- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- question about high credit lines excluded from FIC...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

question about high credit lines excluded from FICO8 scoring

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: question about high credit lines excluded from FICO8 scoring

That sounds like a fair assessment to me above. You don't have access to the other mortgage scores for comparison purposes, right? I think you just get your score updates from EX?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: question about high credit lines excluded from FICO8 scoring

@Anonymous wrote:That sounds like a fair assessment to me above. You don't have access to the other mortgage scores for comparison purposes, right? I think you just get your score updates from EX?

I do have access to them through MyFICO.

Their results aren't as fascinating.

EQ FICO 5 is 15 points lower than EQ FICO 8.

TU FICO 4 is 4 points higher than TU FICO 8.

Here are the negative reason codes:

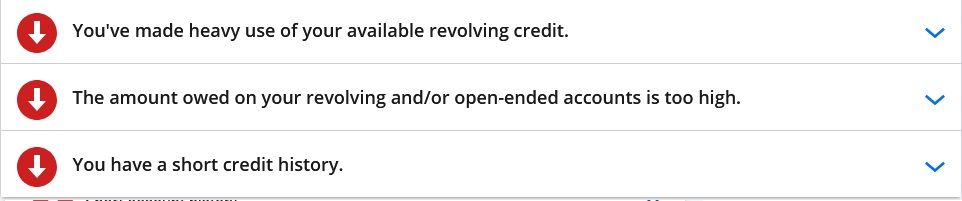

EQ FICO 8:

[Unfortunately not available in the same format for some reason]

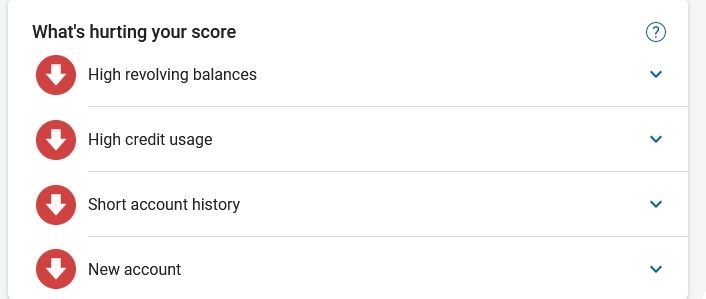

EQ FICO 5:

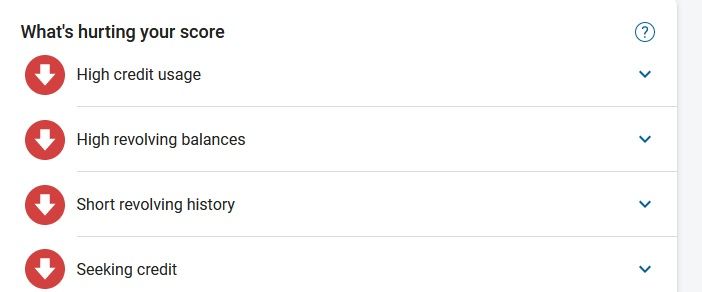

TU FICO 8:

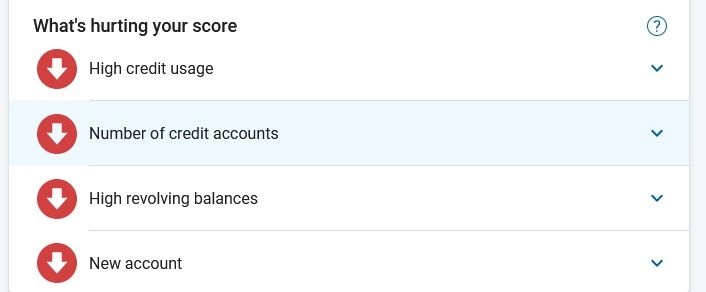

TU FICO 4:

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: question about high credit lines excluded from FICO8 scoring

@tacpoly Thank you very much. So now we know for $28,000 limit will work for EX2 so that means the cut off is between $28000 and 29,000.

For some reason I had $27,000 stuck in my head, but you said the limit on that card was $28,000 correct? So that means the cut off for EX2 is over $28,000.

I need to go back and see if I can find the thread that narrowed it down to $26 to $29,000 and see if $29,000 was excluded, if so this may be the cut off.

