- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Re: What the Heck??

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What the Heck??

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What the Heck??

@2BrownDogs wrote:

@Anonymous wrote:

@2BrownDogs wrote:This is so frustrating. I have NEVER missed a payment. Have PIF. For the last 2 weeks they have been offering a $160 CLI...then today declined with a 2-3 day message. GRRRRR!!!

Were they offering you the $160 before or after you PC'd the card?

Yes. They offered the $160 AFTER the PC to QS.

Ok thanks, I guess my theory is out then. I would just wait a few weeks and try again. I know many people have been having issues with Cap1's website lately, so hopefully that's all it is for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What the Heck??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What the Heck??

@thummel wrote:

What kind of limit do you have on that card if I might ask? 160 seems like a weird number.

Initial CL was $1000 and got the $500 CLI after 5th statement. The card is about a year old. Always paid way more than the minimum and also several times a month. Just recently got approved for a new card with a $3K CL. I was getting the offer for the $160 CLI even after the new account was issued and activated, so I don't think that could be the issue. Well.....actually I have no idea what the issue is. LOL!! Credit sccores have all increased....no new baddies....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What the Heck??

@creditguy wrote:Well unfortunately this is what happens sometimes. There is this urban legend that if you keep hitting the LUV button and refuse the CLI it will get bigger each time, well sometimes that's true and sometimes they rescind the CLI offer altogether, that's the chance you take, just like spinning a roulette wheel. On a side note if you were getting the CLI offers before you PC'd you may have to wait six months after the PC to be granted a new CLI, they have a six month rule after a change has been made to an account.

CLI's are not affected by the QS rewards upgrade. I've always gotten the upgrade prior to the early CLI.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What the Heck??

@2BrownDogs wrote:

@thummel wrote:

What kind of limit do you have on that card if I might ask? 160 seems like a weird number.Initial CL was $1000 and got the $500 CLI after 5th statement. The card is about a year old. Always paid way more than the minimum and also several times a month. Just recently got approved for a new card with a $3K CL. I was getting the offer for the $160 CLI even after the new account was issued and activated, so I don't think that could be the issue. Well.....actually I have no idea what the issue is. LOL!! Credit sccores have all increased....no new baddies....

How much usage per month? Heavy usage is one of the things Cap One bases their CLI's on.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What the Heck??

@Anonymous wrote:

@2BrownDogs wrote:

@thummel wrote:

What kind of limit do you have on that card if I might ask? 160 seems like a weird number.Initial CL was $1000 and got the $500 CLI after 5th statement. The card is about a year old. Always paid way more than the minimum and also several times a month. Just recently got approved for a new card with a $3K CL. I was getting the offer for the $160 CLI even after the new account was issued and activated, so I don't think that could be the issue. Well.....actually I have no idea what the issue is. LOL!! Credit sccores have all increased....no new baddies....

No letter yet from Cap One regarding the CLI decision. Did have an odd identity verification through the App today though.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What the Heck??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What the Heck??

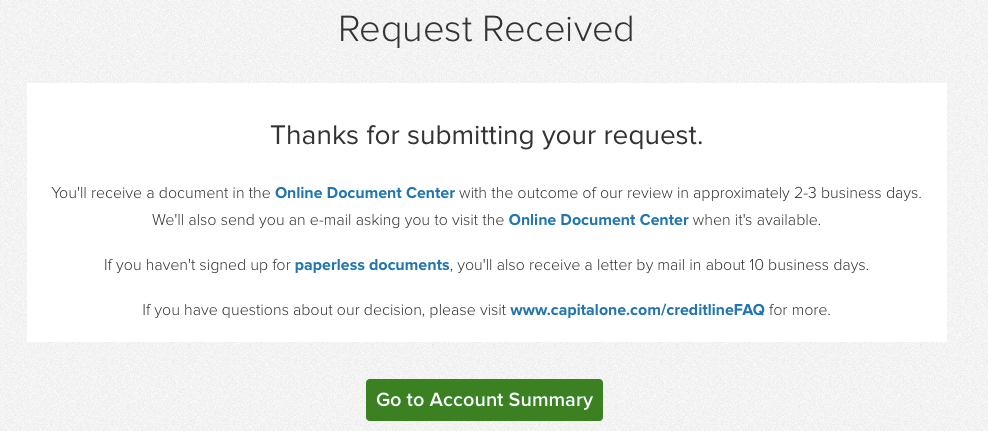

@2BrownDogs wrote:Recently PC'd a Platinum that is over a year old to a QS. Started pressing the LUV button and was getting offered a $160 CLI each time I checked. Went in today and checked again and got this...what the heck??

I'm guessing you've got a letter saying this isn't the news you want to hear, but your request is declined because account is too new. It's probably up there already under "documents".

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What the Heck??

So I got the decision from Cap 1. They stated that the credit score was too low. However the credit score they listed on the letter as their basis for denial is not even in the ballpark of where my current scores are. (I have daily monitoring) Do you know, do they use a score other than the Fico8 for CLI approvals?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What the Heck??

@2BrownDogs wrote:So I got the decision from Cap 1. They stated that the credit score was too low. However the credit score they listed on the letter as their basis for denial is not even in the ballpark of where my current scores are. (I have daily monitoring) Do you know, do they use a score other than the Fico8 for CLI approvals?

I believe they use Fico 4