- myFICO® Forums

- Types of Credit

- Mortgage Loans

- Understanding the Closing Disclosure (CD) - Part I...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Understanding the Closing Disclosure (CD) - Part II of II

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Understanding the Closing Disclosure (CD) - Part II of II

This is part II of a II part series on the new Loan Estimate (LE) and Closing Disclosure (CD). This part will discuss the CD. The LE discussion can be found at http://ficoforums.myfico.com/t5/Mortgage-Loans/Understanding-the-Loan-Estimate-LE-Part-I-of-II/td-p/....

CLOSING DISCLOSURE

You must receive the Initial Closing Disclosure (CD) 3 days prior to consummation of the loan, which is when you sign the mortgage security instrument with the notary at the end of the process even if the loan isn’t funding or recording that same day. This where it is very important to be able to receive the Initial CD (and really all disclosures) electronically rather than have it disclosed to you via regular mail. If it is mailed out, then a “Mailbox Rule” waiting period needs to elapse and the waiting period goes: Initial CD is mailed out on a Friday. Day 1: Sat. Day 2: Mon. Day 3: Tues (the day it is presumed you received the CD). This day is also Day 1 of the new 3 day waiting period for consummation. Day 2: Wed. Day 3: Thurs. Day of consummation: Fri (so 1 full week after the Initial CD is mailed out you can sign the final loan docs). But if it is sent to you electronically (via regular email, secure email, e-sign, etc.) then that initial 3 day Mailbox Rule isn’t needed – and in the above example (disclosed the Initial CD on a Friday) then it’s possible to sign final docs on the following Tuesday (Day 1: Fri. Day 2: Sat. Day 3: Mon). You can also cut down on the 3 day Mailbox Rule by signing the Initial CD before the end of the presumed 3 day period (so if it’s mailed out and you get it the next day, you can sign/date it and that ends the Mailbox Rule waiting period and starts the 3 day waiting period for consummation). Sundays & Federal Holidays are not included in the days being counted. Lenders are requiring title/escrow/attorney’s to confirm final fees in writing before a Closing Disclosure is being issued. In some situations a non-borrowing entity (such as a spouse who will only be on title) will need to sign the Final CD.

So now that you have your Closing Disclosure, let’s go over it, or the one at http://www.consumerfinance.gov/know-before-you-owe/compare.

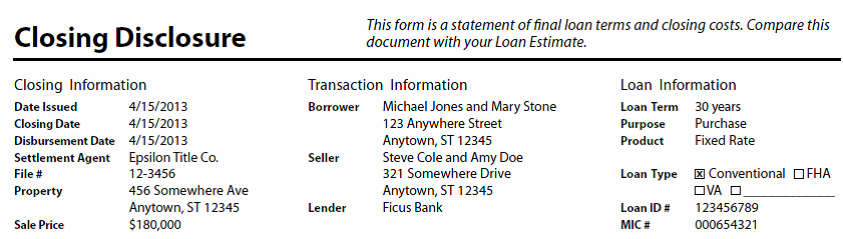

Page 1

The first page of the CD is going to be very similar to page 1 of the LE. The big differences are that some numbers go out to the second decimal, the word “estimated” is removed from a few spots since now exact figures are known, and the top part looks a little different. The date issued is now that date that the CD was issued, it lists the date of closing that the CD is based on and when it’s anticipated to disburse, the settlement company information and their file number. It also lists the buyers, sellers and the lender, as well as the loan information from the LE. The remainder of it should match the most recent LE you received.

Mortgage Broker located in Southern California and lending in all 50 states

Reach out anytime!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Understanding the Closing Disclosure (CD) - Part II of II