@Anonymous we were just in a thread recently and I was stating $27,000 when I should've stated $28,000. do you recall what thread that was so I can correct it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: question about high credit lines excluded from FICO8 scoring

@SouthJamaica here's where we discussed it before. What happens is they're excluded from Revolving Balances it appears, but not utilization, now that we know more.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: question about high credit lines excluded from FICO8 scoring

@Anonymous wrote:

@Anonymous we were just in a thread recently and I was stating $27,000 when I should've stated $28,000. do you recall what thread that was so I can correct it?

Honestly I don't. Perhaps Rem does, I think he was involved in the discussion as well?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: question about high credit lines excluded from FICO8 scoring

Today I got buried, losing 7 points in both EX FICO 2 and FICO 8, when one of my large limit (30k) credit union accounts went from under 50% to over 50%. The reason codes yesterday and today were identical in both scoring metrics. And the experian.com site listed the correct number of "accounts with balances", excluding none of my credit union accounts and none of my larger limit accounts.

The theories which some of you espouse, that credit union accounts are disregarded for some purposes, and that larger limit accounts are disregarded for some purposes, are simply theories, and for me they do not hold water.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: question about high credit lines excluded from FICO8 scoring

@SouthJamaica wrote:Today I got buried, losing 7 points in both EX FICO 2 and FICO 8, when one of my large limit (30k) credit union accounts went from under 50% to over 50%. The reason codes yesterday and today were identical in both scoring metrics. And the experian.com site listed the correct number of "accounts with balances", excluding none of my credit union accounts and none of my larger limit accounts.

The theories which some of you espouse, that credit union accounts are disregarded for some purposes, and that larger limit accounts are disregarded for some purposes, are simply theories, and for me they do not hold water.

@SouthJamaica maybe you misunderstand? The high credit limit cutoff does not exclude an account from revolving utilization nor number of accounts with a balance. So, of course it would show up in your utilization and number of accounts with a balance!

It excludes them from revolving balances, which are what used to trigger the AZ loss. Now if you would like to prove to yourself that it's not a theory, really all you have to do is go back and read the old thread where you got the no revolving activity code when you had No balances on cards with credit limits under the cut off for EX2.

The fact that you will get an AZ loss when you have no balance on a card below the cut off for EX2, and the negative reason code shift is explicit. So are the plethora of data points proving it.

But we can agree to disagree my friend.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: question about high credit lines excluded from FICO8 scoring

So to clarify: I believe you will lose points for increased utilization even on cards that are beyond the cutoff because they are excluded from balances, not utilization. Otherwise you wouldn't still get the high credit usage code which refers to utilization, I believe.

As for credit union cards I cannot state conclusively either way. I just know there have been some irregularities with some of them reporting, but it has not been isolated and it’s not conclusive. It’s just something to keep an eye out for.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: question about high credit lines excluded from FICO8 scoring

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: question about high credit lines excluded from FICO8 scoring

@Anonymous wrote:

@SouthJamaica wrote:Today I got buried, losing 7 points in both EX FICO 2 and FICO 8, when one of my large limit (30k) credit union accounts went from under 50% to over 50%. The reason codes yesterday and today were identical in both scoring metrics. And the experian.com site listed the correct number of "accounts with balances", excluding none of my credit union accounts and none of my larger limit accounts.

The theories which some of you espouse, that credit union accounts are disregarded for some purposes, and that larger limit accounts are disregarded for some purposes, are simply theories, and for me they do not hold water.

@SouthJamaica maybe you misunderstand? The high credit limit cutoff does not exclude an account from revolving utilization nor number of accounts with a balance. So, of course it would show up in your utilization and number of accounts with a balance!

It excludes them from revolving balances, which are what used to trigger the AZ loss. Now if you would like to prove to yourself that it's not a theory, really all you have to do is go back and read the old thread where you got the no revolving activity code when you had No balances on cards with credit limits under the cut off for EX2.

The fact that you will get an AZ loss when you have no balance on a card below the cut off for EX2, and the negative reason code shift is explicit. So are the plethora of data points proving it.

But we can agree to disagree my friend.

Yes I did misunderstand what you were saying.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682