- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: FICO8 and FICO9 data point difference on new a...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO8 and FICO9 data point difference on new accounts

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FICO8 and FICO9 data point difference on new accounts

Recently received new credit card which has just been reported to all the CRAs. The inquiry for that card was with Experian. I have CreditCheckTotal and my Experian FICO is 813. I was curious about the FICO9 scores which are not published on CreditCheckTotal, so I ordered my Transunion and Equifax reports, not my Experian as I kinda know where I am at on it.

What I found interesting was my General FICO9 scores vs my FICO8 scores, considering I have a total of three credit cards less than a year old. Two cards are at the 11 month mark, one just reported this month. My general FICO9 scores are 847 and 850 near and at perfect.

Odd, that this would be possible. So thought perhaps someone collecting FICO9 information could make use of this info. Maybe nothing, maybe something.

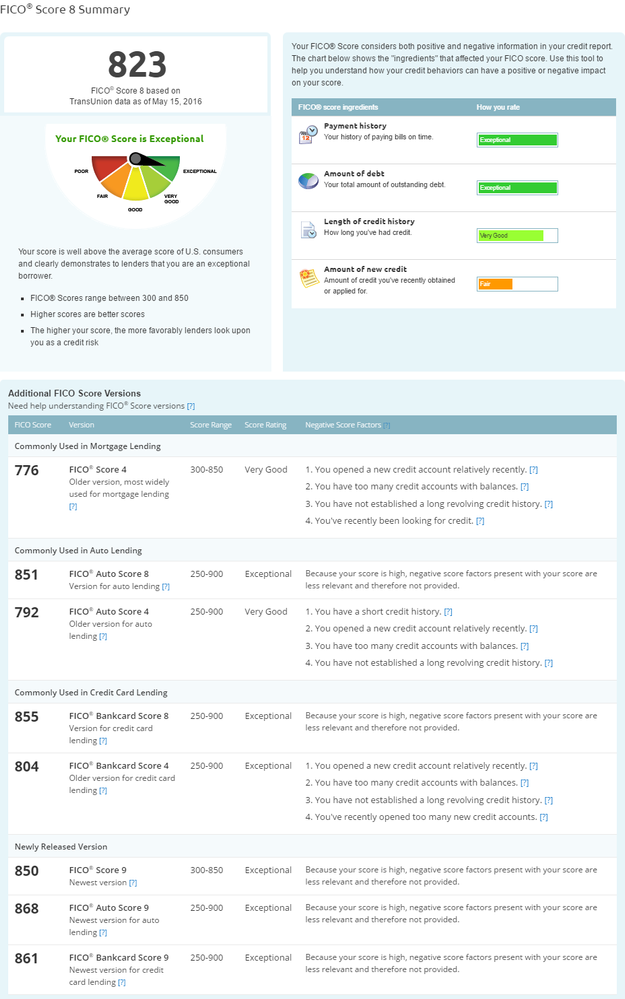

| TransUnion | 5/15/2016 | Transunion Stats | Value | Note | |

| FICO 8 | 823 | Accounts | 9 | ||

| FICO 4 | 776 | AAoA | 67mths | ||

| FICO 8 AU | 851 | Accounts with Balance | 5 | 1% UTI | |

| FICO 4 AU | 792 | Credit Cards Open | 6 | 4 with small balance | |

| FICO 8 BC | 855 | Secured Inst. Loan | 1 | 9% UTI | |

| FICO 4 BC | 792 | New Cards | 3 | Two cards 11 months old One card 1 month old | |

| FICO 9 | 850 | Inquiries | 2 | Fall of next month | |

| FICO 9 AU | 868 | ||||

| FICO 9 BC | 861 | ||||

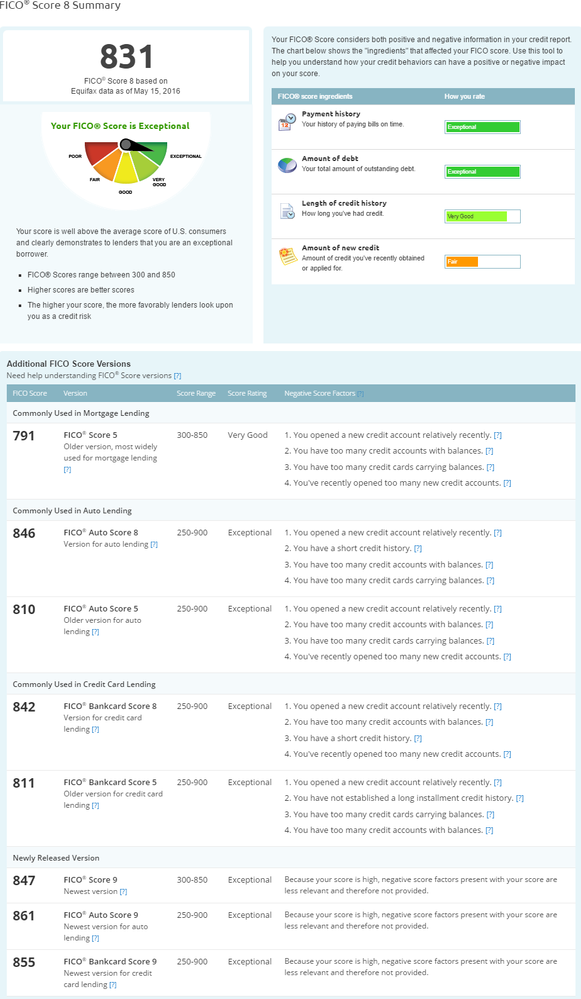

| Equifax | 5/15/2016 | Equifax Stats | Value | Note | |

| FICO 8 | 831 | Accounts | 10 | ||

| FICO 5 | 791 | AAoA | 67mths | ||

| FICO 8 AU | 846 | Accounts with Balance | 5 | 1% UTI | |

| FICO 5 AU | 810 | Credit Cards Open | 7 | 4 with small balance and one card is an AU | |

