- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: should i get a installment loan?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

should i get a installment loan?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

should i get a installment loan?

Hi im new to this, but here is my situation, i had a credit history but did not use any credit for 2 years and my credit union pulled a credit report on me in 3-16 and showed a fico score of 0. anyway they gave me a unsecured credit card with 500 dollar credit limit and they have been reporting to all 3 bureau. i was told i should have a fico score after 6 months of having credit card. its been 3 months now and i was planning to get a auto loan at the end of 6 months, should i keep just the revolving account and wait 6 months or should i get an installment loan now to have a better mix of credit?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: should i get a installment loan?

I'm not sure I'd try to get the installment loan, being that you still may not really have much of a score. I'd grow that card the next 3 months. It may help if you were able to get another card, even if it's like a secured from Cap1. You would gain faster results by having at least 2. Some say 3.

| Total CL: $321.7k | UTL: 2% | AAoA: 7.0yrs | Baddies: 0 | Other: Lease, Loan, *No Mortgage, All Inq's from Jun '20 Car Shopping |

BoA-55k | NFCU-45k | AMEX-42k | DISC-40.6k | PENFED-38.4k | LOWES-35k | ALLIANT-25k | CITI-15.7k | BARCLAYS-15k | CHASE-10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: should i get a installment loan?

I agree that trying to scoop up another revolver or 2 would be most beneficial right now so you get more positive accounts on your report. I'd wait on the installment loan. The installment loan will give you maybe a 20-25 point boost on your score, but as of now you don't even have a score so it shouldn't be a worry.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: should i get a installment loan?

Ok thnx for the advice, I was just trying to do anything to max out my points at the end of 3 more months

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: should i get a installment loan?

@Anonymous wrote:Hi im new to this, but here is my situation, i had a credit history but did not use any credit for 2 years and my credit union pulled a credit report on me in 3-16 and showed a fico score of 0. anyway they gave me a unsecured credit card with 500 dollar credit limit and they have been reporting to all 3 bureau. i was told i should have a fico score after 6 months of having credit card. its been 3 months now and i was planning to get a auto loan at the end of 6 months, should i keep just the revolving account and wait 6 months or should i get an installment loan now to have a better mix of credit?

If you are planning on getting an auto loan then don't get an installment loan. The auto loan will play the same role as an installment loan. As another poster suggested, try to get at least two revolving credit lines in the mix.

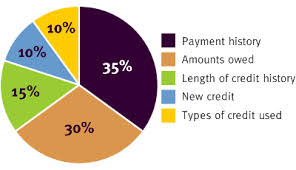

That plus the auto loan should give you a good boost. Here is how scores are calculated incase have haven't seen the pie chart.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: should i get a installment loan?

alright so i applied for a capital one mastercard and got approved, so now i have a visa and a mastercard and 1 more inquiry. should i worry about the 1 inquiry or will the new credit card make up for it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: should i get a installment loan?

@Anonymous wrote:alright so i applied for a capital one mastercard and got approved, so now i have a visa and a mastercard and 1 more inquiry. should i worry about the 1 inquiry or will the new credit card make up for it?

Congrats on the approval. No, the credit card won't make up for it that is why you have to be strategic in your approach when getting credit cards. After one year, the inquiry won't have much of an effect.

Moving forward, treat the cards well, make payments on time etc. and you will be fine.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: should i get a installment loan?

While I agree that the OP shouldn't just add an installment loan for the heck of it at this time, I disagree that the auto loan that he's planning to add will have the same effect... at least not at first. With the share secure loan technique one takes their loan to 9% of the original balance almost instantly which gives the common 20-25 point boost give or take. With an auto loan, typically one's balance will be a high percentage of the original balance for the first year or two. While adding the auto loan may help the credit mix, the balance on it for the first few years would keep the scores from seeing the boost that they'd see from the share secure loan technique. One the auto loan reaches 9% of the original balance I agree the result will be the same, but that would take years longer to achieve depending on the term of the auto loan.