- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Navy Federal Datapoints Thread for Membership,...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

Wife hit her 91st day yesterday. She didn't use her first card until last month, a goRewards with a 5k credit line. Her balance is $2600. She has only two statements cut for the card. Yesterday applied for a cashRewards, and she got approved instantly for $25000. Her FICO 9 from NFCU is 717. Has one old C/O that is due to fall off later this year.

Now if only I can unlock Navy like she did, I will be business.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

@Jdunn02977 wrote:Wife hit her 91st day yesterday. She didn't use her first card until last month, a goRewards with a 5k credit line. Her balance is $2600. She has only two statements cut for the card. Yesterday applied for a cashRewards, and she got approved instantly for $25000. Her FICO 9 from NFCU is 717. Has one old C/O that is due to fall off later this year.

Now if only I can unlock Navy like she did, I will be business.

That's incredible. Congrats.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

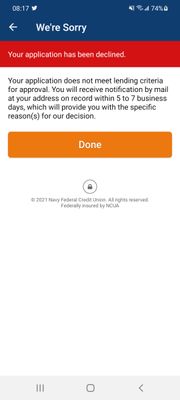

After reading about you wife's success I decided to go for it. I got declined. Here are my data points.

FICO 8's EQ 650 TU 680 EX 685

FICO 9 EQ 688 TU 627 EX 665

have had a secured card with NFCU since 3/4/21 always pay either right after or right before any charges post. 18% util. On all cards. No late payments in over 5 years. I do have 3 CO'S that are fully paid. Will come off next fall. No collections. I'm including a screenshot of the denial. It says "credit worthiness" and not because i didn't wait for the 3rd full statement.

I'm feeling pretty bummed right now. I had such high hopes. I already sent a secured message for a manual recon.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

I myself got the instant decline, same message as you. When I got the letter in the mail, it said the account was too new and I didn't wait the proper time. I then applied again, it went to manual review, and was declined. I didn't get the decline notification for two days after applying.

Hopefully you have better luck on the recon.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

Oh bummer sorry about that. Wait until they fall off then try again. I'll most likely wait untill 95 days then try for my 2nd card unless told by other users its safe to try now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

How are your data points compared to mine? If you don't mind my asking

@Jdunn02977 wrote:I myself got the instant decline, same message as you. When I got the letter in the mail, it said the account was too new and I didn't wait the proper time. I then applied again, it went to manual review, and was declined. I didn't get the decline notification for two days after applying.

Hopefully you have better luck on the recon.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

@Anonymous wrote:How are your data points compared to mine? If you don't mind my asking

FICO 8 EQ 594 TRANS 621 EX 612

FICO 9 EQ 588 TRANS 602 EX 585

I have two CO's still reporting that should be $0 balance in a couple months. I was origanlly approved for a cashRewards with a $500 limit. I wasn't going to apply for a second card and wait it out, but it seems Navy is all over the place with approvals and what not. I din't mind risking the HP.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

So you still have chargoffs that show unpaid and still got approved for a cashrewards? That's awesome.

@Jdunn02977 wrote:

@Anonymous wrote:How are your data points compared to mine? If you don't mind my asking

FICO 8 EQ 594 TRANS 621 EX 612

FICO 9 EQ 588 TRANS 602 EX 585

I have two CO's still reporting that should be $0 balance in a couple months. I was origanlly approved for a cashRewards with a $500 limit. I wasn't going to apply for a second card and wait it out, but it seems Navy is all over the place with approvals and what not. I din't mind risking the HP.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

@designated_knitter wrote:

@USMC_Winger wrote:

@designated_knitter wrote:

- nRewards Approved 12/2.

- First statement was 12/19 (partial-- only 17 days).

- 2nd statement was 1/19 (first full statement)

- 3rd statement was 2/19 (second full statement)

- March 4: Applied and Approved for platinum with 6900 SL

- Platinum Approved 3/4

- 1st statement was 3/9 (partial -- only 5 days)

- 2nd statement was 4/9 -- full statement

- 3rd statement was 5/9 -- full statement

- June 3rd (today but applied just after midnight). : Applied and approved for GoRewards with 15k starting limit.

NOW, One thing that may have "counted" was that I also had a car loan that was opened on December 1st... a day before the nRewards.

MAYBE I was able to circumvent the 3 full statements on my credit cards because it was counting statements for both the loan and the credit cards. So while I only had 2 full statements on the credit card prior to the next approval, perhaps the UWs looked at it as 4 Full Statements: 2 for the cc and 2 for the loan.

Sooooo, that could be a case of YMMV. 🧐

ETA: I just requested a CLI on my platinum which is at 92 days. My 3rd full statement cuts on 6/9... so we'll see if I get shot down for being too soon.

It appears Navy Fed is going by the date of approval of your first credit account, the auto loan, for the 91/3 rule. I don't know your auto loan report date, but 3 entire months passed between the approval date of the auto loan and the approval date of the Platinum CC, and that seems to be 3 full statements. March 4th was 93 days after the approval date of the auto loan.

Please let us know how your CLI goes. Good luck!

@USMC_Winger Actually, I didn't have 3 full statements for the car loan either at the time I was approved for the second card. The car loan statement cut 2 days after I was approved for the car loan. So across all my credit lines at the time of approval of the 2nd card, I had 4 full statements between the loan and the cc.

