- myFICO® Forums

- Types of Credit

- Auto Loans

- Navy Federal Auto Refi Question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Navy Federal Auto Refi Question

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Navy Federal Auto Refi Question

Hello! I have a auto loan with NFCU that will hit 1 year in May. All on-time payments. The rate is currently 9% on a 2017 Jaguar F-Pace S Sport AWD. The loan was originally $40k with no down payment and now sits at $36k as of the close of the Feb 2022 statement. When I app'd in 5/2021, my score was a 616. I want to refi in May but this is my first time ever doing it. I also have 3 cards with NFCU over the last 3 years, exceptional payment history and credit limits growing. I make about $130k every year with all deposits going to NFCU accounts. My scores took a hit recently due to high balances on cards, but I'm in the mid 620s. What does navy consider when requesting a refi? I also was wondering if I should throw a few grand towards my car balance before app'ing? I have about $3k that I could use. Right now the trade in value is $36k-38k. But I'm really trying to get the rate down to 4-5%. Any advice on the shape I'm in? Go for it now in May? Or wait until my scores increase and the loan decreases?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Auto Refi Question

You would need to use a different bank to refinance sine you can't refinance a loan with the same bank as the current loan.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Auto Refi Question

@RASULL12 wrote:You would need to use a different bank to refinance sine you can't refinance a loan with the same bank as the current loan.

Oh man Really? I could have sworn when I picked up my check the advisor said I could refi in 1 year for a lower rate. I'm gonna be completely broken if that's the case. I don't want to move the loan away from NFCU right now. Thanks for the tip. I'm gonna call and ask.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Auto Refi Question

No harm in calling them but I've also never heard of a creditor that will refinance their own auto loan.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Auto Refi Question

I could be wrong but I don't think I am. You could try PenFed. I did a refinance with them before. Very simple process and they have a pre-approval too that lets you know the terms before you pull the trigger and get a HP.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Auto Refi Question

@RASULL12 wrote:I could be wrong but I don't think I am. You could try PenFed. I did a refinance with them before. Very simple process and they have a pre-approval too that lets you know the terms before you pull the trigger and get a HP.

Even without having a relationship with them? I have NFCU through the relationship with my sister which is how I qualified. I've never served in the military so not sure how I could get a loan without opening an account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Auto Refi Question

Anyone is able to join PenFed now. And yes they seem to be pretty lenient on the lending side recently. I helped my aunt apply for a credit card and auto refinance with them the same day she became a member and was approved for both with credit in the 670-680 range and a discharged bk7 from 2016.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Auto Refi Question

@pizzadude wrote:No harm in calling them but I've also never heard of a creditor that will refinance their own auto loan.

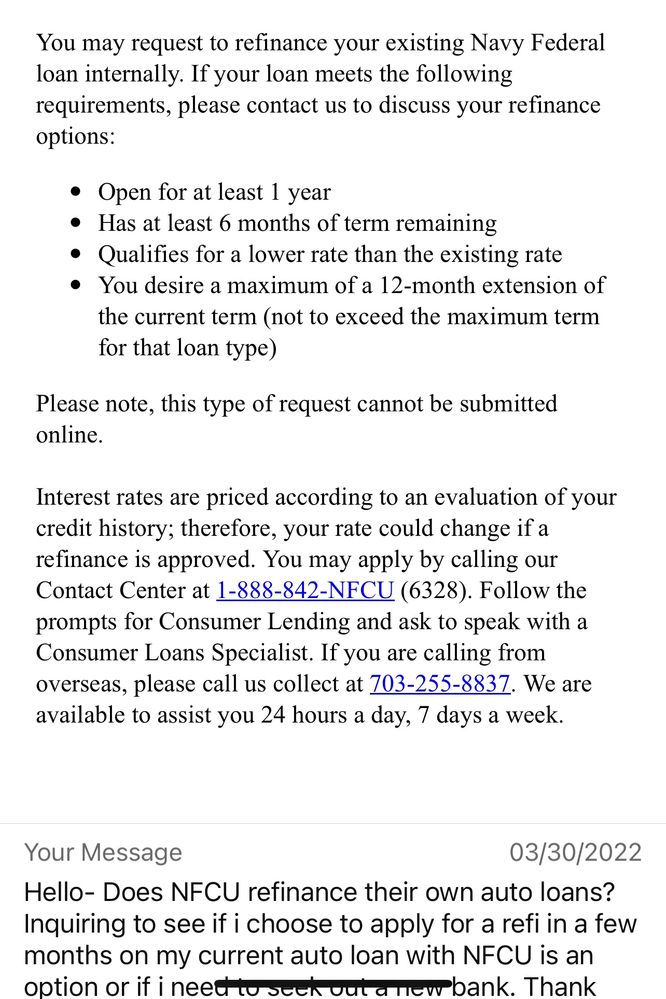

Hi There- just wanted to close this out with the secure message I received from NFCU. They will refi which is great news for me and possibly help some others.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Auto Refi Question

@CreditOnTheRise1 wrote:

@pizzadude wrote:No harm in calling them but I've also never heard of a creditor that will refinance their own auto loan.

Hi There- just wanted to close this out with the secure message I received from NFCU. They will refi which is great news for me and possibly help some others.

Thanks @CreditOnTheRise1 ! That's great news, and hopefully you'll be able to take advantage and drop your interest rate I had no idea that this was an option, it's another big plus for NFCU.