- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Shocking First Apple Card CLI Denial!!!!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Shocking First Apple Card CLI Denial!!!!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Shocking First Apple Card CLI Denial!!!!

Today’s CLI request that I had planned six months in advance for today, did not go as planned. I would appreciate anyones ideas and feedback on where I went wrong.

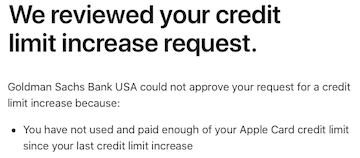

According to the email, I apparently have spend enough. This may be true. Below is my usage over the past 14 months. I think my issue was that, without knowing better, I got two cards (Apple & Disco) issued within a week of each other. I split my spending between them.

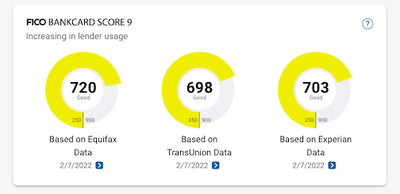

Beyond my spending, I was shocked to find how they viewed my FICO 9 score from TU. According to myFico, my Bankcard Fico 9 is higher than they claim. I am curious to know where the difference is between what I am seeing on my end and what they are seeing that led to such a disparity in the scores.

Data Points time of CLI Request

TU9/TU9 Bankcard: 733/698 according to myFico

Baddies: Bankruptcy Ch7 August 2012 (falls off this year), no collections

Payment history: perfect for nearly 10 years on all accounts.

Total Available CL Reporting: $43.5K

CC Utilization Across all CL's: ~5.85%

DTI: 17%

AAoA: 8 years 2 Months

AoYA: 8 months

Date of first Approval for Card: October 2020

Original Approval Amount: $2500

Prior CLI’s: February 2021 - $1.5K, August 2021 - $500

My plan was to ask for one more CLI, and sock drawer the AppleCard after that. I was going to focus all spending on the new NFCU CashRewards card to increase the odds of high CLI's. I can wring out around $2200/mo in legitmate spend on any card. I am not points hungry at all, and I have no travel comming up for several years. Am I going about this the right way?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shocking First Apple Card CLI Denial!!!!

I've spent $1700 on my Apple Card since December and they denied me for a CLI a few days ago. Same reason they gave you. I opened my card in June 2021 I believe ($3,000) and requested a CLI in September. Bumped it up to $3,750 and that's where I've been since. I did opened a few card after I was approved but have only opened one since my last approved CLI. I was kind of shocked they declined the request, but what am I going to do call them and complain that they won't give me a CLI bc I have used $1,700 in 3 month on a card that has a $3,750 revolving limit? Oh well.

Bank/Loans:

Future Apps:

04/27/2023

FICO 8 - EX: 744 | TU: 772 | EQ: 763

VS 3.0 - EX: 759 | TU: 792 | EQ: 811

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shocking First Apple Card CLI Denial!!!!

I had similar issues with it as well. I spent a decent percentage of the CL on the card in the last three months before I requested a CLI and they denied me. The CL was much too small for me to put the new Macbook on it. I had planned on buying it on the card almost a year in advance and was so annoyed with the denial that I cancelled the card. I'm probably going to reapply later and hopefully get a decent SL now that my credit score is much better. I might have been a bit hasty, but what is done, is done.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shocking First Apple Card CLI Denial!!!!

@HeavyResist wrote:Today’s CLI request that I had planned six months in advance for today, did not go as planned. I would appreciate anyones ideas and feedback on where I went wrong.

Beyond my spending, I was shocked to find how they viewed my FICO 9 score from TU. According to myFico, my Bankcard Fico 9 is higher than they claim. I am curious to know where the difference is between what I am seeing on my end and what they are seeing that led to such a disparity in the scores.

TU9/TU9 Bankcard: 733/698 according to myFicoBaddies: Bankruptcy Ch7 August 2012 (falls off this year), no collections

An item to keep in mind, the variation of the TU FICO 9 scores you are seeing is because they are two different industry-specific models.

