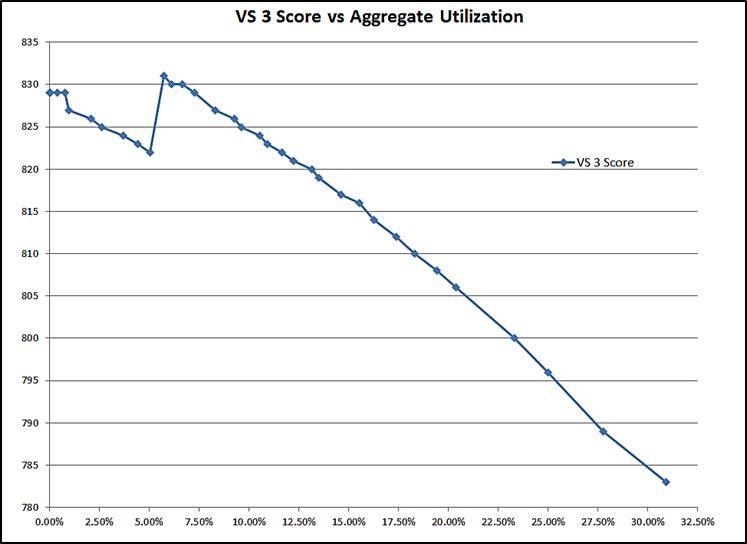

I do think it would be insightful for you to use the VS3 simulator - particularly now that your score is lower. Increment your total balance up and record what the simulator predicts. I have plotted this a couple times and see a local spike up with my profile in the 4.0% to 5.5% UT range. VS3 does have multiple scorecards and undoubetedly each scorecard treats attributes a bit differently. Not sure how profiles are treated by scorecard.

It appears probable that something else is triggering the 13 points up/down shift. At one time I posted a link to all VS reason codes - there are quite a few. A review of their reason codes could add insight. I can't find the link but you can likely still find the list through a search.

VantageScore does score inquiries for a full two years and appears to discount derogs earlier than Fico based on EW800's TU recent Fico and VantageScore data. Also, VantageScore always considers AU cards and appears to look at charge cards as well. Below are the primary scoring categories for VS3.

...

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: VS 3.0 AZEO vs AZE2 & tiny utilization?

Here is some other info on VantageScore. Interesting comments on charge cards and loans.

Note the differentiation in loans starting with VS2.

I have one loan, a 15 year mortgate on file. Back in 2015 my installment B/L was between 50% and 60%. Below are some of my negative reason statements relative to VS3 (from a 3B TU report). Clearly VS is looking for more loans at a lower B/L ratio. Had one HP on EQ - over 12 months but less than 24 months age. VS3 scores were in the low 830s.

...

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: VS 3.0 AZEO vs AZE2 & tiny utilization?

@Thomas_Thumb wrote:Best I can tell VS3 ndoes not care have a scoring attribute for # cards with balances. Also, not sure it has an all cards at zero balance penalty either. As I recall EW800 almost always reports AZEO with a token balance on one card and has VS3 scores of 839. So, an ultra low balance is not likely a root cause for your score drop.

I do think it would be insightful for you to use the VS3 simulator - particularly now that your score is lower. Increment your total balance up and record what the simulator predicts. I have plotted this a couple times and see a local spike up with my profile in the 4.0% to 5.5% UT range. VS3 does have multiple scorecards and undoubetedly each scorecard treats attributes a bit differently. Not sure how profiles are treated by scorecard.

In using the simulator, it shows the breakpoint being a $108 balance. A $107 balance (or less) shows me the lower score, a $108 balance up to $423 shows me the +13 score. $424 results in a 1 point drop, then there are additional 1-2 point drops at different points higher than that. So, the simulator is telling me that having my aggregate utilization at .00058% - .00227% is ideal. Going just under that range, .00057%, results in a 13 point drop.

I know in the past TT you've suggested that 5% or so aggregate utilization may be ideal for VS 3.0, but personally my aggregate has never been that high (usually .1%-2%) when I've seen my top 836-837 scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: VS 3.0 AZEO vs AZE2 & tiny utilization?

@Anonymous wrote:

@Thomas_Thumb wrote:Best I can tell VS3 ndoes not care have a scoring attribute for # cards with balances. Also, not sure it has an all cards at zero balance penalty either. As I recall EW800 almost always reports AZEO with a token balance on one card and has VS3 scores of 839. So, an ultra low balance is not likely a root cause for your score drop.

I do think it would be insightful for you to use the VS3 simulator - particularly now that your score is lower. Increment your total balance up and record what the simulator predicts. I have plotted this a couple times and see a local spike up with my profile in the 4.0% to 5.5% UT range. VS3 does have multiple scorecards and undoubetedly each scorecard treats attributes a bit differently. Not sure how profiles are treated by scorecard.

In using the simulator, it shows the breakpoint being a $108 balance. A $107 balance (or less) shows me the lower score, a $108 balance up to $423 shows me the +13 score. $424 results in a 1 point drop, then there are additional 1-2 point drops at different points higher than that. So, the simulator is telling me that having my aggregate utilization at .00058% - .00227% is ideal. Going just under that range, .00057%, results in a 13 point drop.

I know in the past TT you've suggested that 5% or so aggregate utilization may be ideal for VS 3.0, but personally my aggregate has never been that high (usually .1%-2%) when I've seen my top 836-837 scores.

It looks like you found an anomoly at a very low utilization point. I did not pick up the very low UT% spike in my below test - but that was not a focal point in my simultion. I've never been down in the 0.1% range on UT because I only pay balances after statements cut. I'm typically in the 1.0% to 5% range but, been as high as 8.5% since tracking.

Although you never report in the 5% range I'd be interested in seeing if the simulator gives you a score spike in that 4% to 5.5% range. It's a narrow band so you would need to check at 0.2% increments. I'd like to see if someone else sees this spike. It's also possible the spike anomoly is influenced by balance history. Six months from now you may see a spike UT% shift just as I did when comparing against a simulation from a couple years ago.

BTW - It does appear the UT% simulation result has some correlation to real world results as you have seen.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: VS 3.0 AZEO vs AZE2 & tiny utilization?

I'll go through tonight and throw a bunch of different numbers into the simulator and report back.