- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Navy Federal Datapoints Thread for Membership,...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

@USMC_Winger wrote:

@designated_knitter wrote:

- nRewards Approved 12/2.

- First statement was 12/19 (partial-- only 17 days).

- 2nd statement was 1/19 (first full statement)

- 3rd statement was 2/19 (second full statement)

- March 4: Applied and Approved for platinum with 6900 SL

- Platinum Approved 3/4

- 1st statement was 3/9 (partial -- only 5 days)

- 2nd statement was 4/9 -- full statement

- 3rd statement was 5/9 -- full statement

- June 3rd (today but applied just after midnight). : Applied and approved for GoRewards with 15k starting limit.

NOW, One thing that may have "counted" was that I also had a car loan that was opened on December 1st... a day before the nRewards.

MAYBE I was able to circumvent the 3 full statements on my credit cards because it was counting statements for both the loan and the credit cards. So while I only had 2 full statements on the credit card prior to the next approval, perhaps the UWs looked at it as 4 Full Statements: 2 for the cc and 2 for the loan.

Sooooo, that could be a case of YMMV. 🧐

ETA: I just requested a CLI on my platinum which is at 92 days. My 3rd full statement cuts on 6/9... so we'll see if I get shot down for being too soon.

It appears Navy Fed is going by the date of approval of your first credit account, the auto loan, for the 91/3 rule. I don't know your auto loan report date, but 3 entire months passed between the approval date of the auto loan and the approval date of the Platinum CC, and that seems to be 3 full statements. March 4th was 93 days after the approval date of the auto loan.

Please let us know how your CLI goes. Good luck!

That would be an interesting datapoint. Have a personal or auto loan report for 2 months. Get a new card and request a CLI after the first statement and see if it gets an approval.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

@USMC_Winger wrote:

@designated_knitter wrote:

- nRewards Approved 12/2.

- First statement was 12/19 (partial-- only 17 days).

- 2nd statement was 1/19 (first full statement)

- 3rd statement was 2/19 (second full statement)

- March 4: Applied and Approved for platinum with 6900 SL

- Platinum Approved 3/4

- 1st statement was 3/9 (partial -- only 5 days)

- 2nd statement was 4/9 -- full statement

- 3rd statement was 5/9 -- full statement

- June 3rd (today but applied just after midnight). : Applied and approved for GoRewards with 15k starting limit.

NOW, One thing that may have "counted" was that I also had a car loan that was opened on December 1st... a day before the nRewards.

MAYBE I was able to circumvent the 3 full statements on my credit cards because it was counting statements for both the loan and the credit cards. So while I only had 2 full statements on the credit card prior to the next approval, perhaps the UWs looked at it as 4 Full Statements: 2 for the cc and 2 for the loan.

Sooooo, that could be a case of YMMV. 🧐

ETA: I just requested a CLI on my platinum which is at 92 days. My 3rd full statement cuts on 6/9... so we'll see if I get shot down for being too soon.

It appears Navy Fed is going by the date of approval of your first credit account, the auto loan, for the 91/3 rule. I don't know your auto loan report date, but 3 entire months passed between the approval date of the auto loan and the approval date of the Platinum CC, and that seems to be 3 full statements. March 4th was 93 days after the approval date of the auto loan.

Please let us know how your CLI goes. Good luck!

@USMC_Winger Actually, I didn't have 3 full statements for the car loan either at the time I was approved for the second card. The car loan statement cut 2 days after I was approved for the car loan. So across all my credit lines at the time of approval of the 2nd card, I had 4 full statements between the loan and the cc.

So I still think for approvals of a new credit card, that the 3 full statements could be a combination of loans and credit cards.

NOW, regarding CLIs, it appears that my request was a now go... I haven't gotten a letter but my 3rd full statement for the card in question doesn't cut for another week. So @Brian_Earl_Spilner suggestion of having a loan with 3 full statements and then asking for a CLI a month after being approved for a cc would not work. CLIs definitely seem to be 91 days and 3 full statements...

This is consistent with my nRewards graduation eligibility, I just had my 6th statement but the first was a partial statement. So the earliest I can graduate is June 25th when my 6th statement cuts even though it will be 3 weeks past the 6th month of having the card.

06/15/2019:

03/02/2021:

04/06/2021:

05/28/2021:

Lesson Learned: DON'T POKE THE BEAR!!! THE BEAR WILL WIN!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

Hey all! So I BELEIVE I'm officially in 91/3 land to date but I'm so nervous to request a CLI or new card in fear I'm too soon! So here are my data points

I opened my checking and savings account AND was approved for the cash rewards card on

03/07/2021 score was in the low 700s (720?)

