- myFICO® Forums

- Types of Credit

- Business Credit

- Re: Advice needed, odds on getting Chase Ink Cash

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Advice needed, odds on getting Chase Ink Cash

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Advice needed, odds on getting Chase Ink Cash

Current personal cards:

- Discover It Student $3,750 limit opened Jan 2019

- Amex Delta Gold $15,000 limit opened Jan 2020

- PC'd to Amex Delta Blue

- BoA Cash Rewards $3,500 limit opened Feb 2020

- Chase Freedom $1,000 limit opened April 2020

- Chase Sapphire Prefered $13,600 limit opened Jun 2020

- PC'd to Chase Freedom Flex

- Chase Freedom Flex $5,500 limit opened March 2021

- Apple card $10,000 limit opened March 2021

Current Business cards:

- Amex Blue Business Plus April 2020

- Amex Delta Gold Feb 2021 (will close once 1 year)

- Amex Blue Business Cash June 2021

- Amex Platinum Business Dec 2021

FICO Score: 760

Oldest account age: 3 years

Average age of credit: 1 year, 7 months

Income: $250,000

Open to Business Cards: Yes

I will be dropping to 4/24 in February 2022, and I am looking to apply for the Chase Ink Cash business credit card, but I am unsure how open they are to a sole proprietorship "business" after they tightened up since Covid.

I applied Jan 2021 for this card exactly 1 year ago and got immediately denied for "Business structure".

I tried calling reconsideration and got rejected again for

- "Insufficient business credit information on file"

- "Business too new"

- "You have too many active accounts or too much available credit"

Cards I’ve been looking into:

- Chase Ink Cash SUB & 5% on internet, cable, & phone

- Citi Custom Cash 5% categories

- Chase Freedom Unlimited 1.5% everywhere

- US Bank Alt Go 4% dining

- US Bank Cash+ 5% categories

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice needed, odds on getting Chase Ink Cash

@Anonymous wrote:Current personal cards:

- Discover It Student $3,750 limit opened Jan 2019

- Amex Delta Gold $15,000 limit opened Jan 2020

- PC'd to Amex Delta Blue

- BoA Cash Rewards $3,500 limit opened Feb 2020

- Chase Freedom $1,000 limit opened April 2020

- Chase Sapphire Prefered $13,600 limit opened Jun 2020

- PC'd to Chase Freedom Flex

- Chase Freedom Flex $5,500 limit opened March 2021

- Apple card $10,000 limit opened March 2021

Current Business cards:

- Amex Blue Business Plus April 2020

- Amex Delta Gold Feb 2021 (will close once 1 year)

- Amex Blue Business Cash June 2021

- Amex Platinum Business Dec 2021

FICO Score: 760

Oldest account age: 3 yearsAverage age of credit: 1 year, 7 months

Income: $250,000

Open to Business Cards: Yes

I will be dropping to 4/24 in February 2022, and I am looking to apply for the Chase Ink Cash business credit card, but I am unsure how open they are to a sole proprietorship "business" after they tightened up since Covid.

I applied Jan 2021 for this card exactly 1 year ago and got immediately denied for "Business structure".

I tried calling reconsideration and got rejected again for

- "Insufficient business credit information on file"

- "Business too new"

- "You have too many active accounts or too much available credit"

Cards I’ve been looking into:

- Chase Ink Cash SUB & 5% on internet, cable, & phone

- Citi Custom Cash 5% categories

- Chase Freedom Unlimited 1.5% everywhere

- US Bank Alt Go 4% dining

- US Bank Cash+ 5% categories

I don't think your chances are good. I would wait until I got a preapproval for it. And if you really want the card, I think you should hold off on adding any other credit cards to your collection.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice needed, odds on getting Chase Ink Cash

@Anonymous wrote:Current personal cards:

- Discover It Student $3,750 limit opened Jan 2019 So, you are at least 21?

- Amex Delta Gold $15,000 limit opened Jan 2020

- PC'd to Amex Delta Blue

- BoA Cash Rewards $3,500 limit opened Feb 2020

- Chase Freedom $1,000 limit opened April 2020

- Chase Sapphire Preferred $13,600 limit opened Jun 2020

- PC'd to Chase Freedom Flex

- Chase Freedom Flex $5,500 limit opened March 2021

- Apple card $10,000 limit opened March 2021

Current Business cards: Amex does not report business cards anywhere and are not helping your business credit

- Amex Blue Business Plus April 2020

- Amex Delta Gold Feb 2021 (will close once 1 year)

- Amex Blue Business Cash June 2021

- Amex Platinum Business Dec 2021

FICO Score: 760

Oldest account age: 3 years (very new)Average age of credit: 1 year, 7 months (you may want to "garden" for a while to increase this, no new personal accounts)

Income: $250,000

Open to Business Cards: Yes

I will be dropping to 4/24 in February 2022, and I am looking to apply for the Chase Ink Cash business credit card, but I am unsure how open they are to a sole proprietorship "business" after they tightened up since Covid.

