- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Chase Freedom Application Denied. Called Recon 2X.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase Freedom Application Denied. Called Recon 2X.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Chase Freedom Application Denied. Called Recon 2X.

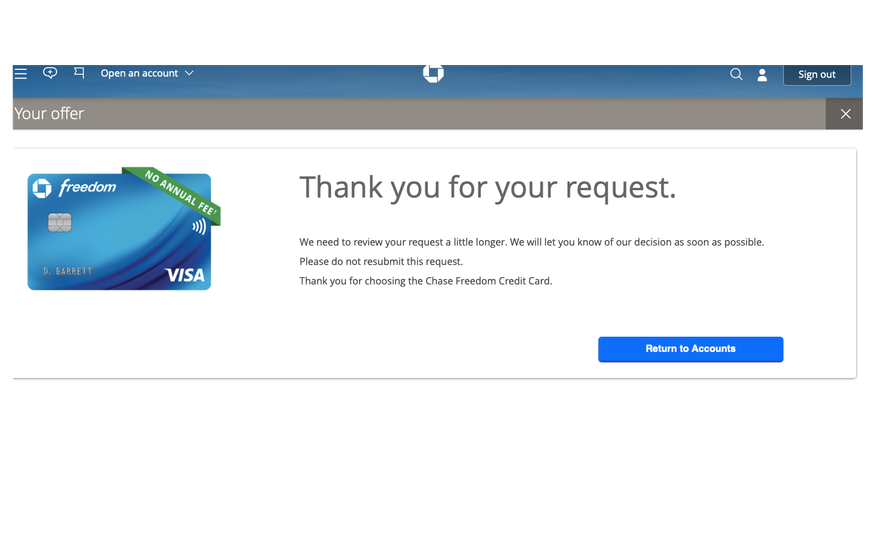

Applied for the Chase Freedom, and then I got the following below:

Currently, I have the following:

1. Chase Freedom Unlimited, $500, opened 6/2016 (AU)

2. CapOne QS1, $1,000, opened 5/2018

3. CapOne Secured, $501, opened 9/2019

4. Discover It Cash Back, $1,000, opened 12/2019

5. Merrick, $1,250, opened 1/1/2020

6. Amex Gold, No Pre-Set SL, opened 3/2020 (Not reported to any CBs)

UTI: 0-1%

Fico 8 scores: EX 654, EQ 633, TU 685

(Tried to pull Experian but I forgot to unlock)

Income: $65K - $74K

Banking Relationship with Chase: Since September 2019. Used to bank with them almost 10 years ago and apparently had a card with them. That's all ancient history. Did not see any pre-approvals so I decided to pull the trigger. Please advise.

UPDATE 3/31: First call was to Chase to unlock my Experian with a CSR that appeared to not have such a good day but I could be wrong. Pleaded my case, income, banking relationship, spend on the card, reasons for wanting the card and I was able to get reconsidered and went from four remarks down to two remarks: Presence of charge off/collection and too many recent inquiries. Called another CSR and she advised to call back tomorrow as Chase can only reconsider once per day.

UPDATE 4/1: Two reconsiderations and this time I built a better rapport with the CSR and she asked clarifying questions about my income and household. I pleaded my case and clarified the charge off/collection as well as the recent inquiries and she said she would do everything in her power to push this through. She seemed genuine enough and apologetic that we could not push it through same reasons as before and that I should just apply again when all the high impact negative items have cleared my report. Also, while my Experian score WAS 654 on 4/1 it dropped to 627 (no bueno)....all zero balance.

Future Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom Application Pending. Call Recon or Let it Be?

Technically you can't recon until you are denied....

Have you checked the status line?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom Application Pending. Call Recon or Let it Be?

How would you recon something that hasn't been denied?

If it's verification, they will contact you via mail if something is needed from you.

Often times nothing is needed, so let the process play itself out.

Some may suggest you call to see if anything is needed from you, but that will be a very long hold (if you even get through), a very tired CSR, and possibly grumpy UW.

A lot of things can go wrong there, so I'd suggest you leave it alone during times like this till they either reach a decision or notify you what's needed.

Just check automated system for updates, or your account to see if card showed up

Good luck with your application

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom Application Pending. Call Recon or Let it Be?

@dragontears wrote:Technically you can't recon until you are denied....

Have you checked the status line?

Yes, typical robot 30-day response. I have often heard of calling the recon line when you get a pending or denied. Curious to what others were thinking. I would try an app-o-rama for the Ink Business but I cannot meet the minimum spend if approved and my scores aren't the best. Into gardening I go for the next 6 months until I fall off 5/24.

Future Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom Application Pending. Call Recon or Let it Be?

@Remedios wrote:How would you recon something that hasn't been denied?

If it's verification, they will contact you via mail if something is needed from you.

Often times nothing is needed, so let the process play itself out.

Some may suggest you call to see if anything is needed from you, but that will be a very long hold (if you even get through), a very tired CSR, and possibly grumpy UW.

A lot of things can go wrong there, so I'd suggest you leave it alone during times like this till they either reach a decision or notify you what's needed.

Just check automated system for updates, or your account to see if card showed up

Good luck with your application

Gracias! I will just wait it out. Applied for Amex Gold and never heard back until two days for an approval. Anything can happen in this crazy world...

Future Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom Application Pending. Call Recon or Let it Be?

Use this guide+

>7/2025 All 3 reports 830 - 845(F8) F9s = all 850 but my app finger is still twitching

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom Application Pending. Call Recon or Let it Be?

@Meanmchine wrote:

Use this guide+

Thank you for this! I just checked and it said two weeks. When I called earlier it said 30 days... I'll check again in 24 to 48 hours. Currently, I am not at 5/24 not technically since Amex has not reported to CBs, they will next month after the 17th. Good to know the statement close date.

Future Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom Application Pending. Call Recon or Let it Be?

No luck, this morning got an email from Chase asking to unlock my Experian report and recon came down to 2 marks from the 4 original marks after I pleaded my case on each mark. HUCA'd (waited on the phone for over an hour) and the CSR told me that I should call back tomorrow or another day as Chase does not process more than 1 reconsideration per day. I will try my luck tomorrow morning.

Future Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom Application Pending. Call Recon or Let it Be?

I would have waited until #2 scrolled off in May since it would have been 2-years.

As it stands, looks like your 5/24 and I don't think recon can help that.

Good luck nonetheless! ![]()

Potential Future Cards

Closed Accounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom Application Pending. Call Recon or Let it Be?

@ultimaterewardsguy357 you can try calling again, but unfortunately you only get one try on recon with Chase.

In the past, it was possible to call again and maybe a different UW approves it.

These days, they will just read the notes from previous recon and leave it at that.

Please update your post, might provide an interesting DP for our members.