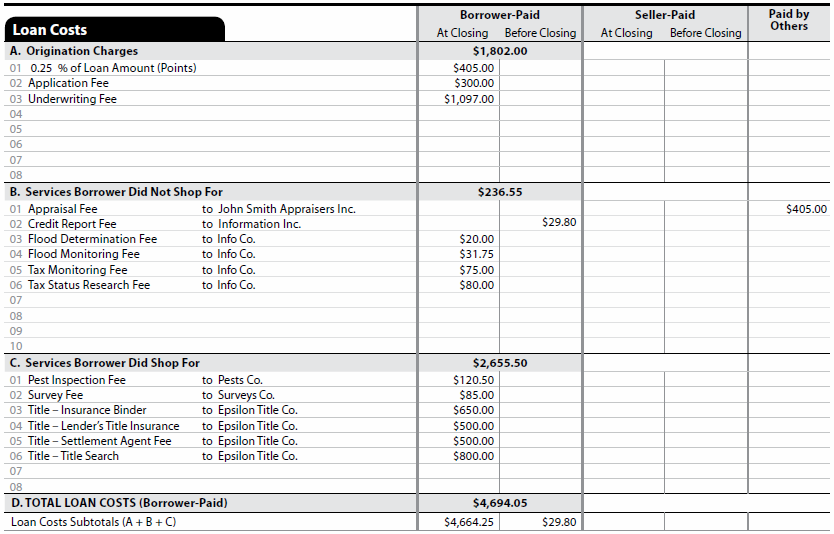

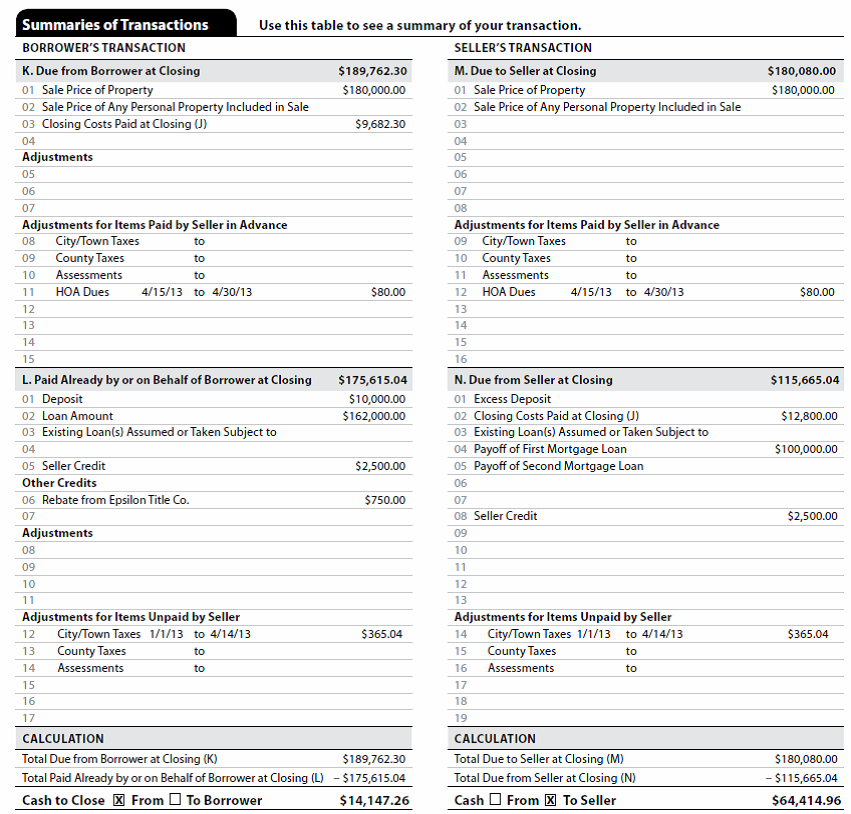

Page 2

If you have seen the Final HUD-1 Settlement Statement (what was used before the Closing Disclosure) then page 2 will look somewhat familiar. It breaks down all of the closing costs details, who is paying them, if they have already been paid or still need to be paid. Items that have been paid “Before Closing” are not collected for again at closing.

Like the previous Final HUD-1 Settlement Statement, there are tolerances on the difference between the fees listed on the CD and the LE. They have the same 3 categories: Zero Tolerance, 10% Tolerance, and No Tolerance.

Zero tolerance fees are fees that cannot increase from the last received LE to the CD, which include fees paid to a creditor, broker, or affiliate, unaffiliated 3rd party fees you were not allowed to shop for, and transfer taxes.

10% tolerance fees can increase up to 10% from the last received LE, which include recording fees, and aggregate of 3rd party charges where you were allowed to shop and selected a provider from the Settlement Service Provider Disclosure.