@designated_knitter, Did your auto loan statement date change from the 3rd of every month? If it didn't, then I count 3 full billing cycles before Mar. 4, 2021, when you applied for your 2nd Navy Fed CC:

Dec. 1, 2020 to Dec. 3, 2020 -- Auto loan approval to 1st statement date <-- short billing cycle

Dec. 3, 2020 to Jan. 2, 2021 -- Auto loan 2nd billing cycle <-- full billing cycle

Jan. 3, 2021 to Feb. 2, 2021 -- Auto loan 3rd billing cycle <-- full billing cycle

Feb. 3, 2021 to Mar. 2, 2021 -- Auto loan 4th billing cycle <-- full billing cycle

So I still think for approvals of a new credit card, that the 3 full statements could be a combination of loans and credit cards.

NOW, regarding CLIs, it appears that my request was a now go... I haven't gotten a letter but my 3rd full statement for the card in question doesn't cut for another week. So @Brian_Earl_Spilner suggestion of having a loan with 3 full statements and then asking for a CLI a month after being approved for a cc would not work. CLIs definitely seem to be 91 days and 3 full statements...

Sorry to hear about the denial for the CLI. But the good news is that you can request the CLI again on Wednesday, after your statement cuts. Good luck again!

This is consistent with my nRewards graduation eligibility, I just had my 6th statement but the first was a partial statement. So the earliest I can graduate is June 25th when my 6th statement cuts even though it will be 3 weeks past the 6th month of having the card.

Start looking for your nRewards card's CL to increase to $2,000 on June 21st 27th if your current CL is less than that. That's the first sign you're graduating, at least that's what happened with mine. Then your nRewards card will change to cashRewards on your list of "Loans & Credit" accounts in the next day or so. A few days later, Navy Fed will release the hold on your secure deposit in your share savings account. Good luck on your graduation, too!

ETA: Since you subsequently clarified that your nRewards card statement date is the 25th, not the 19th, look for the CL to increase to $2,000 on or about June 27th, two days after your statement date.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy Federal Datapoints Thread for Membership, CLIs, and Credit Card Products

@USMC_Winger wrote:

@designated_knitter wrote:

@USMC_Winger wrote:

@designated_knitter wrote:

- nRewards Approved 12/2.

- First statement was 12/19 (partial-- only 17 days).

- 2nd statement was 1/19 (first full statement)

- 3rd statement was 2/19 (second full statement)

- March 4: Applied and Approved for platinum with 6900 SL

- Platinum Approved 3/4

- 1st statement was 3/9 (partial -- only 5 days)

- 2nd statement was 4/9 -- full statement

- 3rd statement was 5/9 -- full statement

- June 3rd (today but applied just after midnight). : Applied and approved for GoRewards with 15k starting limit.

NOW, One thing that may have "counted" was that I also had a car loan that was opened on December 1st... a day before the nRewards.

MAYBE I was able to circumvent the 3 full statements on my credit cards because it was counting statements for both the loan and the credit cards. So while I only had 2 full statements on the credit card prior to the next approval, perhaps the UWs looked at it as 4 Full Statements: 2 for the cc and 2 for the loan.

Sooooo, that could be a case of YMMV. 🧐

ETA: I just requested a CLI on my platinum which is at 92 days. My 3rd full statement cuts on 6/9... so we'll see if I get shot down for being too soon.

It appears Navy Fed is going by the date of approval of your first credit account, the auto loan, for the 91/3 rule. I don't know your auto loan report date, but 3 entire months passed between the approval date of the auto loan and the approval date of the Platinum CC, and that seems to be 3 full statements. March 4th was 93 days after the approval date of the auto loan.

Please let us know how your CLI goes. Good luck!

@USMC_Winger Actually, I didn't have 3 full statements for the car loan either at the time I was approved for the second card. The car loan statement cut 2 days after I was approved for the car loan. So across all my credit lines at the time of approval of the 2nd card, I had 4 full statements between the loan and the cc.

@designated_knitter, Did your auto loan statement date change from the 3rd of every month? If it didn't, then I count 3 full billing cycles before Mar. 4, 2021, when you applied for your 2nd Navy Fed CC:

Dec. 1, 2020 to Dec. 3, 2020 -- Auto loan approval to 1st statement date <-- short billing cycle

Dec. 3, 2020 to Jan. 2, 2021 -- Auto loan 2nd billing cycle <-- full billing cycle

Jan. 3, 2021 to Feb. 2, 2021 -- Auto loan 3rd billing cycle <-- full billing cycle

Feb. 3, 2021 to Mar. 2, 2021 -- Auto loan 4th billing cycle <-- full billing cycle

So I still think for approvals of a new credit card, that the 3 full statements could be a combination of loans and credit cards.

NOW, regarding CLIs, it appears that my request was a now go... I haven't gotten a letter but my 3rd full statement for the card in question doesn't cut for another week. So @Brian_Earl_Spilner suggestion of having a loan with 3 full statements and then asking for a CLI a month after being approved for a cc would not work. CLIs definitely seem to be 91 days and 3 full statements...

Sorry to hear about the denial for the CLI. But the good news is that you can request the CLI again on Wednesday, after your statement cuts. Good luck again!

This is consistent with my nRewards graduation eligibility, I just had my 6th statement but the first was a partial statement. So the earliest I can graduate is June 25th when my 6th statement cuts even though it will be 3 weeks past the 6th month of having the card.

Start looking for your nRewards card's CL to increase to $2,000 on June 21st if your current CL is less than that. That's the first sign you're graduating, at least that's what happened with mine. Then your nRewards card will change to cashRewards on your list of "Loans & Credit" accounts in the next day or so. A few days later, Navy Fed will release the hold on your secure deposit in your share savings account. Good luck on your graduation, too!

So wait.. the 91/3 rule applies to new not only the opening of a CC but also a loan?? That's horrible news for me I wish I would've know that before I took out a personal loan!! My 91 days is up tomorrow.. but I opened a personal loan a month after opening my credit card so I need to wait an additional month your saying before I can get a CLI and my second card?