FICO Classic 9 ranges from 300-850 whereas FICO Bankcard 9 ranges from 250-900. Different factors impact each respective model which is why you see a gap between both.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shocking First Apple Card CLI Denial!!!!

@Anonymous wrote:I had similar issues with it as well. I spent a decent percentage of the CL on the card in the last three months before I requested a CLI and they denied me. The CL was much too small for me to put the new Macbook on it. I had planned on buying it on the card almost a year in advance and was so annoyed with the denial that I cancelled the card. I'm probably going to reapply later and hopefully get a decent SL now that my credit score is much better. I might have been a bit hasty, but what is done, is done.

I have to be honest: While I know that closing a card could be detrimental, I have the same frustration and want to say screw you GS!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shocking First Apple Card CLI Denial!!!!

It is going to suck to sock drawer this card early. But my future spending needs to concentrate on the new cards I am getting, expecially the Chase I have planned in November of this year if I am going to build the trifecta. But its a shame: I wanted to buy a new Mac this year, without using a massive amount of my ultilization to do so.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shocking First Apple Card CLI Denial!!!!

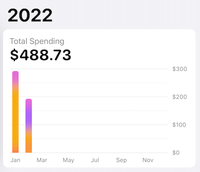

While I don't think anyone has the exact formula figured out the general consensus around CLIs on the Apple card seems to be you need to run at least 1/3 of your CL through it in the quarter leading up to asking, based on the screen shots it seems you didn't quite hit those numbers (rough math puts you about $200~ shy based on the limit in your sig) and their denial reason seems to match up with that.

I got my Apple card last February with scores in same ballpark as you it started at $1,500 and its now at $11,500 with my next CLI request coming up next week. I have followed the 1/3 rule and usually try and spend closer to half of my CL each quarter if I can and so far it has led to some pretty solid increases.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shocking First Apple Card CLI Denial!!!!

@mau471 wrote:While I don't think anyone has the exact formula figured out the general consensus around CLIs on the Apple card seems to be you need to run at least 1/3 of your CL through it in the quarter leading up to asking, based on the screen shots it seems you didn't quite hit those numbers (rough math puts you about $200~ shy based on the limit in your sig) and their denial reason seems to match up with that.

I got my Apple card last February with scores in same ballpark as you it started at $1,500 and its now at $11,500 with my next CLI request coming up next week. I have followed the 1/3 rule and usually try and spend closer to half of my CL each quarter if I can and so far it has led to some pretty solid increases.

I'm wondering if buying an apple product that is half the limit thru the card would help achieve that?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shocking First Apple Card CLI Denial!!!!

@HeavyResist wrote:Today’s CLI request that I had planned six months in advance for today, did not go as planned. I would appreciate anyones ideas and feedback on where I went wrong.

I have asked for CLI increases twice before and received them in about 10 min. My first request was after 100 days. The second 6 months later. I made sure my balance was $0 on this card, with spending just 3 days prior. Today however I did not get immediate approval. In fact I didn’t get my denial until this evening before midnight cst.

According to the email, I apparently have spend enough. This may be true. Below is my usage over the past 14 months. I think my issue was that, without knowing better, I got two cards (Apple & Disco) issued within a week of each other. I split my spending between them.

YTD Spend

Beyond my spending, I was shocked to find how they viewed my FICO 9 score from TU. According to myFico, my Bankcard Fico 9 is higher than they claim. I am curious to know where the difference is between what I am seeing on my end and what they are seeing that led to such a disparity in the scores.

Data Points time of CLI Request

TU9/TU9 Bankcard: 733/698 according to myFico

Baddies: Bankruptcy Ch7 August 2012 (falls off this year), no collections

Payment history: perfect for nearly 10 years on all accounts.

