- myFICO® Forums

- Types of Credit

- Credit Card Applications

- 3rd Cap1 Card? - UPDATE: APPROVED

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

3rd Cap1 Card? - UPDATE: APPROVED

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

3rd Cap1 Card? - UPDATE: APPROVED

I have a quick question because I am bit confused about Cap1's policy on having a certain number of cards. I am trying to help my grandmother get the Venture card for the 60,000 miles SUB. However, I am hesitant for her to apply because she currently has the Savor One ($11k CL) and the Walmart WEMC ($3.25k). Can she get a third card from them? They seem to like her profile a lot (BK7 in 03/2020) so this may be the only bank that will give her such a good SUB. Thanks!!!!

Profile: Her scores range from 677 to 723, depending on the version. The only debt she has is an auto loan that has a balance of about $9k. Her cards are PIF and she has a very long credit history. The cards she included in her BK show up on her report as well (about 4 cards).

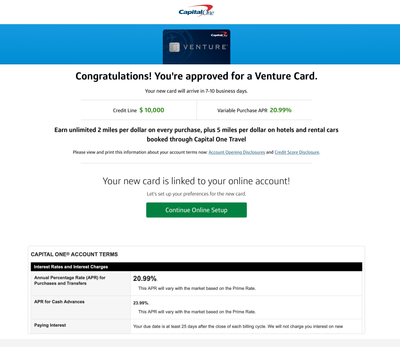

UPDATE: We put her info into the pre-approval page. She was pre-approved for all the Cap1 cards, except for Venture X. She was instantly approved for the Venture for $10k at 20.99%!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3rd Cap1 Card?

I have known others to have multiple Cap1 cards...Cobrand and Core cards like your grandmother. You may want to check their prequalified site to start off the application process

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3rd Cap1 Card?

@RehabbingANDBlabbing wrote:I have a quick question because I am bit confused about Cap1's policy on having a certain number of cards. I am trying to help my grandmother get the Venture card for the 60,000 miles SUB. However, I am hesitant for her to apply because she currently has the Savor One ($11k CL) and the Walmart WEMC ($3.25k). Can she get a third card from them? They seem to like her profile a lot (BK7 in 03/2020) so this may be the only bank that will give her such a good SUB. Thanks!!!!

Profile: Her scores range from 677 to 723, depending on the version. The only debt she has is an auto loan that has a balance of about $9k. Her cards are PIF and she has a very long credit history. The cards she included in her BK show up on her report as well (about 4 cards).

Yes I had 3 cards with them until very recently. I had the Quicksilver, Wal-mart Mastercard and Savorone. Just cancelled Quicksilver because it was obviously never going to grow. So yes 3 cards with them is perfectly normal and fine.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3rd Cap1 Card?

@RehabbingANDBlabbing wrote:I have a quick question because I am bit confused about Cap1's policy on having a certain number of cards. I am trying to help my grandmother get the Venture card for the 60,000 miles SUB. However, I am hesitant for her to apply because she currently has the Savor One ($11k CL) and the Walmart WEMC ($3.25k). Can she get a third card from them? They seem to like her profile a lot (BK7 in 03/2020) so this may be the only bank that will give her such a good SUB. Thanks!!!!

Profile: Her scores range from 677 to 723, depending on the version. The only debt she has is an auto loan that has a balance of about $9k. Her cards are PIF and she has a very long credit history. The cards she included in her BK show up on her report as well (about 4 cards).

Yes. I have the QS, SavorOne, VX.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3rd Cap1 Card?

I'm curious as well. I have two with them... WalMart, and a QS that was PC'd to from a Platinum card last year.

Applied prequal and am seeing Platinum and QS1. I'd really like to get the Venture card, so was wondering if I got the Platinum, would I be able to PC it to a Venture card in a few months. Just can't get past the notion that CapOne pulls from all three reports.

Store Cards:

Major Cards:

In Timeout:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3rd Cap1 Card?

@YoungMoney06 wrote:

Applied prequal and am seeing Platinum and QS1. I'd really like to get the Venture card, so was wondering if I got the Platinum, would I be able to PC it to a Venture card in a few months.

No, you couldn't.

Issuers cannot legally product change a card less than 12 months old to a different one that has a higher annual fee. Since the Venture has an AF and the Platinum does not, even if you otherwise qualified for such an upgrade they can't perform it until you have held the Platinum for at least a year.

FICO 8 (EX) 838 (TU) 846 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3rd Cap1 Card?

@coldfusion wrote:

@YoungMoney06 wrote:

Applied prequal and am seeing Platinum and QS1. I'd really like to get the Venture card, so was wondering if I got the Platinum, would I be able to PC it to a Venture card in a few months.

No, you couldn't.

Issuers cannot legally product change a card less than 12 months old to a different one that has a higher annual fee. Since the Venture has an AF and the Platinum does not, even if you otherwise qualified for such an upgrade they can't perform it until you have held the Platinum for at least a year.

That's what I was wondering. I know my first Platinum card, they did offer me the Venture card (don't think it was the actual Venture, but maybe Venture One, or whatever Venture card has no AF.) But I opted for the QS card instead as the 1.5% made more sense for me than the value of 1 mile.

Store Cards:

Major Cards:

In Timeout:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3rd Cap1 Card?

That would have been one of the Venture One versions. Neither version (Venture One, Venture One for Good Credit) of that card has an AF.

FICO 8 (EX) 838 (TU) 846 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3rd Cap1 Card?

Got it... thanks @coldfusion

Store Cards:

Major Cards:

In Timeout:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 3rd Cap1 Card?

@RehabbingANDBlabbing wrote:I have a quick question because I am bit confused about Cap1's policy on having a certain number of cards. I am trying to help my grandmother get the Venture card for the 60,000 miles SUB. However, I am hesitant for her to apply because she currently has the Savor One ($11k CL) and the Walmart WEMC ($3.25k). Can she get a third card from them? They seem to like her profile a lot (BK7 in 03/2020) so this may be the only bank that will give her such a good SUB. Thanks!!!!

Yes, as others have said, it's possible to have a third card with Cap1. I do. I have a Quicksilver MC, Quicksilver Visa, and Walmart Rewards MC.

However....

I was playing around on their pre-qual page a while back, and it said I didn't qualify for any additional cards with them, i.e., I was at the max number allowed. Now, I don't know if that meant for *me* specifically, or what, so I'm throwing it out there with a YMMV disclaimer!