- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: What did your profile look like when approved ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What did your profile look like when approved by AMEX?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What did your profile look like when approved by AMEX?

@Anonymous wrote:I'm thinking about applying for AMEX, but want to know which of their cards are easier to get?

When I was approved a couple of months ago my profile looked like the following:

Score - 690

Utilization - 12%

Baddies - Missed payments in 2013 (due to reduced income from starting a new company)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What did your profile look like when approved by AMEX?

I had a secured Visa ($1500) for about 5 months and a 735 on EX. I was pretty shocked when they mailed me a pre-approval letter in December since I had their charge card back in 1999 and ruined my relationship with them long ago. I applied in January and was instantly approved for $2k.

Good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What did your profile look like when approved by AMEX?

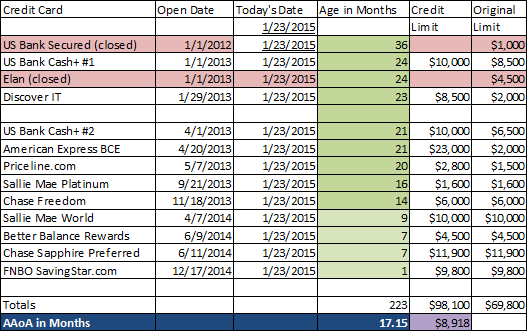

I had a secured card for all of 2012.

In January 2013 I applied for 3 cards. Start of April I applied for a 4th card, and April 20th I applied and got my American Express BCE. They pulled both EX and TU for instant approval. The next day they also pulled EQ.

Never used any other credit prior to this.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What did your profile look like when approved by AMEX?

I think I had a CO with them in 2005, I'm not sure..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What did your profile look like when approved by AMEX?

When I got approved for the Amex BLue Cash Preferred, I had a Fico Experian of 736; 2 inquiries in the last 2 years; 1% utilization; 11 years of AAOA with oldest card being 19 years-old. Was approved for $10k and upon activation, I hit the luv button and was given a CL of $25k. Good luck!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What did your profile look like when approved by AMEX?

I got the Delta Skymiles Gold back in Feb/15. The Experian score they listed was 697. I have a settled CO from 2010 still showing that will fall off in a year. Other than that no baddies and perfect pay history. Have a thin file as far as credit cards but a long history with an AAoA of over 10 years. I had 4 Inq on Ex and 4 on TU They gave me a staring limit of 10k.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What did your profile look like when approved by AMEX?

I got an everyday clear card in Feb. 2015. My score was TU 697 and ex688 or something at the time.

I have a reposession from wellsfargo in 2012.

I settled for less on a home depot and a shellciti card in november 2013.

They gave me a weak 500 limit which i tripled in april on the 65th day. Early on I used the heck out of the card making bi-weeklypayments to reap in the 20% back in points and keep utilization at 50% or less the whole time. i was careful with the 10,000 points back after spending $1,000 and redeemed for all the restaraunts and the higher ones I saw.they pretty much have paid me to use it so far.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What did your profile look like when approved by AMEX?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What did your profile look like when approved by AMEX?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What did your profile look like when approved by AMEX?

Congrats.Hop on twitter and sign up for everything they have to offer, for example: the smartandfinal $50 ->$25 back three times! I bought beer and gas cards. =)