- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Shot down for Patelco CU

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Shot down for Patelco CU

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Shot down for Patelco CU

I sorted suspected it was merely a chance but applied to them after being membership approved and opened both a Money Market Account plus Regular Savings. Good part is that it seemed enough for at least a small approval and offered some hope since they they pull experien which is fairly good so far.

Nothing doing. and yet another wasted INQ for nothing, Heck i would been satisfied with a $1000 and work up from there over the course of time.

Credit Unions seem to hate me except PenFed but that's my fate currently and i have to accept it.

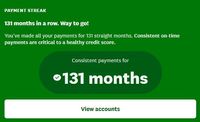

Over 10 years perfect on time payments and not once late ever or otherwise with ALL my lenders.

Months on end from 2020 with 1% utilization as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shot down for Patelco CU

Thanks @AllZero

Its disgusting to say the least but their risk is 0.

I'm done with wasting time and ruining my INQ's with CU's aside from Navy, Alliant and PenFed all whom give you a chance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shot down for Patelco CU

@CreditMagic7 wrote:Thanks @AllZero

Its disgusting to say the least but their risk is 0.

I'm done with wasting time and ruining my INQ's with CU's aside from Navy, Alliant and PenFed all whom give you a chance.

The bigger CUs may be in a position to be a little looser. The other CUs, maybe not so much.

One the plus side, Patelco appears to have decent APY on their accounts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shot down for Patelco CU

@CreditMagic7 wrote:I sorted suspected it was merely a chance but applied to them after being membership approved and opened both a Money Market Account plus Regular Savings. Good part is that it seemed enough for at least a small approval and offered some hope since they they pull experien which is fairly good so far.

Nothing doing. and yet another wasted INQ for nothing, Heck i would been satisfied with a $1000 and work up from there over the course of time.

Credit Unions seem to hate me excect PenFed but that's my fate currently and i have to accept it.

Over 10 years perfect on time payments and not once late ever or otherwise with ALL my lenders.

Months on end from 2020 with 1% utilization as well.

While it's great that you're a new member with such a great CU, Credit Unions (or banks for that matter) do not "hate" you (or anyone really). You've achieved some decent approvals (and CLIs) since the BK7 was discharged, and as you're aware, that particular factor along with the number of new accounts + inquiries in the past ~15 months, is bound to make some potential lenders a bit nervous, especially in today's lending environment.

It's obviously your decision on which approach drives your rebuilding strategy, but in the short horizon, you're going to experience a lot more frustration if the denials keep piling up. I would definitely nurture the CU banking relationships as you've been doing, but hold off on CC products for a while.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shot down for Patelco CU

@CreditMagic7 wrote:I sorted suspected it was merely a chance but applied to them after being membership approved and opened both a Money Market Account plus Regular Savings. Good part is that it seemed enough for at least a small approval and offered some hope since they they pull experien which is fairly good so far.

Nothing doing. and yet another wasted INQ for nothing, Heck i would been satisfied with a $1000 and work up from there over the course of time.

Credit Unions seem to hate me excect PenFed but that's my fate currently and i have to accept it.

Over 10 years perfect on time payments and not once late ever or otherwise with ALL my lenders.

Months on end from 2020 with 1% utilization as well.

Was going to save last post for if Navy approved my recent cli request but chances of that are about the same as me winning lottery lol.

CM7, i feel ya on wasted hps for nothing , im the king of those. Dont feel too bad at being rejected. This is only my opinion and experience, but i feel credit scores are meaningless. Most every application i ever do and get rejected for sights income and debt so those are more important to most lenders. A perfect payment history is nice and all, but once you throw in a bk or a late or a derog that gets tossed out the window imho.

Ive been rejected for a couple CU recently, Affinity says im too poor and too much debt lol. Joined AFFCU but they couldnt pull Eq for a cc app. Approved membership but what good will it do if they cant access my Eq. Stupid as always threw another app at PF to see if my Eq was working . ..hp ! Yes....denied again . I just cant win with them lol. 4 + years 2 pl, perfect paymebt history blah blah they dont care. All they see is low income and debt. I get it understand it but dont agree with their assessment of my profile.

Just have to realize i need to give up the game until i can get a handle on my debt , inqs, etc. Funny thing is my score is going up as my debt goes down little by little. Finally hit 757 Tu and Ex as of today. Lenders dont care.

I guess my big thing for you , and me too, is give our business to those lenders who seem to " treat" our profiles with what we consider good tlc![]() . Lets not stress those who dont. Time is too short to stress on these " failures" lol . Stay well buddy, i know you will come out stronger on your comeback journey. I just hope to make it back to the trail

. Lets not stress those who dont. Time is too short to stress on these " failures" lol . Stay well buddy, i know you will come out stronger on your comeback journey. I just hope to make it back to the trail![]() . ✌

. ✌

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shot down for Patelco CU

@FinStar wrote:

@CreditMagic7 wrote:I sorted suspected it was merely a chance but applied to them after being membership approved and opened both a Money Market Account plus Regular Savings. Good part is that it seemed enough for at least a small approval and offered some hope since they they pull experien which is fairly good so far.

Nothing doing. and yet another wasted INQ for nothing, Heck i would been satisfied with a $1000 and work up from there over the course of time.

Credit Unions seem to hate me excect PenFed but that's my fate currently and i have to accept it.

Over 10 years perfect on time payments and not once late ever or otherwise with ALL my lenders.

Months on end from 2020 with 1% utilization as well.

While it's great that you're a new member with such a great CU, Credit Unions (or banks for that matter) do not "hate" you (or anyone really). You've achieved some decent approvals (and CLIs) since the BK7 was discharged, and as you're aware, that particular factor along with the number of new accounts + inquiries in the past ~15 months, is bound to make some potential lenders a bit nervous, especially in today's lending environment.

It's obviously your decision on which approach drives your rebuilding strategy, but in the short horizon, you're going to experience a lot more frustration if the denials keep piling up. I would definitely nurture the CU banking relationships as you've been doing, but hold off on CC products for a while.

Sincere question: what do you, or others, like about this CU?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shot down for Patelco CU

@Curious_George2 wrote:Sincere question: what do you, or others, like about this CU?

The money market APY looks decent. 2% APY up to $2000. They offer blended rates too.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Shot down for Patelco CU

@AllZero wrote:

@Curious_George2 wrote:Sincere question: what do you, or others, like about this CU?

The money market APY looks decent. 2% APY up to $2000. They offer blended rates too.

Is one of my interests when i signed on to Patelco and their online layout is very neat and navigation friendly.

The card app was for their Pure Mastercard.

@AverageJoesCredit- I certainly relate to your own trials and strenuous efforts that come to nought and leave you with that gnawing despair of having valuable INQ's go up in smoke. Yes they may be unscorable in 12 months but they still lay on our reports 2 years and nobody can tell me they can't count against a manual review later. And geez afterall, our lifespan isn't exactly 100 or 200 years but machines with their entries (data) can and do live on to the next set of centuries. Living breathing people do not.

Wouldn't it be nice to take the sting out of things that a HP denial could simply be transferred over to the SP column. After all the denying Lender will still have record of reason for it anyway. It's the FICO game of chance points system that really lays down the hammer and can set a profile back years on INQ's alone. Because frankly most U/W's for the most part nit pic and look more at negatives than positives.

At any rate, so much for another encouraging try that didn't meet up to standard whatever that is.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content