I applied Jan 2021 for this card exactly 1 year ago and got immediately denied for "Business structure". What is your business? Is it considered risky or do you think Chase meant "sole proprietor" by "structure?"

I tried calling reconsideration and got rejected again for

- "Insufficient business credit information on file" See above, your Amex business cards do not report

- "Business too new" Do you have an EIN? Your business is registered with your state's Secretary of State?

- "You have too many active accounts or too much available credit" Explore the AZEO (All Zero Except One) method here in the credit scoring forum. Essentially, ensure that you only allow 1 of your many credit cards to report a balance at cycle date. You will need to know when each card that you actively use cycles so that you may make a payment before that occurs. This may resolve this issue of "too many active accounts" and will do wonders for your overall credit score. As always, make sure the card that you do allow to report is not over 30% of the limit.

Cards I’ve been looking into:

- Chase Ink Cash SUB & 5% on Internet, cable, & phone

- Citi Custom Cash 5% categories

- Chase Freedom Unlimited 1.5% everywhere

- US Bank Alt Go 4% dining US Bank can be brutally conservative

- US Bank Cash+ 5% categories see above they are very sensitive to new accounts and inquiries, be sure to read more about US Bank before applying.

I do remember in 2020 that Chase, and other banks, were tightening up due to what everybody thought would happen with COVID. Chase and BofA loved to provide denial for "insufficient balance in deposit accounts" meaning, not having a checking account with the bank and/or not having a large enough balance. I was under the impression that they have sense relaxed the purse strings.

You have done very well for yourself if my assumption that you are in your early 20s is true. However, credit takes a while to build up and some creditors like Chase, US Bank etc may want to see more credit history. Please read more about how conservative US Bank is before you go applying with them.

So, after all of that, I agree with what SouthJamiaca suggested, you may want to wait for a pre-approval from Chase. You currently have Chase products so you would be able to see pre-approvals through your account management on the existing cards. Look for green or black stars.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice needed, odds on getting Chase Ink Cash

@SouthJamaica wrote:

@Anonymous wrote:Current personal cards:

- Discover It Student $3,750 limit opened Jan 2019

- Amex Delta Gold $15,000 limit opened Jan 2020

- PC'd to Amex Delta Blue

- BoA Cash Rewards $3,500 limit opened Feb 2020

- Chase Freedom $1,000 limit opened April 2020

- Chase Sapphire Prefered $13,600 limit opened Jun 2020

- PC'd to Chase Freedom Flex

- Chase Freedom Flex $5,500 limit opened March 2021

- Apple card $10,000 limit opened March 2021

Current Business cards:

- Amex Blue Business Plus April 2020

- Amex Delta Gold Feb 2021 (will close once 1 year)

- Amex Blue Business Cash June 2021

- Amex Platinum Business Dec 2021

FICO Score: 760

Oldest account age: 3 yearsAverage age of credit: 1 year, 7 months

Income: $250,000

Open to Business Cards: Yes

I will be dropping to 4/24 in February 2022, and I am looking to apply for the Chase Ink Cash business credit card, but I am unsure how open they are to a sole proprietorship "business" after they tightened up since Covid.

I applied Jan 2021 for this card exactly 1 year ago and got immediately denied for "Business structure".

I tried calling reconsideration and got rejected again for

- "Insufficient business credit information on file"

- "Business too new"

- "You have too many active accounts or too much available credit"

Cards I’ve been looking into:

- Chase Ink Cash SUB & 5% on internet, cable, & phone

- Citi Custom Cash 5% categories

- Chase Freedom Unlimited 1.5% everywhere

- US Bank Alt Go 4% dining

- US Bank Cash+ 5% categories

I don't think your chances are good. I would wait until I got a preapproval for it. And if you really want the card, I think you should hold off on adding any other credit cards to your collection.

Are Chase Ink pre-approvals only done through mail? I don't see any pre-approval portal through my Chase account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice needed, odds on getting Chase Ink Cash

@BearsCubsOtters wrote:

@Anonymous wrote:Current personal cards:

- Discover It Student $3,750 limit opened Jan 2019 So, you are at least 21? Yes

- Amex Delta Gold $15,000 limit opened Jan 2020

- PC'd to Amex Delta Blue

- BoA Cash Rewards $3,500 limit opened Feb 2020

- Chase Freedom $1,000 limit opened April 2020

- Chase Sapphire Preferred $13,600 limit opened Jun 2020

- PC'd to Chase Freedom Flex

- Chase Freedom Flex $5,500 limit opened March 2021

- Apple card $10,000 limit opened March 2021

Current Business cards: Amex does not report business cards anywhere and are not helping your business credit

- Amex Blue Business Plus April 2020

- Amex Delta Gold Feb 2021 (will close once 1 year)

- Amex Blue Business Cash June 2021

- Amex Platinum Business Dec 2021

FICO Score: 760

Oldest account age: 3 years (very new)Average age of credit: 1 year, 7 months (you may want to "garden" for a while to increase this, no new personal accounts)

Income: $250,000

Open to Business Cards: Yes

I will be dropping to 4/24 in February 2022, and I am looking to apply for the Chase Ink Cash business credit card, but I am unsure how open they are to a sole proprietorship "business" after they tightened up since Covid.

