- myFICO® Forums

- Bouncing Back from Credit Problems

- Bankruptcy

- Removing Collections Account post Chapter 7 Discha...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Removing Collections Account post Chapter 7 Discharge

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Removing Collections Account post Chapter 7 Discharge

Hey guys,

Filed for chapter 7 in Sept'19, discharged Dec'19 in California.

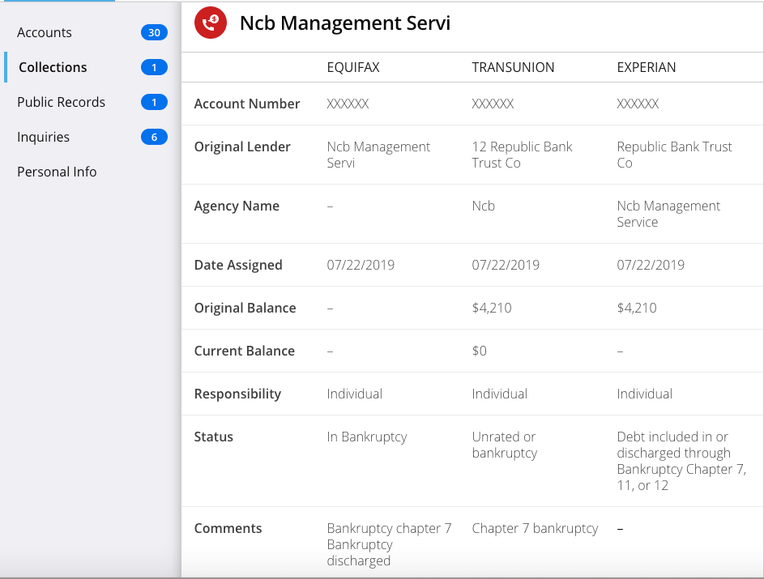

I have since disputed all wrong information post bankrupty (following instructions in below link - with cover letters, table of contents, doc describing how its being reported and how it should, etc - very meticulous and organized). I only got one dispute result letter back, the others arrived at someones elses mailbox (USPS sends you scans of incoming mail and I never got 2 of the 3). But 30+ days post receipt (I sent cerfied mail) I pulled my credit report... unfortunately one account which was discharged in the bankruptcy is still listed as a collections account even though status says "discharged in bankruptcy" or "in bankruptcy". My question is should this no longer be reported as collections at all? I thought per bankruptcy laws debts discharged in the bankruptcy can not be reported as collections - is this not true? See below myfico lists it under "collections".

Is my understanding wrong? If it's not, I will apply for credit and redispute and if get denied for credit I will consult a lawyer.

Lawyer website which I followed instructions from: https://www.bondnbotes.com/2015/12/28/fix-credit-report-after-bankruptcy/

Screenshot of report:

April 2013: EX: 561 EQ (myFICO): 606 TU: 614

May 2013: EX: 689 EQ (myFICO): 623 TU: 615

June 2013: EX: 712 EQ (myFICO): 659 TU: 649 EQ Direct: 576

Finished rehab August 2012. Equifax no longer shows any deliquency, Experian has one deliquent account, and Transunion has 2 reporting.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Removing Collections Account post Chapter 7 Discharge

Not a lawyer, but your site says it can't report any balance owed, in collection, etc. Your report has 0 balance and discharged in bankruptcy. What are you saying is wrong?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Removing Collections Account post Chapter 7 Discharge

@Anonymous wrote:Not a lawyer, but your site says it can't report any balance owed, in collection, etc. Your report has 0 balance and discharged in bankruptcy. What are you saying is wrong?

That my credit reporting agencies still see it as a collections. It's listed as collections account not as part of regular accounts so it's still considered collections (see screenshot), account is placed specifically under collections. I don't think that should be the case.

April 2013: EX: 561 EQ (myFICO): 606 TU: 614

May 2013: EX: 689 EQ (myFICO): 623 TU: 615

June 2013: EX: 712 EQ (myFICO): 659 TU: 649 EQ Direct: 576

Finished rehab August 2012. Equifax no longer shows any deliquency, Experian has one deliquent account, and Transunion has 2 reporting.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Removing Collections Account post Chapter 7 Discharge

Anything negative before the file date of a BK stays the same. Only difference it has to say $0 balance and IIB. Past negs dont go poof because you filed. Just the balance for the debt is wiped out. When the fall off date comes. Thats when it will no longer affect your scores.

BK Free Aug25