- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: APR yikes!!! ... is something off?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

APR yikes!!! ... is something off?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: APR yikes!!! ... is something off?

@indiolatino61 wrote:

@axledobe wrote:I applied for a Huntington Voice card yesterday and was immediately approved online. I was finally able to get through today and get my starting CL and APR. HNB has two options for their Voice (no rewards advertising a lower APR between 9.99 to 20.99 and a 3X rewards option with a higher APR between 12.99 to 23.99). I opted for the 3X rewards.

First, I'll say I never go into a CC app with a sense of entitlement. I'm happy about the opportunity of creating a relationship with a financial institution. That said, I've been gardening for a long time and have worked hard to get over 800 (it took years). I went into the app with the following:

809 EQ (what they pulled), AAoA 6 years, no derogs at all, income 47K, 1% util, 0 inquiries in the past year, DTI 17%. I have three other CC's reporting and a student loan and Chase auto loan.

I was expecting my first 5K limit with an APR closer to the low end of the range (12.99'ish). They gave me a starting CL of $2.1K and an APR of 20.99%

Does the APR seem high? I've never gone into a CC app with a decent score so my 24.99 CapOne cards is all I know. I think the CL is horrible and the APR seems really high. I mean, don't they say your APR is "based on credit worthiness"? Is that what an 800+ gets you? I'm seriously confused and honestly regret this app. I feel like the low CL and APR tells me they really didn't even want me as a customer and honestly, I'm considering just closing the card as soon as I get it.

Am I expecting too much? Any insight would be greatly appreciated.

** Here's what I think it is but not totally sure. I had an auto loan with them back a few years ago when my credit was not as good (630'ish). Could that be it? I was never late and even paid extra every month but I guess they could have an old report on file.

IMO, it seems high for your profile. My Discover It card is at 22.99% and they won't budge, even with my 800 TU score, which is presumably what they pull. I PIF, so I don't care, but it is the "principle" of the matter...lol.

100% agree Indio. I plan to PIF, as well. It's like "Is this 22.99% the thanks I get?" ![]()

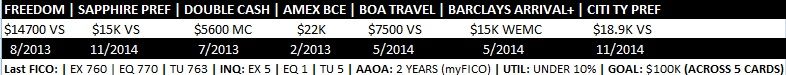

FICO SCORES: TU 769; EX 790; EQ 790 ***Gardening indefinitely***

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: APR yikes!!! ... is something off?

Its a high APR, but carrying balances on a rewards card negates the value of the rewards anyway. I don't pay interest on any of my cards, not even SDFCU, which is at 6.99%. If I wanted to finance something and carry the balance, I would use a 0% promotion.

After 6 months to a year of good payment history, you could call to see if they will lower the APR on your new card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: APR yikes!!! ... is something off?

@axledobe wrote:

@lg8302ch wrote:

@axledobe wrote:Like I mentioned, I'm curious to see their "price you pay for credit" and see what's listed as affecting their decision and pricing. When I got approved for AMEX, they sent me a mirror copy of what I purchased on myFico with the exact same score. I just wonder if the negative items affecting your score shows anything. It don't on here. Thanks for everyone's responses thus far.

if you find out I would love to know it too. Chase accepted me with EQ Fico of 793 but with an internal score of 681 and got me 22,99% APR..their worst terms for the Freedom ...it's my first card from Chase

...Does Huntinton also use internal scores?

lg- Wow. With my lowest score (EX), Chase's prequal link offered me 18.99 on the Freedom but I opted out for other cards. For a 793, you would think you qualify for the best terms they offer. HNB must have some type of internal scoring system or they are holding an old report/score against me unannounced. Have you called Chase to ask about it?

I have asked and was told that Chase does not change APRs...you are stuck with what you get for the card's life![]() ....I am a PIF customer so APR does not matter but I do take it personal when Chase puts me in the drawer of their worst customers...Got best terms from all others but Chase and Discover.

....I am a PIF customer so APR does not matter but I do take it personal when Chase puts me in the drawer of their worst customers...Got best terms from all others but Chase and Discover.

At least with Huntington you have a chance to lower APR.....Chase is the only one that does not touch it. Who did not give me best terms changed it afterwards. Regarding the limit it could be your new accounts? Chase gave me this horrible APR because of my app spree..got 4 cards (spree once and never again - lesson learnt for me)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: APR yikes!!! ... is something off?

@indiolatino61 wrote:

@axledobe wrote:I applied for a Huntington Voice card yesterday and was immediately approved online. I was finally able to get through today and get my starting CL and APR. HNB has two options for their Voice (no rewards advertising a lower APR between 9.99 to 20.99 and a 3X rewards option with a higher APR between 12.99 to 23.99). I opted for the 3X rewards.

