- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: Navy FCU MORE REWARDS AMEX *DENIAL*

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

(Update): NFCU MORE REWARDS AMEX *DENIAL*

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy FCU MORE REWARDS AMEX *DENIAL*

@AverageJoesCredit wrote:

@Anonymous wrote:.. but you've noted in your post that you've never actually swiped the card.Never swiping the card is a no no

Ya gotta show sum luv once in awhile🥳

@AverageJoesCredit wrote:

@Aim_High wrote: ... the Platinum was great for the low APR but it hasn't been a card I want to put spend on due to no rewards. It's more of a pocket-and-hold card. They may have noted that I'm not using it, so why give me more!?! :smileyfrustratedThis* i know its anti MyFico to not use a card with no rewards but sometimes using the card is reward in itself. Its our only real way to show our appreciation for what they give the majority of us.

Yeah, you're right @AverageJoesCredit. I guess I thought the big BT and paying it off was enough "LUV" but not swiping the card might have been a factor too! Yes, sometimes putting some spend on a card pays rewards in other ways than cash-back or points!

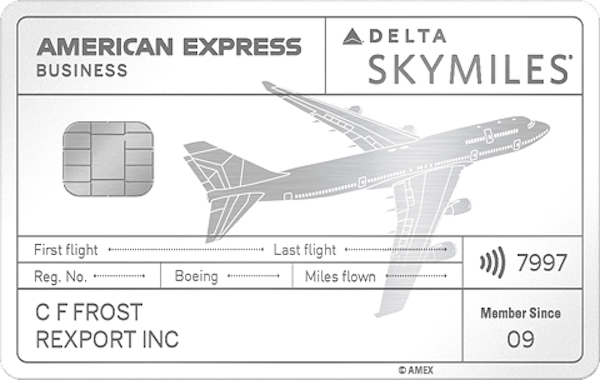

Business Cards

Length of Credit > 40 years; Total Credit Limits >$936K

Top Lender TCL - Chase 156.4 - BofA 99.9 - CITI 96.5 - AMEX 95.0 - NFCU 80.0 - SYCH - 65.0

AoOA > 31 years (Jun 1993); AoYA (Oct 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy FCU MORE REWARDS AMEX *DENIAL*

Doing a large BT at 0% didn't make them any money so it may not have been enough to sway them in your favor. CUs still need returns in order to be able to continuously reinvest in the credit union.

It definitely seems like they have tightened up now. Sorry for the denial but at least you're taking it in stride instead of throwing a fit and threatening to leave them. ![]()

It is also commonly said that NFCU does not take deposits into account when it comes to UW. The vast majority of us have very little money in our NFCU deposit accounts and we have no issues.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy FCU MORE REWARDS AMEX *DENIAL*

@Anonymous wrote:Sorry for the denial but at least you're taking it in stride instead of throwing a fit and threatening to leave them.

Thanks @Anonymous ... but you didn't see me when it happened!

Lol

J/K

I do still believe in Navy's reputation as a good solid credit union that I want to be affliated with!

It is also commonly said that NFCU does not take deposits into account when it comes to UW. The vast majority of us have very little money in our NFCU deposit accounts and we have no issues.

Good to know, thanks for that info! Yeah, I think they just want to get better acquainted and let the economy stabilize.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$936K

Top Lender TCL - Chase 156.4 - BofA 99.9 - CITI 96.5 - AMEX 95.0 - NFCU 80.0 - SYCH - 65.0

AoOA > 31 years (Jun 1993); AoYA (Oct 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy FCU MORE REWARDS AMEX *DENIAL*

Sorry about the denial @Aim_High Totally baffles the mind with your profile and the results recieved. I agree with many posters previously regarding the reasons being BS.

I myself have a modest amount of funds in one of their CDs and was denied for CC for over a year before finally breaking through last year with the Amex approval. Before that I would always receive the message (maximum unsecured credit allowed) or something like that. Even tried for a cli after 91/3 and was denied because only (2) statements had generated during that time. Took a second crack at it the following month a recieved a $8k increase with very minimum spend. So I really don't think spend is the issue either.

Navy is just one strange bird like that as many other members have come up against the maximum unsecured secured credit allowed. Maybe give it another 3-6 months any try again and I believe you will obtain the card no problems.

Debt-income ratio can be a stickler as well. Although it's a mystery as to what formula they use to get there.

I am actually coming up on my 6 month mark since my last increase and will be making another attempt at it. I have also added some personal loans to my profile so will see if that affects my chances and report back with results.