I applied Jan 2021 for this card exactly 1 year ago and got immediately denied for "Business structure". What is your business? Is it considered risky or do you think Chase meant "sole proprietor" by "structure?"

I tried calling reconsideration and got rejected again for

- "Insufficient business credit information on file" See above, your Amex business cards do not report

- "Business too new" Do you have an EIN? Your business is registered with your state's Secretary of State?

- "You have too many active accounts or too much available credit" Explore the AZEO (All Zero Except One) method here in the credit scoring forum. Essentially, ensure that you only allow 1 of your many credit cards to report a balance at cycle date. You will need to know when each card that you actively use cycles so that you may make a payment before that occurs. This may resolve this issue of "too many active accounts" and will do wonders for your overall credit score. As always, make sure the card that you do allow to report is not over 30% of the limit.

Cards I’ve been looking into:

- Chase Ink Cash SUB & 5% on Internet, cable, & phone

- Citi Custom Cash 5% categories

- Chase Freedom Unlimited 1.5% everywhere

- US Bank Alt Go 4% dining US Bank can be brutally conservative

- US Bank Cash+ 5% categories see above they are very sensitive to new accounts and inquiries, be sure to read more about US Bank before applying.

I do remember in 2020 that Chase, and other banks, were tightening up due to what everybody thought would happen with COVID. Chase and BofA loved to provide denial for "insufficient balance in deposit accounts" meaning, not having a checking account with the bank and/or not having a large enough balance. I was under the impression that they have sense relaxed the purse strings.

You have done very well for yourself if my assumption that you are in your early 20s is true. However, credit takes a while to build up and some creditors like Chase, US Bank etc may want to see more credit history. Please read more about how conservative US Bank is before you go applying with them.

So, after all of that, I agree with what SouthJamiaca suggested, you may want to wait for a pre-approval from Chase. You currently have Chase products so you would be able to see pre-approvals through your account management on the existing cards. Look for green or black stars.

My business structure is a Sole proprietor "business" doing used retail reselling as I sell some of my old family belongings on eBay.

I do not have an EIN since I didn't think I needed one in order to get a Business Credit Card, but would getting one help in my approval odds?

Thanks for the tips, especially AZEO. I didn't know that was a factor in my credit score. I had been having many small balances report on all of my personal credit cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice needed, odds on getting Chase Ink Cash

@Anonymous wrote:My business structure is a Sole proprietor "business" doing used retail reselling as I sell some of my old family belongings on eBay.

I do not have an EIN since I didn't think I needed one in order to get a Business Credit Card, but would getting one help in my approval odds?

Thanks for the tips, especially AZEO. I didn't know that was a factor in my credit score. I had been having many small balances report on all of my personal credit cards.

Not having an EIN and registered business does not necessarily hinder your odds at getting approved for a lot of business cards as they are mostly personal gaurantee. I have two Chase Ink cards (2018 and 2019) that I opened as Sole Proprietor with no EIN and many others here have done the same. I only asked to see how established your business was. Some of the smaller lenders may want business documentation, such as Citizens and possibly FNBO.

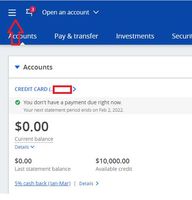

As far as preapprovals. I do not know where they live on mobile; however, on desktop, log into your Chase online account management. Once you are logged in, on the upper left-hand corner of your screen, you will see three, horizontal bars. Click that and a menu opens. Towards the bottom of that menu reads: "EXPLORE PRODUCTS" and the first option reads "Just For You." Here, if you are pre-approved for credit, you would already see a green or black star. Click the "Just For You" and you will be taken to a screen which indicates all products and services that you are pre-approved for. If you are pre-approved for an Ink card, there is a good chance at approval.

I included screen shots for your reference. Understand that I have no pre-approved credit products as I already have four Chase cards with little use. But more or less, this is what it would look like.

Please see this thread from 805orbust to see what it would look like for a pre-approved business credit card:

https://ficoforums.myfico.com/t5/Business-Credit/Chase-Pre-Approval-Scam/td-p/6459265

Absolutely practice the AZEO method for a few months and you will see the difference. As far as Chase, give them some more time and keep looking for pre-approvals. I would recommend letting your current accounts grow for a while so that your credit history can lengthen.

