- myFICO® Forums

- Types of Credit

- Auto Loans

- Re: Bmw financial loan app results

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Bmw financial loan app results

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bmw financial loan app results

Finally pulled the trigger on a 22 m5c, about 160k all in being financed, instant denial based off of a TU pull (my lowest score) awaiting POI and also no other comparable trade lines in the past. (30k max balance on auto loans before)

Just submitted my POI, waiting to see if they counter and ask for more money down (only put 5k down)

Can I ask them to pull EX, would it make any difference? Has anyone encountered a similar situation with bmw and what was the result? I'll update tomorrow with some concrete DP for all that are interested.

Discover it cashback: $10900

Citi DC: $13000

WF Propel: closed 2k

Amex BCED: $3000

Amex Gold: $NPSL

Amex Plat: NPSL

Cap1 QS: $3200

Cap1 VX $50k

VS CC: $2900

Kohls: $3000

Synchrony car care: $3000

citi best buy visa: $8500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bmw financial loan app results

Have you tried with other banks or credit unions who might be more favorable to you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bmw financial loan app results

@micvite wrote:Finally pulled the trigger on a 22 m5c, about 160k all in being financed, instant denial based off of a TU pull (my lowest score) awaiting POI and also no other comparable trade lines in the past. (30k max balance on auto loans before)

Just submitted my POI, waiting to see if they counter and ask for more money down (only put 5k down)

Can I ask them to pull EX, would it make any difference? Has anyone encountered a similar situation with bmw and what was the result? I'll update tomorrow with some concrete DP for all that are interested.

I would be shocked if this gets overturned you said your higest reporting auto loan was 30K. You don't have comparable auto loan experience with these amounts. Going with a different bank will not make much of a difference. Look at it like this in there eyes you are trying to go from a Camry to a Lamborghini. You just aimed to high with this car choice.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bmw financial loan app results

@bigpoppa09 wrote:

@micvite wrote:Finally pulled the trigger on a 22 m5c, about 160k all in being financed, instant denial based off of a TU pull (my lowest score) awaiting POI and also no other comparable trade lines in the past. (30k max balance on auto loans before)

Just submitted my POI, waiting to see if they counter and ask for more money down (only put 5k down)

Can I ask them to pull EX, would it make any difference? Has anyone encountered a similar situation with bmw and what was the result? I'll update tomorrow with some concrete DP for all that are interested.

I would be shocked if this gets overturned you said your higest reporting auto loan was 30K. You don't have comparable auto loan experience with these amounts. Going with a different bank will not make much of a difference. Look at it like this in there eyes you are trying to go from a Camry to a Lamborghini. You just aimed to high with this car choice.

Well see what happens, depending how much they want down ill still get the car, but I'm going to talk to finance manager today to see if I can explain the situation a big better to them and see if bmw will overturn the decision... even though I've only had 3 30k loans before, they were all paid off within 6 months to a year so if you look at it that way the equivalent of a 150k loan over 5 years. Yes I know I'm grasping at straws, but who knows Maybe my weird logic just might work on them🤣🤣

Discover it cashback: $10900

Citi DC: $13000

WF Propel: closed 2k

Amex BCED: $3000

Amex Gold: $NPSL

Amex Plat: NPSL

Cap1 QS: $3200

Cap1 VX $50k

VS CC: $2900

Kohls: $3000

Synchrony car care: $3000

citi best buy visa: $8500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bmw financial loan app results

Can you share your latest DPs? Scores, income, utilization, etc...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bmw financial loan app results

@Anonymous wrote:Can you share your latest DPs? Scores, income, utilization, etc...

