- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Why did my scores increase 30+ points on all t...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Why did my scores increase 30+ points on all three CBs?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why did my scores increase 30+ points on all three CBs?

@iv wrote:

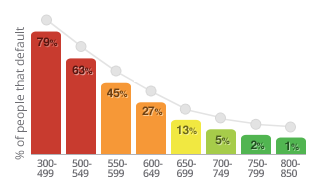

@Anonymous wrote:2. A drop in Risk Factor from 5% and 13% to 2% across the board

That's an effect, not a cause.

Moving up to a new score range causes the system to display the related risk of default associated with that score range.

It's not a factor in the score moving up, just a displayed side effect of the fact that it DID move.

See the assoicated chart from MyFICO:

Thanks IV! Well...that makes sense. The 30-35 points increase put me in a different score range which cause me to be view "less risky". Got it! ![]()

Care to shed some light on #4? ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why did my scores increase 30+ points on all three CBs?

@Anonymous wrote:Thanks IV! Well...that makes sense. The 30-35 points increase put me in a different score range which cause me to be view "less risky". Got it!

Care to shed some light on #4?

That's the % of Accounts Paid as Agreed question?

I don't have direct experience on that topic (no late payments), but as far as I know, that % is not directly a scoring factor, just an informational display.

In other words, the effect of having 5 postive accounts and one with a 30-day late is exactly the same as having 10 postive accounts and the same 30-day late. (To the best of my knowledge, anyway. Could be wrong.... not something I'm going to go test!)

As for your overall question:

Are you sure that the initial reporting of your installment loan, and the current reporting of your installment loan are the same?

Sometimes the first report of a tradeline is incomplete (or in this case, could have reported at 100% util), and the following month's update could provide full data (or your paid-down amount), and thus the full scoring impact. In other words, was the initlal gain just from credit mix, and the following gain from credit mix + low installment util?

EQ9:847 TU9:847 EX9:839

EQ5:797 TU4:807 EX2:813 - 2021-06-06

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why did my scores increase 30+ points on all three CBs?

@iv wrote:Are you sure that the initial reporting of your installment loan, and the current reporting of your installment loan are the same?

Good observation.

LOTR's EQ alert for the 35 point increase was received on February 1st. The 3B report was pulled on Feb 2nd. I'm wondering if it is realistic for all 3 CRA's to have updated by the second, if Alliant reported on January 31st.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why did my scores increase 30+ points on all three CBs?

@iv wrote:

@Anonymous wrote:Thanks IV! Well...that makes sense. The 30-35 points increase put me in a different score range which cause me to be view "less risky". Got it!

Care to shed some light on #4?

That's the % of Accounts Paid as Agreed question?

Yes.

I don't have direct experience on that topic (no late payments), but as far as I know, that % is not directly a scoring factor, just an informational display.

In other words, the effect of having 5 postive accounts and one with a 30-day late is exactly the same as having 10 postive accounts and the same 30-day late. (To the best of my knowledge, anyway. Could be wrong.... not something I'm going to go test!)

Totally makes sense and agrees with what I am seeing as I have had no lates or negatives before or after the three 30-day lates I mentioned earlier. So the percentage just changed based on the increase of accounts reporting.

As for your overall question:

Are you sure that the initial reporting of your installment loan, and the current reporting of your installment loan are the same?

Yes, I am sure. In fact, the intial TU 17pt increase, EQ 18pt increase, and EX 20pt increase showed in Jan 8th-12th alerts not only indicated a new account added but also contained the balance of $42 of $500 (the amount I paid it down to before the first due date) in the same alerts (one alert for each CB, received a few days apart).

Sometimes the first report of a tradeline is incomplete (or in this case, could have reported at 100% util), and the following month's update could provide full data (or your paid-down amount), and thus the full scoring impact. In other words, was the initlal gain just from credit mix, and the following gain from credit mix + low installment util?

From best I can tell and I feel pretty sure of this, the initial gain was from the credit mix + the low installment util. I feel 100% about this as the balance of the Alliant account on the February 2017 3B report is still $42 - as I did not make any more payments on it since the initial payment. So the amount reported in the mid-Jan alerts is the same amount that was reported in the Feb 3B report - namely $42.

[edited} Oops... I lied. I did make a small payment to test an auto payment. That payment has not yet reported from January's activity. This further confirms that the mid-January scores reflect the credit mix + initial the low util. Otherwise, the balance on February report would be $40 not $42.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why did my scores increase 30+ points on all three CBs?

@JLK93 wrote:

@iv wrote:Are you sure that the initial reporting of your installment loan, and the current reporting of your installment loan are the same?Good observation.

LOTR's EQ alert for the 35 point increase was received on February 1st. The 3B report was pulled on Feb 2nd. I'm wondering if it is realistic for all 3 CRA's to have updated by the second, if Alliant reported on January 31st.

Just to clarify timing, Alliant was opened in December. It was early/mid January that Fico alerted me of the new Alliant account being added. The first 3B report pulled with the Alliant account listed was in Feb 2017.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why did my scores increase 30+ points on all three CBs?

@Anonymous wrote:BBS, thank you for answering this! Now I know my file is considered a old/thick file. And even before adding the accounts, it would have been considered so.

Just to clarify it, so at what point does a file cross over from young to old? 3 years? 7 years? Just wondering. You've basically answered this question for thin/thick - which seems to be having 5 or so accounts being the consensus threshold

Again, thanks!

I think this question is a bit tougher to answer and there's more room for debate on it. Unlike thickness which is only comprised of one variable, number of accounts, age is comprised of 2 or even 3 variables: AAoA, AoOA and AoYA. I would think most wouldn't really consider youngest account, but the first two variables can be interpreted and/or weighed differently by different people. And of course there's the FICO algorithm as well. Someone can have an AAoA of 4 years and have their AoOA be 4 years as well. If TT is around he can chime in on the upper limits (best positions) of each of these, but shooting from the hip I think an AAoA of 8-10 years and a AoOA of 10-12 years is about all you need for maximum FICO scoring and maximum consideration of an "old" file. I would think numbers of about half that, though, would be the start of where a file could be considered "aged" or "old" ... say an AAoA of 4-5 years and an AoOA of slightly longer than that.