Good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice needed, odds on getting Chase Ink Cash

Under menu look for "Just For You"

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice needed, odds on getting Chase Ink Cash

@Anonymous wrote:

@SouthJamaica wrote:

@Anonymous wrote:Current personal cards:

- Discover It Student $3,750 limit opened Jan 2019

- Amex Delta Gold $15,000 limit opened Jan 2020

- PC'd to Amex Delta Blue

- BoA Cash Rewards $3,500 limit opened Feb 2020

- Chase Freedom $1,000 limit opened April 2020

- Chase Sapphire Prefered $13,600 limit opened Jun 2020

- PC'd to Chase Freedom Flex

- Chase Freedom Flex $5,500 limit opened March 2021

- Apple card $10,000 limit opened March 2021

Current Business cards:

- Amex Blue Business Plus April 2020

- Amex Delta Gold Feb 2021 (will close once 1 year)

- Amex Blue Business Cash June 2021

- Amex Platinum Business Dec 2021

FICO Score: 760

Oldest account age: 3 yearsAverage age of credit: 1 year, 7 months

Income: $250,000

Open to Business Cards: Yes

I will be dropping to 4/24 in February 2022, and I am looking to apply for the Chase Ink Cash business credit card, but I am unsure how open they are to a sole proprietorship "business" after they tightened up since Covid.

I applied Jan 2021 for this card exactly 1 year ago and got immediately denied for "Business structure".

I tried calling reconsideration and got rejected again for

- "Insufficient business credit information on file"

- "Business too new"

- "You have too many active accounts or too much available credit"

Cards I’ve been looking into:

- Chase Ink Cash SUB & 5% on internet, cable, & phone

- Citi Custom Cash 5% categories

- Chase Freedom Unlimited 1.5% everywhere

- US Bank Alt Go 4% dining

- US Bank Cash+ 5% categories

I don't think your chances are good. I would wait until I got a preapproval for it. And if you really want the card, I think you should hold off on adding any other credit cards to your collection.

Are Chase Ink pre-approvals only done through mail? I don't see any pre-approval portal through my Chase account.

Good Q. I'm only offered another checking account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice needed, odds on getting Chase Ink Cash

Your credit profile (personal and business) looks relatively new and thin.

I am a sole prop (10 years business) with a thin credit profile but a very thick and mature personal credit history.

I am giving up on Chase as they have denied me twice (2021 Marriott co branded personal) and most recently their Chase Ink Card with the same reasons you had last year.

Waited until I was a 3/24 and apped for the Ink card as my first app - denied with a EX 745 score !

To see how business bank cards treats me, I have then apped for and approved within the past 2 months:

- Citizen's Business

- FNBO Business

- Hawaiian Airlines Business

- Amex Amazon Prime Business

- Walmart Commercial Net 30

- Arco Commercial Fuel

- FleetCor Fleet fuel

I guess you can say Chase does not like me....![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Advice needed, odds on getting Chase Ink Cash

@Anonymous wrote:Current personal cards:

- Discover It Student $3,750 limit opened Jan 2019

- Amex Delta Gold $15,000 limit opened Jan 2020

- PC'd to Amex Delta Blue

- BoA Cash Rewards $3,500 limit opened Feb 2020

- Chase Freedom $1,000 limit opened April 2020

- Chase Sapphire Prefered $13,600 limit opened Jun 2020

- PC'd to Chase Freedom Flex

- Chase Freedom Flex $5,500 limit opened March 2021

- Apple card $10,000 limit opened March 2021

Current Business cards:

- Amex Blue Business Plus April 2020

- Amex Delta Gold Feb 2021 (will close once 1 year)

- Amex Blue Business Cash June 2021

- Amex Platinum Business Dec 2021

FICO Score: 760

Oldest account age: 3 yearsAverage age of credit: 1 year, 7 months

Income: $250,000

Open to Business Cards: Yes

I will be dropping to 4/24 in February 2022, and I am looking to apply for the Chase Ink Cash business credit card, but I am unsure how open they are to a sole proprietorship "business" after they tightened up since Covid.

I applied Jan 2021 for this card exactly 1 year ago and got immediately denied for "Business structure".

I tried calling reconsideration and got rejected again for

- "Insufficient business credit information on file"

- "Business too new"

- "You have too many active accounts or too much available credit"

Cards I’ve been looking into:

- Chase Ink Cash SUB & 5% on internet, cable, & phone

- Citi Custom Cash 5% categories

- Chase Freedom Unlimited 1.5% everywhere

- US Bank Alt Go 4% dining

- US Bank Cash+ 5% categories

Very very low probability!