| FICO 8 BC | 842 | Secured Inst. Loan | 1 | 9% UTI | |

| FICO 5 BC | 811 | New Cards | 3 | Two cards 11 months old One card 1 month old | |

| FICO 9 | 847 | Inquiries | 0 | ||

| FICO 9 AU | 861 | ||||

| FICO 9 BC | 855 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO8 and FICO9 data point difference on new accounts

Thanks for sharing the date. Some good information here.

1) Your TU data with a couple inquiries strongly supports the conclusion reached from Oilcan12's detailed data and SJ reported results which show:

* Inquiries have less negative impact on score with Fico 09 relative to Fico 08 - specifically inquiries over 3 months age.

* Your classic Fico 08 and Fico 09 scores are closer together on Equifax (which shows no inquiries than on TransUnion (which lists 2 inquiries between 6 mo and 12 mo age). This further suggests that Fico 09 is more lenient with inquiries.

2) Your EQ data shows no inquiries and your EX data with a recent inquiry lacks Fico 09 scores.

* Unable to further substantiate or refute Revelate's idea that Fico 09 fucuses on the 1st 90 days for inquiries.

* Experian data (with the 1 month old inquiry) would have been helpful in looking at potential "new inquiry impact" on Fico 09

3) Both TU score 4 and Equifax score 5 are Fico 04 model scores. Unfortunately, real world top score on the Classic and Industry enhanced versions of this older model are less than 850 and 900, respectively. So, comparison to Fico 08/Fico 09 is problematic without looking at side-by-side score shifts comparing 2 or more months of data.

* The Fico 04 model data is consistent with past statements suggesting Fico 04 penalizes score more heavily for multiple cards reporting balances.

* Unable to sufficiently isolate # cards reporting a balance factor on Fico 09 relative to Fico 08. However, given the closeness of Bankcard scores, there is nothing in this data set to indicate a difference in how these two models treat the # cards factor.

4) Not really sure how many open + closed credit cards you have. However, your file is not thin. A single new account (meaning less than 3 months old) is unlikely to impact Fico 09 score. From what I have read, Fico 09 looks for patterns and quantities. If you get a QTY of new cards or have repeated lates, then you may see a harsher penalty than with Fico 08.

Ultimately, the best way to compare how Fico 09 reacts relative to Fico 08 is change one factor significantly and review before/after results side by side. The other key insight is comparing scores among CRAs particularly when one CRA has something while another does not. That's what helped a lot with Olican12's data.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO8 and FICO9 data point difference on new accounts

Thanks for the insight Thomas,

Now that I think about it, the secured installment loan is also less than a year old as well.

I know you a Relavate really isolate these difference, which is much appreciated.

Not being as meticulous, I tend to generalize So this is what I see.

What could be considered bad on my credit reports.

1. TransUnion 2 inquiries

2. Two credit cards less than one year

3. One credit card less than 90 days old

4. One installment loan less than one year old

5. Four credit cards reporting balance. (This would effect both credit reports, so not considering it a large factor here)

I cancel out the 2 inquiries by giving TransUnion additional 5points. which would put it at 828. Now it would be much comparable to the 831 EQ score.

In relation the FICO9 scores are TU 850 and EQ 847 which I am applying no change to.

So what I see is a minimum 15 point difference (taking in to account the 4 credit cards reporting balance which I am generously valuing at 4 points) between FICO8 and FICO9 in relation to several accounts less than a year old (Four in this case).

Really it appears FICO9 is deducting very little if at all for accounts less than a year old. So I wonder how many new accounts it would take before a substantial deduction, lets say 10 or 15 point would occur?

One could assume that FICO9 is applying a different time scale to new accounts, say 3 months or 6 months. However, if that where true I would think my FICO9 score would have at least a 5 point deduction accounting for the newest account.

My overall thoughts looking at the picture is, assuming you have no lates or collections, apply for credit sparingly, have a good credit mix, one can peg the general FICO9 meter with less effort.

I would assume that it's somewhat inversely sensitive to collections and lates depending on the trigger point as Thomas points out.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO8 and FICO9 data point difference on new accounts

| Total CL: $321.7k | UTL: 2% | AAoA: 7.0yrs | Baddies: 0 | Other: Lease, Loan, *No Mortgage, All Inq's from Jun '20 Car Shopping |

BoA-55k | NFCU-45k | AMEX-42k | DISC-40.6k | PENFED-38.4k | LOWES-35k | ALLIANT-25k | CITI-15.7k | BARCLAYS-15k | CHASE-10k