No Tolerance fees have no limit on the amount that can increase from the last received LE, which would include prepaid interest, property insurance, and amounts in escrow, charges paid for 3rd party services that are not required by the creditor, and if the creditor permits you to shop and you select 3rd party provider not on the Settlement Service Provider Disclosure.

So in Section A will be Zero Tolerance charges, they should match the last received LE. Section B is also Zero Tolerance. Section C would either be 10% Tolerance or No Tolerance charges, depending on what company was selected for each.

Section E #01 is 10% Tolerance, #02 is Zero Tolerance. F/G/H are all No Tolerance. I & J add up the “Other Costs” and J adds up everything on page 2.

Mortgage Broker located in Southern California and lending in all 50 states

Reach out anytime!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Understanding the Closing Disclosure (CD) - Part II of II

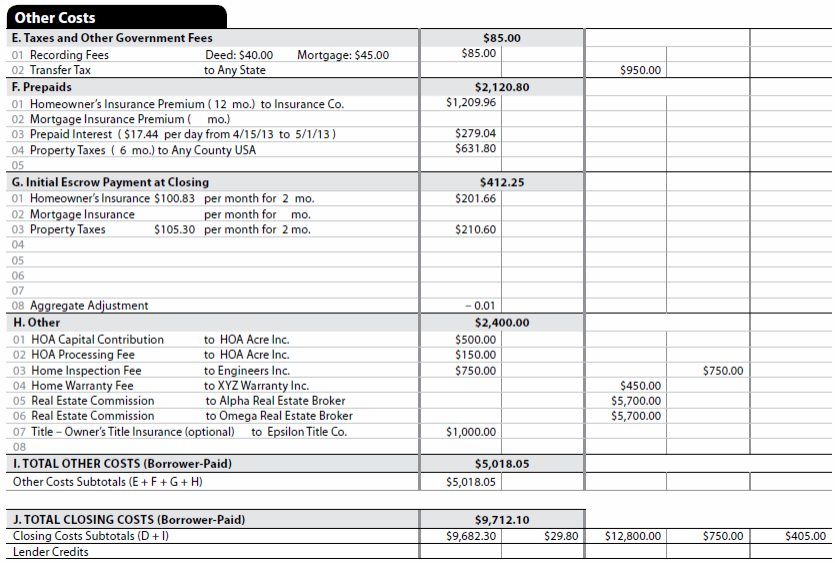

Page 3

The top of this page displays a cash to close table similar to page 2 of the LE. It brings down the total closing costs from section J, applies any deposits, down payments, seller credits, and other adjustments/credits to show you what you need to write/write a check for (or be prepared to get cash back in the amount of).

The next section of the third page is a seems a little more complex, as it shows a series of debits (amounts you need to pay) and credits (amounts in your favor). But once you get to the bottom of it then it becomes pretty clear, as you are just taking K and subtracting L and the difference is what you need to bring in at closing. If you go back to the above charge and look at the “Adjustments and Other Credits” line for $1,035.04 you’ll see it’s the sum of the $750 Rebate from Title + the $365.04 City/Town pro-rated tax credit minus the $80 HOA dues pro-ration, this is the part that isn’t normally reflected on the LE.

Mortgage Broker located in Southern California and lending in all 50 states

Reach out anytime!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Understanding the Closing Disclosure (CD) - Part II of II