Current FICO08 Scores SEP 2023 (TU 834) (EQ 831 (EXP 831)

“The credit is no longer bruised, it has endured the test of time” (formally know as bruisedcredit)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy FCU MORE REWARDS AMEX *DENIAL*

@credit_endurance wrote:Sorry about the denial @Aim_High Totally baffles the mind with your profile and the results recieved. I agree with many posters previously regarding the reasons being BS.

I myself have a modest amount of funds in one of their CDs and was denied for CC for over a year before finally breaking through last year with the Amex approval. Before that I would always receive the message (maximum unsecured credit allowed) or something like that. Even tried for a cli after 91/3 and was denied because only (2) statements had generated during that time. Took a second crack at it the following month a recieved a $8k increase with very minimum spend. So I really don't think spend is the issue either.

Navy is just one strange bird like that as many other members have come up against the maximum unsecured secured credit allowed. Maybe give it another 3-6 months any try again and I believe you will obtain the card no problems.

Debt-income ratio can be a stickler as well. Although it's a mystery as to what formula they use to get there.

I am actually coming up on my 6 month mark since my last increase and will be making another attempt at it. I have also added some personal loans to my profile so will see if that affects my chances and report back with results.

Thanks for the encouragement and data points @credit_endurance ! Yes, I'll give it time and another go at the card later. Best of luck on your own new efforts with Navy! ![]()

Business Cards

Length of Credit > 40 years; Total Credit Limits >$936K

Top Lender TCL - Chase 156.4 - BofA 99.9 - CITI 96.5 - AMEX 95.0 - NFCU 80.0 - SYCH - 65.0

AoOA > 31 years (Jun 1993); AoYA (Oct 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy FCU MORE REWARDS AMEX *DENIAL*

I really dislike denials. If I had your score, I would dislike it even more. Sorry for the denial, I would of thought it was a shoe in also! Good information in this thread though, thanks for contributing to the data points.

It really seems as time is the answer to all things credit. Better luck next time AH!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy FCU MORE REWARDS AMEX *DENIAL*

@randomguy1 wrote:I really dislike denials. If I had your score, I would dislike it even more. Sorry for the denial, I would of thought it was a shoe in also! Good information in this thread though, thanks for contributing to the data points.

It really seems as time is the answer to all things credit. Better luck next time AH!

I know, right?! ![]() Thanks @randomguy1! Glad the thread and the information was helpful! I try to post the bad (denials or setbacks) as well as the good (approvals or successes) for everyone to learn and glean data points! Maybe this will help a few people know when it may not be a good choice to app or not.

Thanks @randomguy1! Glad the thread and the information was helpful! I try to post the bad (denials or setbacks) as well as the good (approvals or successes) for everyone to learn and glean data points! Maybe this will help a few people know when it may not be a good choice to app or not.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$936K

Top Lender TCL - Chase 156.4 - BofA 99.9 - CITI 96.5 - AMEX 95.0 - NFCU 80.0 - SYCH - 65.0

AoOA > 31 years (Jun 1993); AoYA (Oct 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy FCU MORE REWARDS AMEX *DENIAL*

How does NFCU calculate their internal score?

So with being in COVID-19 and everything happening, does the 91/3 rule of thumb still apply for CLI or 2nd card? I read somewhere that now they want 6 months for CLI. Which is more applicable to NFCU these days?

AVEN Visa $80k; BCU LOC $50k; PSECU LOC: $20K; Langley FCU LOC $10K; CuSoCal LOC $25k; BECU LOC: 15k; Apple FCU LOC $20k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy FCU MORE REWARDS AMEX *DENIAL*

Ouch, that stinks and has to be strongly influenced by the state of the economy because otherwise it's ridiculous and even still with your stats, it still is. I think your chances off a recon would be a lot stronger than mine are/were.

Updated 8/12/22.

Total Inquiries: EX: 1|TU: 1|EQ: 1

Derogs: 0

AAoA: 2Y1M

AoOA: 2Y6M.

AoYA: 1Y1M.

Total CL: 57,600

Utilization: ~1%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Navy FCU MORE REWARDS AMEX *DENIAL*

I really cannot add much more to what has already been said. However, I have noticed for years that NFCU seems to really like those with new, or improving credit rather than those of us with solid, established credit with no blemishes. Perhaps they feel that by treating the former with lots of love, those individuals will make NFCU "top of wallet" rather than us, the latter.

There could be many reasons already brough up here; too many recent credit accounts established, no real use of your current NFCU card or too much overall available credit. And of course, it could be that NFCU is tightening the purse strings due to the current economic pressures.

I would suggest PCing your Platinum to the Amex More Rewards and use it often. Then, if you feel you still need or want the Platinum, apply for a new Platinum card once there has been a good amount of account use from the More Rewards.