04/20/2021 I was also approved instantly for a Personal loan for $8,000 trans Union was pulled scores were still in the low 700s

05/12/2021 I Opened a business checking Account and have kept a $10,000 available balance with them since then.

now on my cash rewards credit card I've used it religiously maxing it out for the past 3 months and paying it in full my starting limit was only $1,000 sadly.. but I've managed to earn their promotional $250 reward for spending $3,000 on the first 90 days with them.

my personal checking with them I've cashed checks, made deposits, and I've had a weekly deposit going to the account every week since it opened in the amount of $362 and that personal account has had an average of $8,000 available in it.

I'm a month ahead on my personal loan with them and my total utilization across 20 credit cards is currently 1%

my question is first have I passed the 90 day threshold required to wait before you can request a CLI and open a new card? My statement cuts the 22nd of each month and payments are due the 19th of each month. I opened my cash rewards card on the 7th of March 2021.

knowing what you now know about me and my file am I eligible for a CLI? I really want the flagship card.. I just want big big big spending limits I don't really care to much for perks or cash back or rewards I just want a card that will yield me the highest credit limit. what are my chances of an approval if I apply when I figure my eligibility date? Additionally the way to approach a 91/3 is to FIRST request a CLI and then apply for a new card all within minutes of each other correct?

one more side note my score on the navy federal app is currently a 726 I do have 12 hard pulls on my Transunion file and 3 on my Equifax file.

Any help is so greatly appreciated thank you for taking the time to read all this!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

@Anonymous wrote:Hey all! So I BELEIVE I'm officially in 91/3 land to date but I'm so nervous to request a CLI or new card in fear I'm too soon! So here are my data points

I opened my checking and savings account AND was approved for the cash rewards card on

03/07/2021 score was in the low 700s (720?)

04/20/2021 I was also approved instantly for a Personal loan for $8,000 trans Union was pulled scores were still in the low 700s

05/12/2021 I Opened a business checking Account and have kept a $10,000 available balance with them since then.

now on my cash rewards credit card I've used it religiously maxing it out for the past 3 months and paying it in full my starting limit was only $1,000 sadly.. but I've managed to earn their promotional $250 reward for spending $3,000 on the first 90 days with them.

my personal checking with them I've cashed checks, made deposits, and I've had a weekly deposit going to the account every week since it opened in the amount of $362 and that personal account has had an average of $8,000 available in it.

I'm a month ahead on my personal loan with them and my total utilization across 20 credit cards is currently 1%

my question is first have I passed the 90 day threshold required to wait before you can requeat a CLI and open a new card? My statement cuts the 22nd of each month and payments are due the 19th of each month. I opened my cash rewards card on the 7th of March 2021.

knowing what you now know about me and my file am I eligible for a CLI? I really want the flagship card.. I just want big big big spending limits I don't really care to much for perks or cash back or rewards I just want a card that will yield me the highest credit limit. what are my chances of an approval if I apply when I figure my eligibility date?

one more side note my score on the navy federal app is currently a 726 I do have 12 hard pulls on my Transunion file and 3 on my Equifax file.

many help is slow greatly appreciated thank you for taking the time to read all this!

I opened my Nrewards on March 4th and I just passed 91 today. Won't have my 3rdstatement until the 11th.

If you opened yours on March 7th you're not quite there yet. After your June statement you will be.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

@Anonymous wrote:

@Anonymous wrote:Hey all! So I BELEIVE I'm officially in 91/3 land to date but I'm so nervous to request a CLI or new card in fear I'm too soon! So here are my data points

I opened my checking and savings account AND was approved for the cash rewards card on

03/07/2021 score was in the low 700s (720?)

04/20/2021 I was also approved instantly for a Personal loan for $8,000 trans Union was pulled scores were still in the low 700s

05/12/2021 I Opened a business checking Account and have kept a $10,000 available balance with them since then.

now on my cash rewards credit card I've used it religiously maxing it out for the past 3 months and paying it in full my starting limit was only $1,000 sadly.. but I've managed to earn their promotional $250 reward for spending $3,000 on the first 90 days with them.

my personal checking with them I've cashed checks, made deposits, and I've had a weekly deposit going to the account every week since it opened in the amount of $362 and that personal account has had an average of $8,000 available in it.

I'm a month ahead on my personal loan with them and my total utilization across 20 credit cards is currently 1%

my question is first have I passed the 90 day threshold required to wait before you can requeat a CLI and open a new card? My statement cuts the 22nd of each month and payments are due the 19th of each month. I opened my cash rewards card on the 7th of March 2021.

knowing what you now know about me and my file am I eligible for a CLI? I really want the flagship card.. I just want big big big spending limits I don't really care to much for perks or cash back or rewards I just want a card that will yield me the highest credit limit. what are my chances of an approval if I apply when I figure my eligibility date?

one more side note my score on the navy federal app is currently a 726 I do have 12 hard pulls on my Transunion file and 3 on my Equifax file.

many help is slow greatly appreciated thank you for taking the time to read all this!I opened my Nrewards on March 4th and I just passed 91 today. Won't have my 3rdstatement until the 11th.

