- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: what is Utilization of revolving accounts(s) t...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

what is Utilization of revolving accounts(s) too high ?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

what is Utilization of revolving accounts(s) too high ?

''Utilization of revolving accounts(s) too high'' i like to know what is too high ? You'll see it writen here which is odd because my overall utilization is 7%. And only have 3 accounts out of 13 with balances ! maybe an old score ? i thought score go up to 850.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: what is Utilization of revolving accounts(s) too high ?

FBNO is an EX FICO 8 Bankcard Enhanced score which is why it has the differing score range than the traditional baseline models.

Hard to say what's too high in that one as Bankcard Enhanced isn't a score most members have access to regularly (and those that do, may not be testing rigorously and certainly not as easy to do as with something like Scorewatch); do you happen to know what balances you have reported on EX currently? Would note that on the ordered list 1-4 of "reasons your score ain't higher" something in that 4th slot is pretty irrelevant to your actual score.

The interesting one is the "Proporation of loan balances to loan amounts is too high" in my book; like the CC one, do you know what the current vs. original balances are on your installment history?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: what is Utilization of revolving accounts(s) too high ?

@Revelate wrote:FBNO is an EX FICO 8 Bankcard Enhanced score which is why it has the differing score range than the traditional baseline models.

Hard to say what's too high in that one as Bankcard Enhanced isn't a score most members have access to regularly (and those that do, may not be testing rigorously and certainly not as easy to do as with something like Scorewatch); do you happen to know what balances you have reported on EX currently? Would note that on the ordered list 1-4 of "reasons your score ain't higher" something in that 4th slot is pretty irrelevant to your actual score.

The interesting one is the "Proporation of loan balances to loan amounts is too high" in my book; like the CC one, do you know what the current vs. original balances are on your installment history?

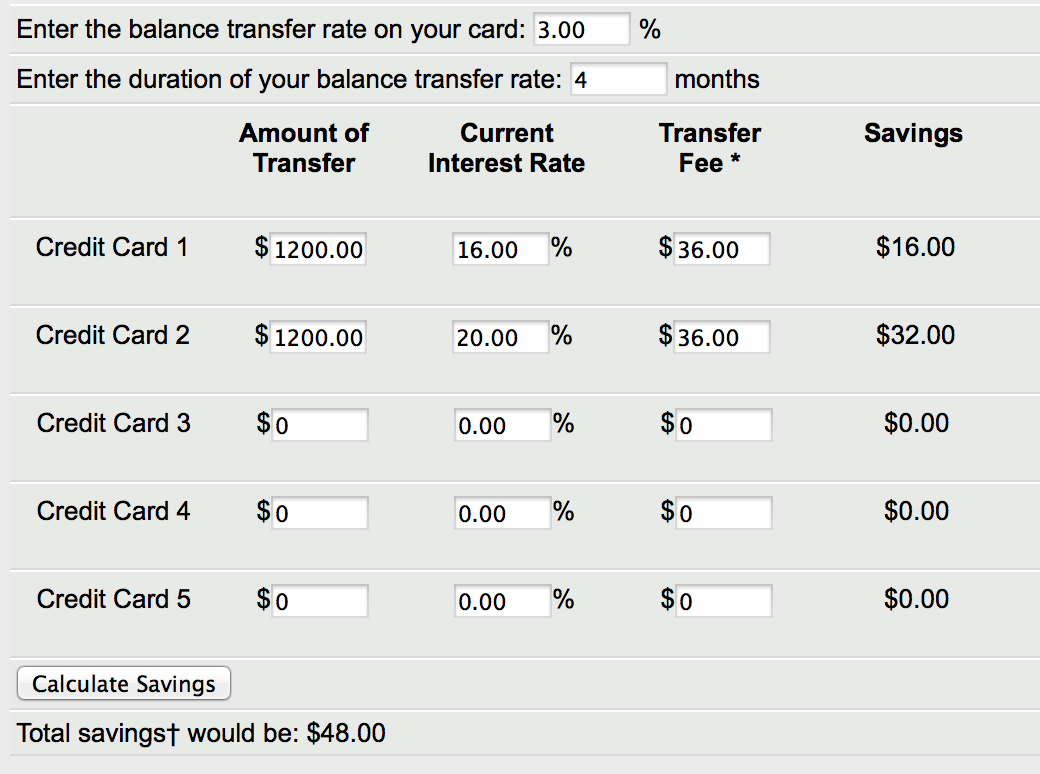

yeah my car loan is $13,000 its now $10,000. i only had it for a year. that is why i canceled my NASA refinance because i thought maybe be better i cotinue to pay it rather than getting it refinanced after just 1 year of history paying an installment loan. My EX is reporting everyhting. It's 746 on myfico however what FBNO gave me is 753. i don't really care though because i obviously got the credit card. It got my attention because too many accounts with balances'' so i was going to throw 2 cards i have balances onto 1 card (FNBO) as a balance transfer but then it would be over 50% of my credit limit so that is why i was questioning what is ''high balance on resolving accoutns'' but even if i did a balance transfer it says i will only save $48 which makes me wonder if doing a balance transfer justifiable.