- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: PenFed Conditional Approval

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

PenFed Conditional Approval

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PenFed Conditional Approval

Hello forum,

I recently joined PenFed where I applied for the Pathfinder Amex Card as I would like to try and secure a no annual fee travel card given my credit over the last 2 years has rebound from 500 to 700 plus range after cleaning up errors on my reports, getting qualified and securing a new mortgage and steadily decreasing my credit utilization while growing my credit limits on active accounts some of which are 1-2 years old now.

Current CC utilization is 12%, average age of all open accounts is a little over 2 years.

The result of the credit card application, PenFed gave a conditional approval but when I inquired further it was an approval for a different card - Power Cash Visa Card with only a $1,200 CL at the highest interest rate.

When I called this morning and spoke with the CSR, I asked for reconsideration of a higher limit and lower interest rate given I have open CC accounts with CL mostly in the 9-14K range, she proceeded to discuss with the loan team.

In the end, I was not granted a higher limit or lower interest rate though my current EQ 9 score is 738 (as confirmed by PenFed). The reasons given for an alternate offer, too many recent inquiries and new accounts within the past 12 months. Given I am a new member they would like to establish more history with me before extending more credit. I was also advised that if I accept the offer in 6 months I can get re-evaluated for limit increase and terms.

Outside of getting the Amex card, I am not really looking to add additional credit cards in the next 12 -18 months.

With that said, I wanted to get some feedback from the community - would you accept the low limit PenFed card and try to build some history and then reapply for the Amex in 6 mos?

Starting Score: 536

Starting Score: 536Current Scores EQ/TU/EX Fico8: 791/792/792

Current Scores EQ/TU/EX Fico9: 790/767/793

Goal Score: 800

Take the myFICO Fitness Challenge

AMEX Plat; Apple Card (18.5K); BOFA Cash Rewards (40K); BOFA Travel Rewards (23K); Bilt (4K); BMW (17.5K); Chase Amazon (25.2K); Chase SW Priority (23K); Chase United Quest (20K); Citi Advantage (42K); Citi Rewards+ (12K); Discount Tire (10K); Discover (28K); DCU (20K); Ebay MC (10K); HSBC Premier (27K); HSBC Premier Elite (29K); Macys Amex (25K); Navy Fed More Rewards (21K); Navy Fed Flagship (46.1K); Navy Fed Platinum (12.9K); Pen Fed Gold (17.5K); Pen Fed Power Cash Rewards (25K); PNC Cash Rewards (15K); PNC Core (10K); Signature FCU (20K); Truist x2 (7.5K); WF Reflect (16.3K)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed Conditional Approval

Do you want it?

You can PC later on to the other version? (not sure as I dumped PF ages ago and never ventured into their credit products while with them)

Did you take the HP?

I've gotten familiar with other CU's in the past and currently still hold a stable of 4 CC's from different ones. There's a sliding scale based on score typically with a CU "loan" that tells you what you'll end up with for an APR.

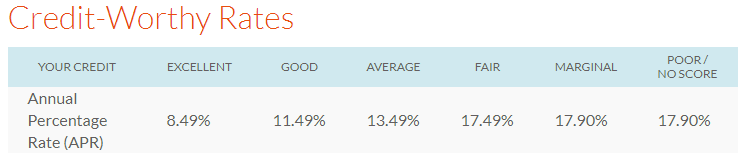

for instance if your scores are 730+ you would be at the 8.49%, say 710-730 11.49% and so on. As your scores improve you can "re-evaluate" the current terms and slide down the rate scale. I eventually locked in 6.9% Fixed with a particular CU by doing this. From experience most don't show you the scale but, you know the range when you apply or look at the website.

Anyway.... so the delimma is whether to accept/keep and determine if it's going to be a long term fit. Like I said I have 4 accounts elsewhere that have been pretty decent over the past 12 years or so I've held them. They're not going to give you a baller limit but, they do make a good stable standby when you really need them for something that can't be PIF. Most of them offer $0 BT functions which comes in handy if you want to hit the SUB on another card but that new card doesn't offer 0% period.

My 2 highest that are open to anyone are JFCU and Consumers which are both over 25K/ea sitting at ~12% APR. The 6.9 is only 16.5K though for emergencies and they won't bump the limit since I don't "bank" with them any more with other open loans/shares.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed Conditional Approval

@Anonymous wrote:Do you want it? - Yes I am considering it at this point since they did a separate HP for the original application submitted, and true they typically do not have fees for BT if ever needed.

