- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: AMEX 3X CLI question.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

The Definitive Amex 3X CLI Guide

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Definitive Amex 3X CLI Guide

Nice!

To reiterate for those that may be confused, the "3X CLI" refers to requesting a limit that is 3X your current limit and has no bearing on what your starting limit was.

For example, someone starts with a $3k SL on an Amex card. They aren't in the know about the 3X CLI, so for their first CLI they only request $2k to bring their limit to $5k. They're approved. 181 days later, this person wants to go for their max CLI. 3X CLI refers to taking their current $5k limit to $15k; it doesn't mean 3X their SL ($6k in this example) which would mean a request for a limit of only $11k.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Definitive Amex 3X CLI Guide

My 6th month from my last CLI came and went. I requested to go from $30K to $36.3. My plan was to reallocate that 6.3K to my BCE to make it an even $10k. I got hit up for Income Verification. I almost backed out and went for $35K thinking it would be go through easy peasy. But I decided to take a chance and just go bigger and asked for $45K. I didn't really feel like asking 5K every 6 months to avoid it IV. I didn't go for higher since my highest CL on any one card with any creditor is 44K. I submitted the 4506-T information on Sept 8th and am still waiting to hear a decision.

I currently have with AMEX:

30K EveryDay Card

3.3K Blue Cash Everyday

10K Gold Delta Skymiles Business

Just a reminder that it took me well over a year to get my a CLI with them. So I was happy to not get an instant decline after they finally approved my the much talked about 3X CLI on the Everyday that took it from 10K to 30K.

I'll update as it may help others who decide to go this route. I looked for posts for others who went through this and almost everyone just backed down until it didn't require it. I may end up with 5K after all or nothing at all. Who knows! ![]() If this is approved, I''ll ask for one more CLI in 6 months to get it to 50K and call it good.

If this is approved, I''ll ask for one more CLI in 6 months to get it to 50K and call it good.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Definitive Amex 3X CLI Guide

@Anonymous wrote:

@shoegal wrote:Go for the 18k! But, make sure it has been 181days since your last CLI

@Anonymous wrote:This 3X CLI maybe I am not understanding and curious about this. When I first got the account open blue cash. They started me with $1k. Since then I have had 2 increases I have requested. One for $3k and $6k. Tonight I am do for another 3X increase. Should I shoot for the stars and try for $18k? Or am I suppose to be really going for $9k instead? If that is right and they go by the amount the account was first opened with at $1k. So, each 3X CLI is at $3k yes?

.I went for $18k and they countered with $12k instead. I am cool with that and took it. AMEX has been by far the most generous for CLI's out of all the cards I have ever had.

Congrats🎉🎉🎉

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Definitive Amex 3X CLI Guide

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Definitive Amex 3X CLI Guide

Fico sitting super still at 682 for the last 3 months.

I currently have:

Amex Platinum

PRG

Business Gold

Aspire 9300

Delta platinum 10k

BCP 4000

SPG lux 3100

SPG 1000 (first revolver)

All opened within a little less than a year ago.

What do you think are my chances?

Probably heading for an IV for full 3X ?

Which card should I ask for a 3X?

Do I go for 27900 on aspire or would it be better to balance the cards out and go for a BCP increase?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX 3X CLI question.

@Anonymous wrote:

@AnonymousHere is another data point. Today marked 161 days from my last CLI. My limit was 16.5k, originally 5.5k, I requested for the maximum of 49.5k expecting to verifiy with 4506-T and start having to bump down my requesting limit. However, I was returned with an instant approval of $42.3k, a $25.8k increase, total without having to back out and resubmit.Nice and this may be the first time I've seen someone cruise past $35k from a sub $20k limit without an IV prompt. Can you provide any additional information regarding your spend/payment patterns and/or any profile data you feel may have contributed to your success?

@Anonymous

Everyday card

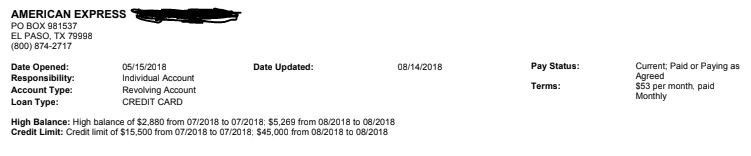

I went from a SL of $15.5k to $45k on 9x day

Fico scores in the high 700/low 800

AAoA 7-8 years - 8 open revolvers, 1 installment

6 closed revolvers and 2 installments

2-4 inquiries on each CRA with 2 in the past year

5-8% overall utiliation with a reported balance on 6-7 cards (140k available credit)

Meet my spending threshhold in a few months and paid in full when the statement cut. This was all before I applied AZEO.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX 3X CLI question.

Cool, thanks for the data. Looking over your info provided, the only thing that stands out to me as possibly being the reason "why" I believe is your income. Most of your data points mirror mine, as do they many others that have contributed in this thread. Your income however stands out as being considerably higher, so my take would be that Amex allowed you to bypass the $35k IV point simply based on that.

It's ironic when you think about it: In order to avoid IV, you need to tell Amex that your income is higher ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX 3X CLI question.

Posted this on approvals but thought I'd share here as well.

SPG - 5K -> 13K. Asked for IV when asking for 15 and 14k so I lowered it to 13K for an instant approval.

This started off at 1K in 12/17, moved some of the cl from my Everyday card to this one and went for the increase 6 months afer my first increase on the SPG.

I just moved 3k back to the Everyday card leaving 10K. Hoping for a good sized increase next March when I'm ready for the next one.

Business Cards:

Started my journey in the high 500's 10/1/2016

Current Fico: EQ:740 | TU:757 | EX:775

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX 3X CLI question.

I'm curious if Auto CLIs are affected by requested CLIs? It's been one year on my BCE, but no auto CLI. Could it be that it's because it hasn't been 6 months since I requested one?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content