If you opened yours on March 7th you're not quite there yet. After your June statement you will be.

Oh wow!' June?? Even though it's literally been 90 days since I opened the account? My first statement cut March the 22nd I have 3 statements that have been mailed to me wouldn't June make 4 months?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:Hey all! So I BELEIVE I'm officially in 91/3 land to date but I'm so nervous to request a CLI or new card in fear I'm too soon! So here are my data points

I opened my checking and savings account AND was approved for the cash rewards card on

03/07/2021 score was in the low 700s (720?)

04/20/2021 I was also approved instantly for a Personal loan for $8,000 trans Union was pulled scores were still in the low 700s

05/12/2021 I Opened a business checking Account and have kept a $10,000 available balance with them since then.

now on my cash rewards credit card I've used it religiously maxing it out for the past 3 months and paying it in full my starting limit was only $1,000 sadly.. but I've managed to earn their promotional $250 reward for spending $3,000 on the first 90 days with them.

my personal checking with them I've cashed checks, made deposits, and I've had a weekly deposit going to the account every week since it opened in the amount of $362 and that personal account has had an average of $8,000 available in it.

I'm a month ahead on my personal loan with them and my total utilization across 20 credit cards is currently 1%

my question is first have I passed the 90 day threshold required to wait before you can requeat a CLI and open a new card? My statement cuts the 22nd of each month and payments are due the 19th of each month. I opened my cash rewards card on the 7th of March 2021.

knowing what you now know about me and my file am I eligible for a CLI? I really want the flagship card.. I just want big big big spending limits I don't really care to much for perks or cash back or rewards I just want a card that will yield me the highest credit limit. what are my chances of an approval if I apply when I figure my eligibility date?

one more side note my score on the navy federal app is currently a 726 I do have 12 hard pulls on my Transunion file and 3 on my Equifax file.

many help is slow greatly appreciated thank you for taking the time to read all this!I opened my Nrewards on March 4th and I just passed 91 today. Won't have my 3rdstatement until the 11th.

If you opened yours on March 7th you're not quite there yet. After your June statement you will be.

Oh wow!' June?? Even though it's literally been 90 days since I opened the account? My first statement cut March the 22nd I have 3 statements that have been mailed to me wouldn't June make 4 months?

Lol no worries. It's my understanding that you need 3 full statements. There's been a few exceptions mentioned here lately for what It's worth but I believe your 3rd full statement would be your June statement.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

@Anonymous wrote:Lol no worries. It's my understanding that you need 3 full statements. There's been a few exceptions mentioned here lately for what It's worth but I believe your 3rd full statement would be your June statement.

Aww wow! It's a good thing I came here and asked lol because I was contemplating hitting the switch! That denial would've crushed my spirits as I've been working religiously on being a navy fed good boy the last 90 days giving them all my money and maximizing their services!! Lol thank you!

so in my case my June statement cuts the 22nd.

so June 23rd I should hit that switch and hope for the best ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

You're welcome and good luck. It sounds like you'll be just fine from your data points. A few more weeks and you'll more than likely feel the navy love in a big way.

This coming Friday is my 91/3 actually it'll be 98/3 . I'm going for the more rewards amex.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

@Anonymous wrote:You're welcome and good luck. It sounds like you'll be just fine from your data points. A few more weeks and you'll more than likely feel the navy love in a big way.

This coming Friday is my 91/3 actually it'll be 98/3 . I'm going for the more rewards amex.

Awesome please if you can remember to keep us updated on your journey as I will do the same my goal is the flag ship I really hope I get approved but the denial always scares me lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

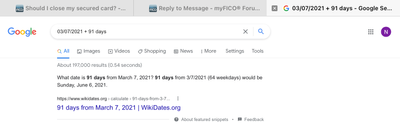

For anyone wanting to know what thei 91st day would be, ask the google machine.

So you can say "03/07/2021 + 91 days" in the search bar and you'll get the following:

This is useful for Comenity as well which is often on a 61 day schedule.

You can also use a spreadsheet that will calculate the date for you as well.

That being said, @Anonymous , expect a great result when you do apply since your usage across all accounts is what they like to see. I would predict card number 2 with a SL of either 25k or 10k based on data points. Either way, you're probably looking at at least 5 digits!

Also, apply for your second card first. THEN hit the Luv button for the CLI. Common wisdom on these boards is that you get a better result that way in terms of SL on card number 2.

Hope this helps and good luck! Day 90 is the hardest!

06/15/2019:

03/02/2021:

04/06/2021:

05/28/2021:

Lesson Learned: DON'T POKE THE BEAR!!! THE BEAR WILL WIN!!!