You can PC later on to the other version? (not sure as I dumped PF ages ago and never ventured into their credit products while with them) - I would be curious to know from others on the forum their experience with this or if this is even available at PF

Did you take the HP? Yes unfortunately, I would have expected it to just be one since I am a new customer

Starting Score: 536

Starting Score: 536Current Scores EQ/TU/EX Fico8: 791/792/792

Current Scores EQ/TU/EX Fico9: 790/767/793

Goal Score: 800

Take the myFICO Fitness Challenge

AMEX Plat; Apple Card (18.5K); BOFA Cash Rewards (40K); BOFA Travel Rewards (23K); Bilt (4K); BMW (17.5K); Chase Amazon (25.2K); Chase SW Priority (23K); Chase United Quest (20K); Citi Advantage (42K); Citi Rewards+ (12K); Discount Tire (10K); Discover (28K); DCU (20K); Ebay MC (10K); HSBC Premier (27K); HSBC Premier Elite (29K); Macys Amex (25K); Navy Fed More Rewards (21K); Navy Fed Flagship (46.1K); Navy Fed Platinum (12.9K); Pen Fed Gold (17.5K); Pen Fed Power Cash Rewards (25K); PNC Cash Rewards (15K); PNC Core (10K); Signature FCU (20K); Truist x2 (7.5K); WF Reflect (16.3K)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed Conditional Approval

Well, then I would just say YES to the CC and provide them with the docs they'll ask for to setup the new account.

If you want to diversify things a bit then check out JFCU / Consumers as they're both easy to work with / join.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed Conditional Approval

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed Conditional Approval

Very cool story @Hex. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed Conditional Approval

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed Conditional Approval

Thank you everyone for sharing your stories, sounds like I may have a similar story working with them to build history over time.

I decided this morning to move forward with their terms and accepted the card, thanks again.

Starting Score: 536

Starting Score: 536Current Scores EQ/TU/EX Fico8: 791/792/792

Current Scores EQ/TU/EX Fico9: 790/767/793

Goal Score: 800

Take the myFICO Fitness Challenge

AMEX Plat; Apple Card (18.5K); BOFA Cash Rewards (40K); BOFA Travel Rewards (23K); Bilt (4K); BMW (17.5K); Chase Amazon (25.2K); Chase SW Priority (23K); Chase United Quest (20K); Citi Advantage (42K); Citi Rewards+ (12K); Discount Tire (10K); Discover (28K); DCU (20K); Ebay MC (10K); HSBC Premier (27K); HSBC Premier Elite (29K); Macys Amex (25K); Navy Fed More Rewards (21K); Navy Fed Flagship (46.1K); Navy Fed Platinum (12.9K); Pen Fed Gold (17.5K); Pen Fed Power Cash Rewards (25K); PNC Cash Rewards (15K); PNC Core (10K); Signature FCU (20K); Truist x2 (7.5K); WF Reflect (16.3K)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed Conditional Approval

1) A direct deposit of at least $500 a month into the checking account ($125 per week works). Or

2) Maintain a balance of at least $500 in the checking account.

Happy to hear you accepted their offer.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PenFed Conditional Approval

Starting Score: 536

Starting Score: 536Current Scores EQ/TU/EX Fico8: 791/792/792

Current Scores EQ/TU/EX Fico9: 790/767/793

Goal Score: 800

Take the myFICO Fitness Challenge

AMEX Plat; Apple Card (18.5K); BOFA Cash Rewards (40K); BOFA Travel Rewards (23K); Bilt (4K); BMW (17.5K); Chase Amazon (25.2K); Chase SW Priority (23K); Chase United Quest (20K); Citi Advantage (42K); Citi Rewards+ (12K); Discount Tire (10K); Discover (28K); DCU (20K); Ebay MC (10K); HSBC Premier (27K); HSBC Premier Elite (29K); Macys Amex (25K); Navy Fed More Rewards (21K); Navy Fed Flagship (46.1K); Navy Fed Platinum (12.9K); Pen Fed Gold (17.5K); Pen Fed Power Cash Rewards (25K); PNC Cash Rewards (15K); PNC Core (10K); Signature FCU (20K); Truist x2 (7.5K); WF Reflect (16.3K)