First, I'll say I never go into a CC app with a sense of entitlement. I'm happy about the opportunity of creating a relationship with a financial institution. That said, I've been gardening for a long time and have worked hard to get over 800 (it took years). I went into the app with the following:

809 EQ (what they pulled), AAoA 6 years, no derogs at all, income 47K, 1% util, 0 inquiries in the past year, DTI 17%. I have three other CC's reporting and a student loan and Chase auto loan.

I was expecting my first 5K limit with an APR closer to the low end of the range (12.99'ish). They gave me a starting CL of $2.1K and an APR of 20.99%

Does the APR seem high? I've never gone into a CC app with a decent score so my 24.99 CapOne cards is all I know. I think the CL is horrible and the APR seems really high. I mean, don't they say your APR is "based on credit worthiness"? Is that what an 800+ gets you? I'm seriously confused and honestly regret this app. I feel like the low CL and APR tells me they really didn't even want me as a customer and honestly, I'm considering just closing the card as soon as I get it.

Am I expecting too much? Any insight would be greatly appreciated.

** Here's what I think it is but not totally sure. I had an auto loan with them back a few years ago when my credit was not as good (630'ish). Could that be it? I was never late and even paid extra every month but I guess they could have an old report on file.

IMO, it seems high for your profile. My Discover It card is at 22.99% and they won't budge, even with my 800 TU score, which is presumably what they pull. I PIF, so I don't care, but it is the "principle" of the matter...lol.

That's insane! My Discover it came today and I have $2,500 limit with a 14.99 rate after the 0% intro...which is the lowest of all of my interest rates. 696 EQ Fico they pulled. My Freedom came with the highest 22.99 apr

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: APR yikes!!! ... is something off?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: APR yikes!!! ... is something off?

What's odd is I've seen posters who have had significantly worse credit profiles (mid-600's FICO) get much better starting limits (upwards of $10k) and APR's with the Voice card. I wonder if it has to do with having an established relationship with them.

FICO Scores 800+

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: APR yikes!!! ... is something off?

@lg8302ch wrote:

@axledobe wrote:

@lg8302ch wrote:

@axledobe wrote:Like I mentioned, I'm curious to see their "price you pay for credit" and see what's listed as affecting their decision and pricing. When I got approved for AMEX, they sent me a mirror copy of what I purchased on myFico with the exact same score. I just wonder if the negative items affecting your score shows anything. It don't on here. Thanks for everyone's responses thus far.

if you find out I would love to know it too. Chase accepted me with EQ Fico of 793 but with an internal score of 681 and got me 22,99% APR..their worst terms for the Freedom ...it's my first card from Chase

...Does Huntinton also use internal scores?

lg- Wow. With my lowest score (EX), Chase's prequal link offered me 18.99 on the Freedom but I opted out for other cards. For a 793, you would think you qualify for the best terms they offer. HNB must have some type of internal scoring system or they are holding an old report/score against me unannounced. Have you called Chase to ask about it?

I have asked and was told that Chase does not change APRs...you are stuck with what you get for the card's life

....I am a PIF customer so APR does not matter but I do take it personal when Chase puts me in the drawer of their worst customers...Got best terms from all others but Chase and Discover.

At least with Huntington you have a chance to lower APR.....Chase is the only one that does not touch it. Who did not give me best terms changed it afterwards. Regarding the limit it could be your new accounts? Chase gave me this horrible APR because of my app spree..got 4 cards (spree once and never again - lesson learnt for me)

For life, huh? Goodness. I agree with everything you said. Here's the kicker. I've never done an app spree before, ever. Yesterday, I app'ed for my first AMEX (EX pull) and Huntington (EQ pull). Neither one saw the other pull and on both bureaus, my last HP was well over a year old. Kicker #2, I decided to finish out my first and probably last spree ever with a Citi card about 3 hours ago (AAdvantage). What happened? 9.5K limit with 15.24% APR and they saw both recent pulls from yesterday. Go figure. LOL. That made it even worse, really. ![]()

FICO SCORES: TU 769; EX 790; EQ 790 ***Gardening indefinitely***

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: APR yikes!!! ... is something off?

@Leadberry wrote:What's odd is I've seen posters who have had significantly worse credit profiles (mid-600's FICO) get much better starting limits (upwards of $10k) and APR's with the Voice card. I wonder if it has to do with having an established relationship with them.

Leadberry- I've been a HNB customer in the past on an auto loan. Perfect payment history, paid extra every month. Put $7K cash down on the deal at the time so they know I'm not broke. It's just insane.

FICO SCORES: TU 769; EX 790; EQ 790 ***Gardening indefinitely***