- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: NFCU only gave $500 limit? What to do?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

NFCU only gave $500 limit? What to do?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NFCU only gave $500 limit? What to do?

Hello! So today I decided to apply for NFCU credit card because I need about $10,000 in funding for my business. I recently paided off everything on my credit cards and my scores are

770 exp

734 tu

634 eq - Want update for the past 2 months

I'm guess NFCU pulled eq because my limit was only $500. Do yall know where else i should try to apply to get $10k funding? My income is $8,000-$10,000 a month but all of my income is going into my business account with navy federal.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU only gave $500 limit? What to do?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU only gave $500 limit? What to do?

Dont worry. Be patient. Wait for 90/3 statements cut and apply for 2nd card with much higher limit.

Take a look my approval posting for data point:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU only gave $500 limit? What to do?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU only gave $500 limit? What to do?

Weird, have you tried a CLOC? I'm pretty sure they pull TU on CC's and EQ on the CLOC (which I know is your lowest), but it might be worth a shot...if not Discover?

I started with a $500 SL in Jan and was disappointed. 2nd card started at $15k.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU only gave $500 limit? What to do?

@Anonymous wrote:

Well I applied for chase ink business, chase reverse, American blue cash. All denied. All say 30 day later. Guess ill try again next year.

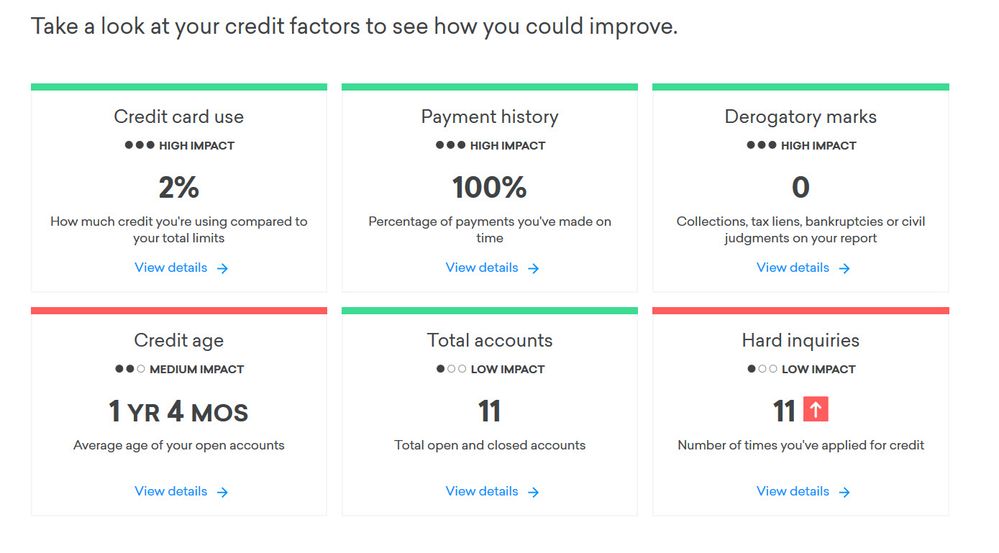

You're getting your scores from Credit Karma which uses Vantagescore. Which almost no lender uses. What are your FICO scores? Your fico scores could be lower.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU only gave $500 limit? What to do?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU only gave $500 limit? What to do?

@Anonymous wrote:Hello! So today I decided to apply for NFCU credit card because I need about $10,000 in funding for my business. I recently paided off everything on my credit cards and my scores are

770 exp

734 tu

634 eq - Want update for the past 2 months

I'm guess NFCU pulled eq because my limit was only $500. Do yall know where else i should try to apply to get $10k funding? My income is $8,000-$10,000 a month but all of my income is going into my business account with navy federal.

Im sorry OP but realistically I dont see credit card lenders offering you a $10k credit limit at this point when your highest limit is only $2k. My suggestion is to take your financial statements and past tax forms to your local banker and look for business loan

From what Ive read, NFCU normally pulls TU

>8/2024 All 3 reports 835ish (F8) F9s = 850 but my app finger is still twitching

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU only gave $500 limit? What to do?

What are your scores? How long have your accounts been open? If you need 10K in funding for your business, why not use the business income to secure a line of credit or credit card or loan? It would help you achieve larger limits with your current creditors. Also, you should make sure that are you requesting CLI at least once every 6 months or so to help build you existing credit limits.

Starting Scores 06/10/13 EQ474 EX538 TU503