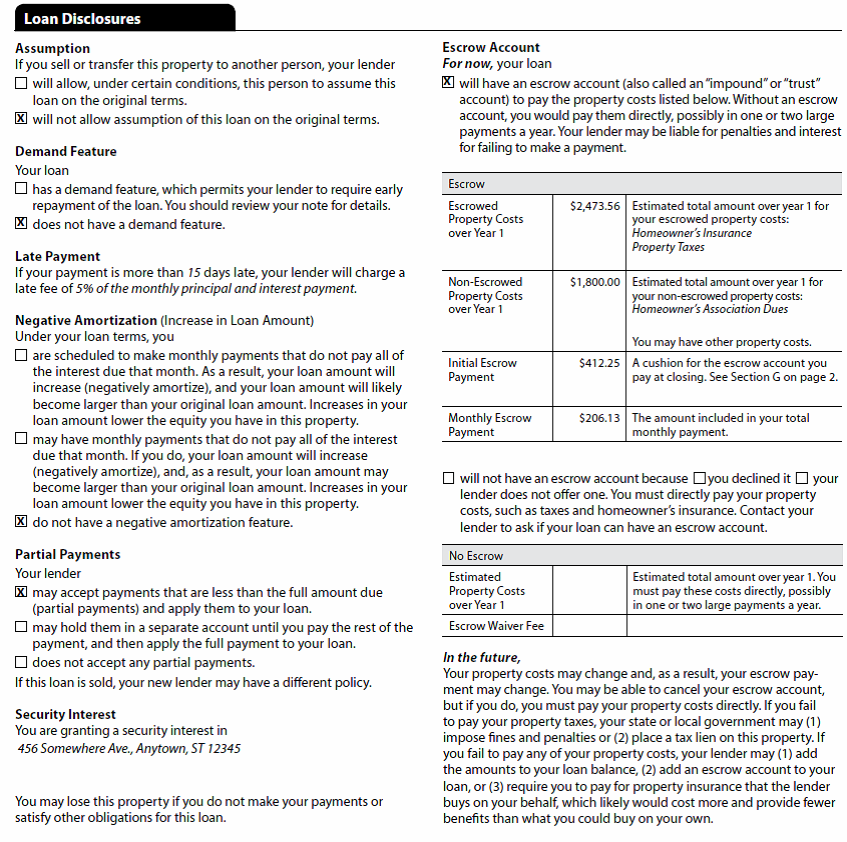

Page 4

The fourth page will have information whether the loan is assumable, has a demand feature, outlines the late payment terms, if there is the potential for negative amortization, whether partial payments can be made, and information on an escrow account and property taxes & insurance. Not pictured below, but this page would also include adjustable payment and interest rate tables if they are applicable to your loan.

Mortgage Broker located in Southern California and lending in all 50 states

Reach out anytime!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Understanding the Closing Disclosure (CD) - Part II of II

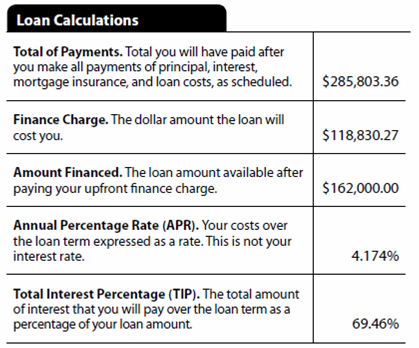

Page 5

The last page contains a loan calculations and more disclosure statements. The total payments is the total of everything you’ll pay if you just make the minimum required payments. The finance charge is the interest/PMI over the life of the loan + other loan related costs paid at closing. The Amount Financed is the loan amount after any upfront mortgage insurance, etc. has been paid. The APR listed on the Final CD needs to be within .125% of the APR listed on the initial CD, otherwise a Revised CD needs to be re-issued correcting the fees to what they will actually be at closing and a new 3 day consummation waiting period needs to elapse. Also displays the TIP.

The disclosure statements point to information elsewhere in the final loan documents, such as the note/mortgage security instrument (contract details). Lastly at the bottom it has contact information for the parties involved in the transaction and a spot for you to sign/date.

You may be wondering what happens if the fees on the CD exceed those tolerances I previously discussed. Usually after the Final CD is prepared, the lender will review, and will apply any required tolerance “cures” to the settlement statement to correct your funds to close. However they have up to 60 days to refund you the amount you were under-disclosed by.

The CFPB also put out an easy to follow along explanation of the CD at http://www.consumerfinance.gov/owning-a-home/closing-disclosure.

Feel free to ask any questions about the CD here. If you have specific questions about your own CD that are time sensitive you should consider creating a new post so it will get everyone to look at it, as not everyone will read the responses in this thread.

Mortgage Broker located in Southern California and lending in all 50 states

Reach out anytime!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Understanding the Closing Disclosure (CD) - Part II of II

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Understanding the Closing Disclosure (CD) - Part II of II

Yes, I have asked the mods to make this one and the other thread a sticky. Here is the other one: http://ficoforums.myfico.com/t5/Mortgage-Loans/Understanding-the-Loan-Estimate-LE-Part-I-of-II/m-p/4...

EDIT: The mods have put the threads under "Helpful Threads". Thank you