- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Truist CLI request

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Truist CLI request

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Truist CLI request

I'll be waiting until I've had the cards for more than 12 months before I request a CLI with them.

I don't mind taking the HP when I do, I used a loophole to get 2 cards with them on a SP, so kinda owe them a HP anyway.

Current FICO8:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Truist CLI request

My request for a increase was denied and I will be getting a letter in 7 days letting me know the reason... now I wish I had waited the full 12 months ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Truist CLI request

Keep us posted on the denial reason(s). Your DPs can help others in the community since there aren't a whole lot of DPs on TRUIST CLIs.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Truist CLI request

@FinStar wrote:Keep us posted on the denial reason(s). Your DPs can help others in the community since there aren't a whole lot of DPs on TRUIST CLIs.

Having just got a Truist Enjoy Cash last month, I will be following this thead to find out...

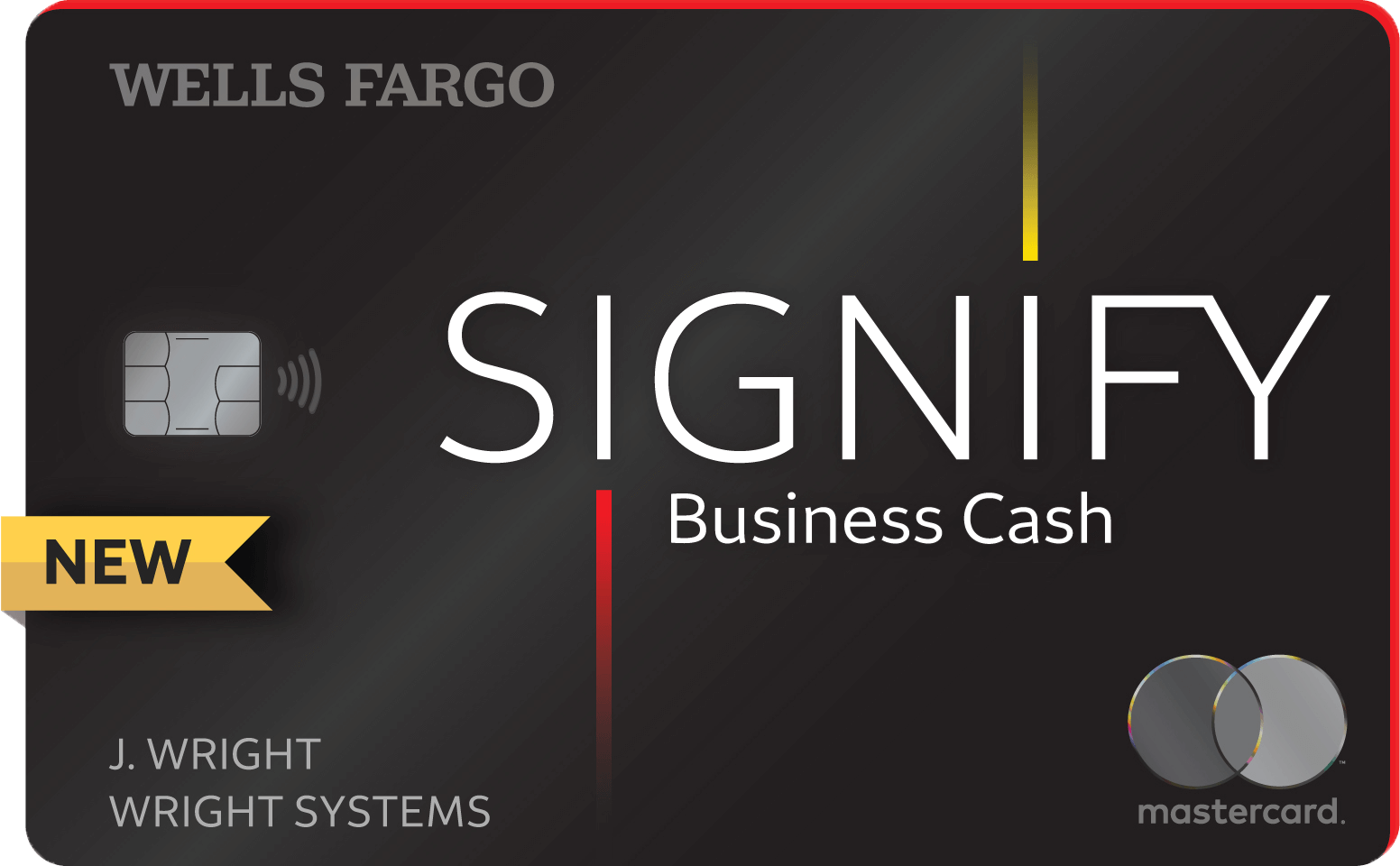

Business Cards: Total CL $43,800

FICO 8: Equifax - 686 / Transunion - 727 / Experian - 678

FICO 9: Equifax - 659 / Transunion - 776 / Experian - 673

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Truist CLI request

Denial reason: Total of all balances on bankcard or revolving accounts is too high. Additional data point: it now shows I am not pre qualified for any of their cards when I was just 2 weeks ago.

I did recently utilize one of my cards limit by 39% from the usual 0% to take advantage of a balance transfer offer and I guess Truist did not like the larger than normal increase in my reported debt load (Over 5K extra). I'll try again after I have taken advantage of the offer and repaid most or all of the debt. I'll see if my pre approvals are back first and if they are then I will submit another CLI request and report what the outcome is at that time.