Total Available CL Reporting: $43.5K

CC Utilization Across all CL's: ~5.85%

DTI: 17%

AAoA: 8 years 2 Months

AoYA: 8 months

Date of first Approval for Card: October 2020

Original Approval Amount: $2500

Prior CLI’s: February 2021 - $1.5K, August 2021 - $500

My plan was to ask for one more CLI, and sock drawer the AppleCard after that. I was going to focus all spending on the new NFCU CashRewards card to increase the odds of high CLI's. I can wring out around $2200/mo in legitmate spend on any card. I am not points hungry at all, and I have no travel comming up for several years. Am I going about this the right way?

I'm sorry to hear about your denial! I've gotten this denial reason before too! From what I'm reading from some Apple Card holders in another credit forum they tend to like to see us use between 20 to 30% of our current limit. The 2 limit increases I've received came after I purchased a new iPhone and a new MacBook. Those were the only times I got a yes. Not saying you have to spend that much. Just noticed me spending $400 to $500 a month wasn't getting me a limit increase.

As far as the difference in your MyFico Fico 9 and what Apple has reported, I could be wrong but I believe they use the Fico 9 that's found under "Other Loans" not the Bankcard 9 version.

Also worth noting in my experience before I got the Apple Card, every time I applied for the Apple card and got denied and now every time I ask for a limit increase and get denied I notice the score on the denial email is what my Fico 9 was 1 to 2 months ago. Goldman Sachs tends to use 1 to 2 month old credit reports for their soft pulls. So that is likely why your score on your denial email is different.

For your plan to focus a lot of your spend on your Navy Federal Cash Rewards for a big limit increase. You may find that not to be necessary. My wife has a reoccurring monthly subscription on her Cash Rewards card of $16. In 2021 she got a $4000 limit increase back when that was the max, and an $8000 increase. This year she's also gotten another $8000 increase so far. We never spend more than $16 on it in a month.

Sorry again for your denial! Best wishes to you the next time you ask them for an increase!

![Capital One Quicksilver | $4000 | July 2013 [AU]](https://ecm.capitalone.com/WCM/card/products/quicksilver-card-art.png)

![Capital One Venture X | $40,000 | September 2023 [AU]](https://ecm.capitalone.com/WCM/card/products/venturex-cg-static-card-1000x630-2.png)

![Chase Amazon Prime | $17,400 | March 2020 [AU]](https://creditcards.chase.com/content/dam/jpmc-marketplace/card-art/prime_visa.png)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shocking First Apple Card CLI Denial!!!!

@Jordan23ww wrote:

I'm sorry to hear about your denial! I've gotten this denial reason before too! From what I'm reading from some Apple Card holders in another credit forum they tend to like to see us use between 20 to 30% of our current limit. The 2 limit increases I've received came after I purchased a new iPhone and a new MacBook. Those were the only times I got a yes. Not saying you have to spend that much. Just noticed me spending $400 to $500 a month wasn't getting me a limit increase.

As far as the difference in your MyFico Fico 9 and what Apple has reported, I could be wrong but I believe they use the Fico 9 that's found under "Other Loans" not the Bankcard 9 version.

Also worth noting in my experience before I got the Apple Card, every time I applied for the Apple card and got denied and now every time I ask for a limit increase and get denied I notice the score on the denial email is what my Fico 9 was 1 to 2 months ago. Goldman Sachs tends to use 1 to 2 month old credit reports for their soft pulls. So that is likely why your score on your denial email is different.

For your plan to focus a lot of your spend on your Navy Federal Cash Rewards for a big limit increase. You may find that not to be necessary. My wife has a reoccurring monthly subscription on her Cash Rewards card of $16. In 2021 she got a $4000 limit increase back when that was the max, and an $8000 increase. This year she's also gotten another $8000 increase so far. We never spend more than $16 on it in a month.Sorry again for your denial! Best wishes to you the next time you ask them for an increase!

Thanks for the feedback. Is Nfcu different than other card issuers that way? The traditional advice has been to focus the spend on a new card.