- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Surprise again! Capital One QS CLI to $30K

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Surprise again! Capital One QS CLI to $30K

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Surprise again! Capital One QS CLI to $30K

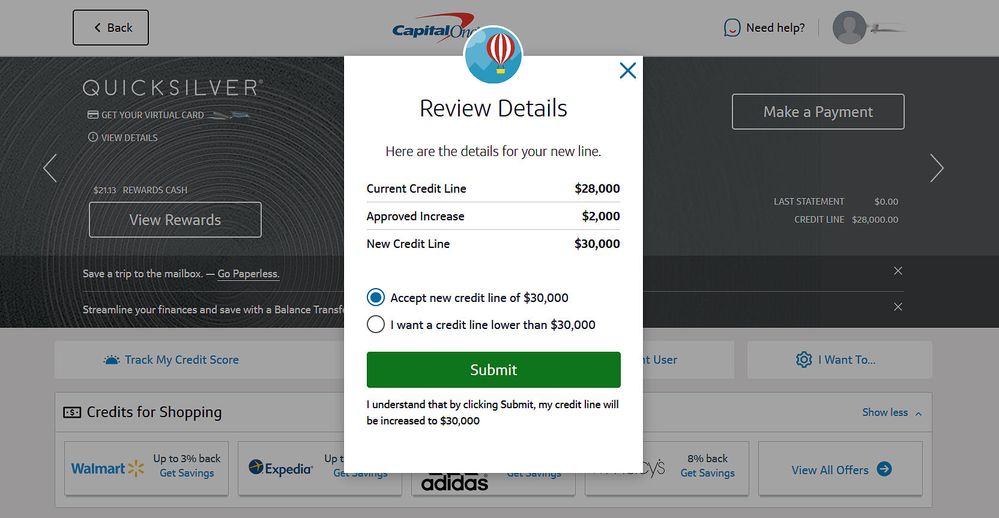

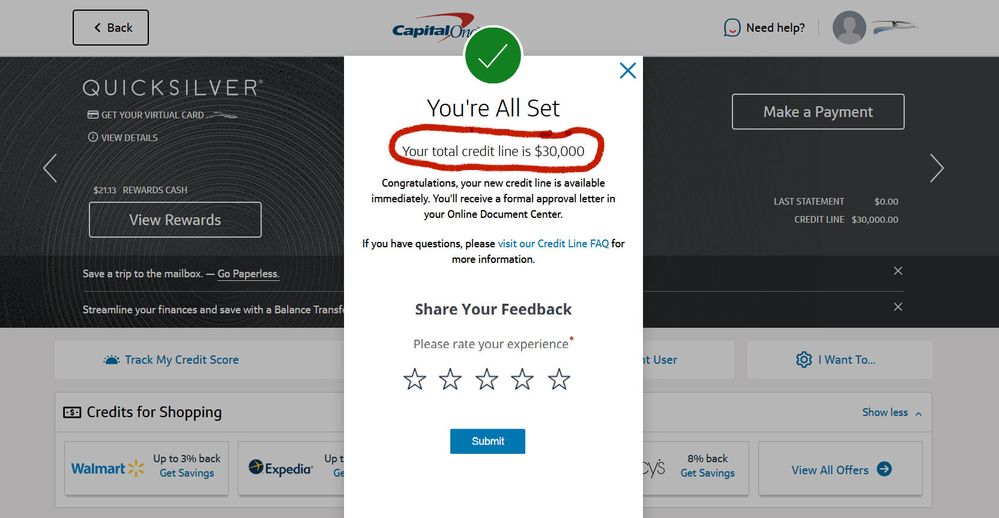

On a whim, I applied for a soft pull CLI again on my Capital One Quicksilver card tonight. Approved for another $2K increase and a new CL of $30K! ![]()

For years, I slowly grew my Capital One Quicksilver but it was a tedious process that usually involved moderate sustained spending. It started out as a non-bucketed Platinum card with $1K limit in 2009. Finally >in March 2020<, I reached my goal of $25K on the card and thought I was done. (See the link for spend and other data points.)

However, imagine my surprise when they gave me additional $1K CLIs to $26K, $27K, and then to $28K in 2022 without significant spending. ![]() Those also occurred with less than six month intervals, breaking another rule that I thought applied to Capital One CLIs. After a few denials since the last one, they approved me for the $2K tonight after a little over six months. (All of my CLIs have been initiated by myself, not automatic.)

Those also occurred with less than six month intervals, breaking another rule that I thought applied to Capital One CLIs. After a few denials since the last one, they approved me for the $2K tonight after a little over six months. (All of my CLIs have been initiated by myself, not automatic.)

For data points, in the last 12 months, I've only have five statements post a balance. Those balances were mostly low at $90 to $200 with only one at $500. For whatever reason, this spend is considerably less than what I'm accustomed-to for a successful CLI.

Hope these helps others who are hopeful for a Capital One CLI.

Business Cards

Length of Credit > 42 years; Total Credit Limits > $947K

Top Lender TCL - Chase 156.4 - BofA 99.9 - CITI 97.5 - AMEX 95.1 - NFCU 80.0 - SYCH - 65.0

AoOA > 32 years (Jun 1993); AoYA (Oct 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Surprise again! Capital One QS CLI to $30K

Interesting story. Congratulations on your Capital One CLI! @Aim_High

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Surprise again! Capital One QS CLI to $30K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Surprise again! Capital One QS CLI to $30K

Impressive, but not surprising @Aim_High ... you got the formula down my friend!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Surprise again! Capital One QS CLI to $30K

Congratulations on your Capital One QS CLI!

Current FICO 8 | 9 (December 2025):

Credit Age:

Inquiries (6/12/24):

Banks & CUs:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Surprise again! Capital One QS CLI to $30K

All interesting stuff, well played, and appreciate all the insight, congratulations on your CLI, and the growth!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Surprise again! Capital One QS CLI to $30K

CONGRATS!!!!!

I had to do a double take, 30k limit on a cap one card??

It seems cap 1 is handing you cli's like hot cakes, keep it up, you are doing something right.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Surprise again! Capital One QS CLI to $30K

congrats on the cli

SOCKDRAWER/ NFCU FLAGSHIP $40,000 CL/ NFCU MORE REWARDS $40,000/ WELLS FARGO AUTOGRAPH $8200/APPLE CARD $6500/DISCOVER IT $3000 SL/CITI COSTCO ANYWHERE VISA $6000 SL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Surprise again! Capital One QS CLI to $30K

congrats on the continous CLIs!! i want to be like you when i grow up LOL!

Business Cards:

Store Cards:

Credit Health:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Surprise again! Capital One QS CLI to $30K

Congrats on the increase!