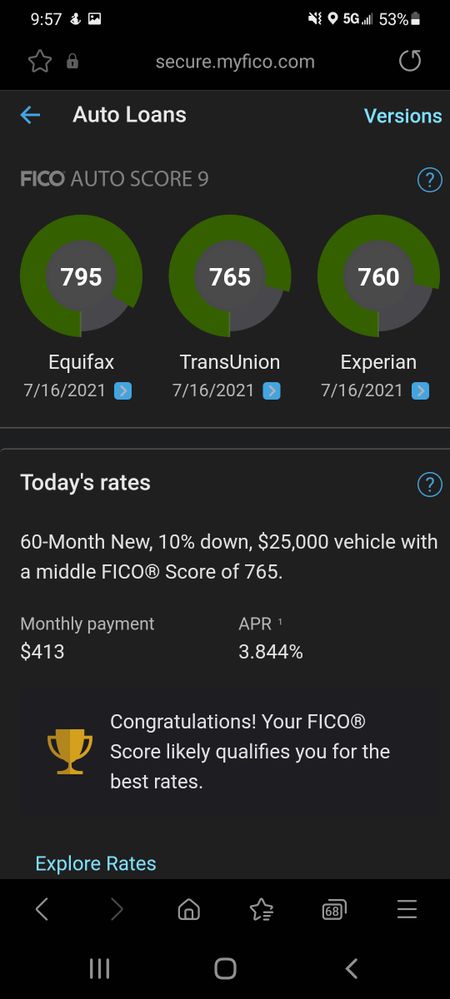

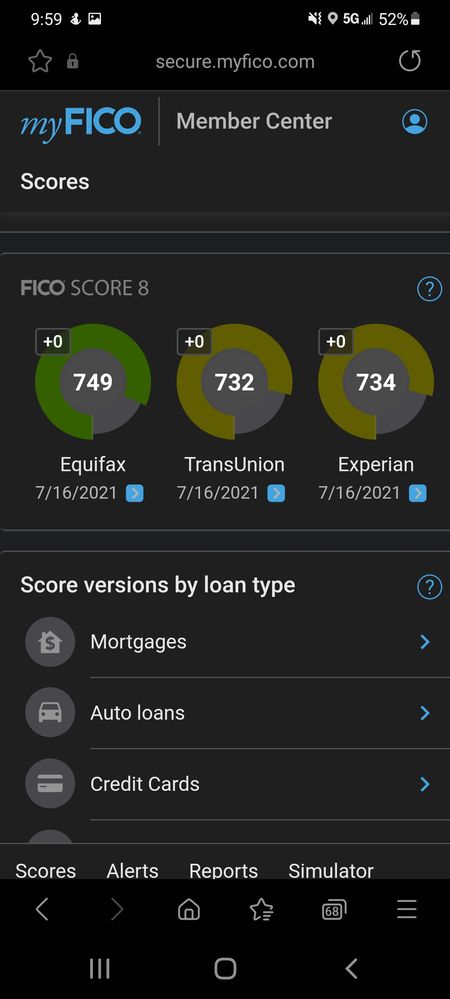

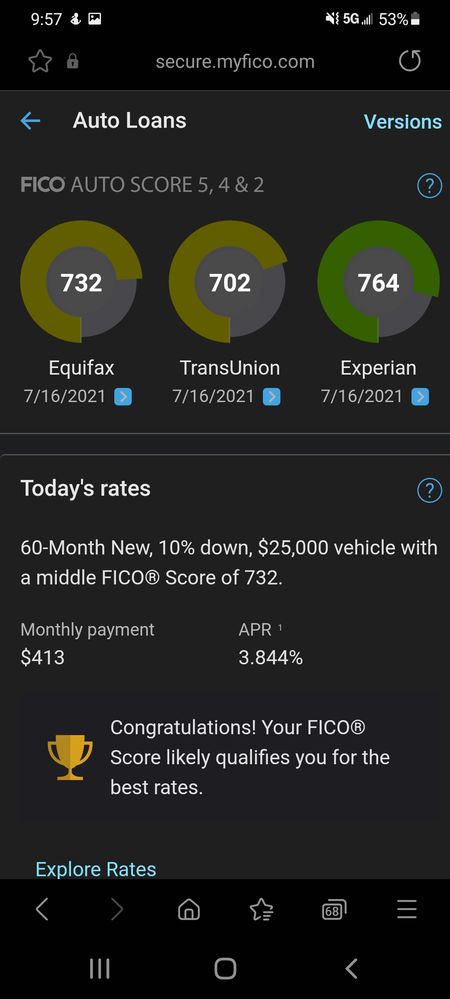

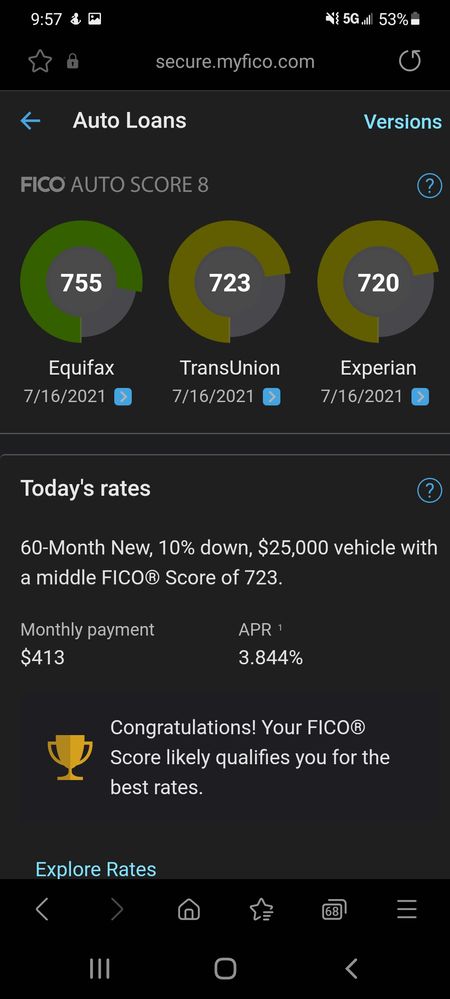

I'm not sure exactly what they pulled for bmw, I just got the one TU inq, will update with concrete details once I get my letter in the mail, but my fico 8 is 726 for TU, not sure of my auto scores (I was hoping they were going to pull EX fico 8 is 734, auto 2 is 720 auto 8 is 764)

Income is 320 a year based on my half year profit loss.

Util is 1% on cc, 20k total limit, 16.5 personal limit. Total debt is 19k (2 motorcycle loans through sync at 6k each, 3 student loans 1.5k, 3.5k and 2k)

30 inq on TU, again hoping they were gonna pull EX only have 17, most are a year old already only had 6 in last 12 months on TU and 3 in EX

Discover it cashback: $10900

Citi DC: $13000

WF Propel: closed 2k

Amex BCED: $3000

Amex Gold: $NPSL

Amex Plat: NPSL

Cap1 QS: $3200

Cap1 VX $50k

VS CC: $2900

Kohls: $3000

Synchrony car care: $3000

citi best buy visa: $8500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bmw financial loan app results

@Anonymous wrote:Can you share your latest DPs? Scores, income, utilization, etc...

I pulled the trigger and bought my reports lol

Discover it cashback: $10900

Citi DC: $13000

WF Propel: closed 2k

Amex BCED: $3000

