- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Shocking First Apple Card CLI Denial!!!!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Shocking First Apple Card CLI Denial!!!!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shocking First Apple Card CLI Denial!!!!

Ok I read it twice and still don't know why the denial is "shocking". You are not using it much so they should tie up more reserves to give you a CLI that you will continue to not use?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shocking First Apple Card CLI Denial!!!!

@HeavyResist wrote:

@Jordan23ww wrote:I'm sorry to hear about your denial! I've gotten this denial reason before too! From what I'm reading from some Apple Card holders in another credit forum they tend to like to see us use between 20 to 30% of our current limit. The 2 limit increases I've received came after I purchased a new iPhone and a new MacBook. Those were the only times I got a yes. Not saying you have to spend that much. Just noticed me spending $400 to $500 a month wasn't getting me a limit increase.

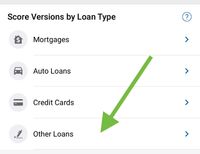

As far as the difference in your MyFico Fico 9 and what Apple has reported, I could be wrong but I believe they use the Fico 9 that's found under "Other Loans" not the Bankcard 9 version.

Also worth noting in my experience before I got the Apple Card, every time I applied for the Apple card and got denied and now every time I ask for a limit increase and get denied I notice the score on the denial email is what my Fico 9 was 1 to 2 months ago. Goldman Sachs tends to use 1 to 2 month old credit reports for their soft pulls. So that is likely why your score on your denial email is different.

For your plan to focus a lot of your spend on your Navy Federal Cash Rewards for a big limit increase. You may find that not to be necessary. My wife has a reoccurring monthly subscription on her Cash Rewards card of $16. In 2021 she got a $4000 limit increase back when that was the max, and an $8000 increase. This year she's also gotten another $8000 increase so far. We never spend more than $16 on it in a month.Sorry again for your denial! Best wishes to you the next time you ask them for an increase!

Thanks for the feedback. Is Nfcu different than other card issuers that way? The traditional advice has been to focus the spend on a new card.

@HeavyResist you're welcome! So far they seem to be different. I have 2 cards and my wife has 1 and only the Flagship card see's a lot of consistent spend. It's my card I use for all the bills that I don't have cards with higher multipliers on. The More Rewards is at 33K and the Cash Rewards is at 21K. They keep granting increases when requested although less than $50 is spent each month on them.

![Capital One Quicksilver | $4000 | July 2013 [AU]](https://ecm.capitalone.com/WCM/card/products/quicksilver-card-art.png)

![Capital One Venture X | $40,000 | September 2023 [AU]](https://ecm.capitalone.com/WCM/card/products/venturex-cg-static-card-1000x630-2.png)

![Chase Amazon Prime | $17,400 | March 2020 [AU]](https://creditcards.chase.com/content/dam/jpmc-marketplace/card-art/prime_visa.png)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shocking First Apple Card CLI Denial!!!!

@dragontears wrote:Ok I read it twice and still don't know why the denial is "shocking". You are not using it much so they should tie up more reserves to give you a CLI that you will continue to not use?

It wasnt shocking. I probably should have put shocking in quotes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shocking First Apple Card CLI Denial!!!!

It's real simple actually GS/Apple loves (not likes but loves) big spend and big payments on their card for CLI. So unless you do that they will either deny a CLI or give a very small one. Only way to get nice CLI's is what I said in the first line.