- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: App Sprees ?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

App Sprees ?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: App Sprees ?

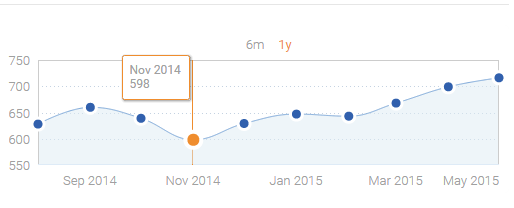

I found a graph of my 40 store card app spree "new account ding". I guess a "ding" would be an understatement, more like a slegehammer to the credit. ![]()

It does get pretty ugly for sure:. It's a CK FAKO score so the scores are not accurate but you can get a jist of what happens when you add a ton of new credit at once.

My "Real" FICO dropped to around 613 at that low point and First Premier probably would have denied me.

If you're going on an app spree, just know you're gonna have some serious gardening to do after ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: App Sprees ?

@Anonymous wrote:Funny part is, I see lots of app sprees by people with perfect credit who can afford to take the hit on their credit more than someone starting out. Someone starting out sees this, figures this is the way to go, despite their credit not being able to support it, and they wind up in deeper trouble.

I'm one of those who believes you apply for the cards that suit you best. For me that's 4 or 5, for others it may be more. Unfortunately for the 50+ card crowd, bankruptcy attorneys don't accept credit as payment.

Are you implying that someone who has 50 cards is automatically doomed to bankruptcy?

Also, what stops one from taking a cash advance for the attorney? ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: App Sprees ?

@Anonymous wrote:Funny part is, I see lots of app sprees by people with perfect credit who can afford to take the hit on their credit more than someone starting out. Someone starting out sees this, figures this is the way to go, despite their credit not being able to support it, and they wind up in deeper trouble.

I'm one of those who believes you apply for the cards that suit you best. For me that's 4 or 5, for others it may be more. Unfortunately for the 50+ card crowd, bankruptcy attorneys don't accept credit as payment.

@Anonymous,

Can you enlighten us on this comment - see blue. We are all hear to learn so what exactly do you mean by that?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: App Sprees ?

It means of course that those of us who choose to have more cards than fingers and toes are certain to be in financial ruin. ![]()

See ya in the funny pages!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: App Sprees ?

@Anonymous wrote:

@Anonymous wrote:Funny part is, I see lots of app sprees by people with perfect credit who can afford to take the hit on their credit more than someone starting out. Someone starting out sees this, figures this is the way to go, despite their credit not being able to support it, and they wind up in deeper trouble.

I'm one of those who believes you apply for the cards that suit you best. For me that's 4 or 5, for others it may be more. Unfortunately for the 50+ card crowd, bankruptcy attorneys don't accept credit as payment.

Are you implying that someone who has 50 cards is automatically doomed to bankruptcy?

Also, what stops one from taking a cash advance for the attorney?

Certainly not everybody is doomed for BK with that many, but there are a select few people who can handle that kind of credit. The ones that don't will wind up there. So, yes, I am implying. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: App Sprees ?

I'll chime in. My app spree was perfect timing for me. I closed on my home a month ago and once I had my keys in my hand I could app for what I wanted.

It just depends on your needs/wants. I wanted a couple new prime cards in my wallet since my focus over the past 24 months has been my new home. I also wanted to take advantage of as many signup bonuses I could get since I had to purchase a lot of new things for my new home. Now I have pretty much every card I could wish for (except my Fidelity card). So now I can sit back, let these inquiries fall off in the next 24 months. AAoA will bounce back and I will still be sitting with cards I want to grow.

My Cards: CSP: $5,000 // Hyatt: $5,000 // Cap1 Venture: $5,000 // US Bank Plat: $3,500 // Discover: $1,000 // AMEX BCE: $1,000 // Lowes: $5,500 // Furniture Row: $3,500 // Buckle Store Card: $750

Current MyFico Scores: EX 687 EQ 696 TU 687 Gardening from 5/15 till 5/16

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: App Sprees ?

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:Funny part is, I see lots of app sprees by people with perfect credit who can afford to take the hit on their credit more than someone starting out. Someone starting out sees this, figures this is the way to go, despite their credit not being able to support it, and they wind up in deeper trouble.

I'm one of those who believes you apply for the cards that suit you best. For me that's 4 or 5, for others it may be more. Unfortunately for the 50+ card crowd, bankruptcy attorneys don't accept credit as payment.

Are you implying that someone who has 50 cards is automatically doomed to bankruptcy?

Also, what stops one from taking a cash advance for the attorney?

Certainly not everybody is doomed for BK with that many, but there are a select few people who can handle that kind of credit. The ones that don't will wind up there. So, yes, I am implying.

I entirely disagree for the simple fact that it is not easy to rack up 50+ credit cards.

You make it seem like just anybody can get 50 credit cards at any time if they wanted to.

It is NOT easy, and there are multiple tricks involved and it takes YEARS of work.

Anybody who can actually spend the time, has the interest and the skill to rack up 50 cards is much more knowledgable than your average Joe with 5 credit cards.

In school, those who put in the time and earn the knowledge are more likely to succeed.

Your average Joe with no credit knowledge is 1000X more likely to go BK than somebody who has learned the way credit works.

You just can't get to 50+ cards without ALOT of responsibility, work and knowledge.

If it is so easy to get 50+ credit cards, how would YOU go about getting 50+ cards and how many years will it take you to do it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: App Sprees ?

@Anonymous wrote:

Anybody who can actually spend the time, has the interest and the skill to rack up 50 cards is much more knowledgable than your average Joe with 5 credit cards.

You didn't include "has the scores". ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: App Sprees ?

Part of the difference of opinion on app sprees might be also a difference in goals. Spreeing (which I'll define as apping for lots of cards over a short period of time, where short can be as long as a few months) will certainly hit your score and thus potentially CL/APR of a new card, but if your starting score is high, and your goal is to get bonuses, it doesn't matter that much.

So if I apped with a clean record, let's say I get card X as a Visa Sig with a $20K CL and a 14% APR. But instead I app after a spree, and get it as a Plat with a $4K CL and a 22.9% APR. Now as both versions of card X offer $Y after $Z spend in 3 months, I really don't care, I do the spend, get the reward and move on to the next card. Providing I can keep getting the card, the terms don't really matter, as they will be SD/closed at some point.

So a lot of the FT heavy hitters for travel bonuses were fine with scores in say the 750 range. No point in aiming for 800+ as you don't gain anything, and the only real point of a high score is to get the things you want.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: App Sprees ?

I'll just say this, I'm happy with the three cards I have now, when I want more I'll get more. I don't have to 'spree' to get what I want. I just have to be in a place that I'm comfortable with acquiring more credit. That hasn't happened yet.