Amex Gold: $NPSL

Amex Plat: NPSL

Cap1 QS: $3200

Cap1 VX $50k

VS CC: $2900

Kohls: $3000

Synchrony car care: $3000

citi best buy visa: $8500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bmw financial loan app results

With your income and scores I would think you could get approved with more down payment.

BMWs depreciate rapidly so you may need to put down $50k.

GL!

DON'T WORK FOR CREDIT CARDS ... MAKE CREDIT CARDS WORK FOR YOU!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bmw financial loan app results

@Shooting-For-800 wrote:With your income and scores I would think you could get approved with more down payment.

BMWs depreciate rapidly so you may need to put down $50k.

GL!

Yeah I'm gonna wait and see what they say, 50k is really not something I want to put down because I don't like having that much tied up, but it's going to be a decision for later after I hear back from them.

Discover it cashback: $10900

Citi DC: $13000

WF Propel: closed 2k

Amex BCED: $3000

Amex Gold: $NPSL

Amex Plat: NPSL

Cap1 QS: $3200

Cap1 VX $50k

VS CC: $2900

Kohls: $3000

Synchrony car care: $3000

citi best buy visa: $8500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bmw financial loan app results

Best of luck! Hopefully the F&I manager can get a recon and counter approval from BMW FS. Keep u s updated.