- myFICO® Forums

- Types of Credit

- Credit Cards

- Affinity FCU 1st quarter Hi5 bonus cats released

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Affinity FCU 1st quarter Hi5 bonus cats released

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Affinity FCU 1st quarter Hi5 bonus cats released

They may not be putting a lot of marketing dollars into it since at think they're already a bit overwhelmed by applications. The banker did say they were a bit backed up and my app did take a few days. It's a great card though! The $200 SUB for $3k spend is nothing special, but when you add the 5%+ earnings it's pretty amazing. Plus a $150 checking SUB these days, I'm a fan of affinity these days!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Affinity FCU 1st quarter Hi5 bonus cats released

@ptatohed wrote:

@JNA1 wrote:

@ptatohed wrote:

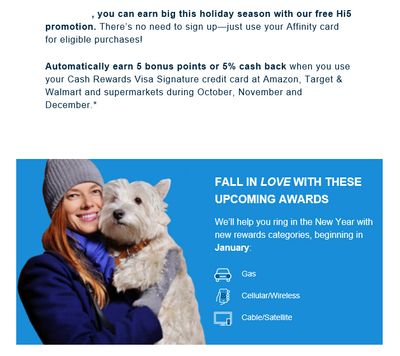

@Duke_Nukem wrote:AFCU has released their Hi5 categories for the 1st quarter of 2022.

ETA: actual cashback % when using the Cash Rewards card added below.

GAS = 7% (Gas is normally 2%, so Hi5 adds additional 5%)

CELLULAR / WIRELESS

CABLE / SATELLITE

So what am I missing about this card? I had looked into it (I'm all for 5%, lol) but quickly dismissed it because the website says 5% on Amazon and Bookstores. Boo. Here you are showing that the 5% is for Amazon, Target, Walmart, and Grocery. That's a big difference! I also had no idea the categories rotated as there is zero evidence of that on the website, including the video. Is this the case of poor advertising or are they purposely keeping it a secret?

I can't speak for why, but they don't broadcast the rotating categories. Right now (Oct - Dec) we are getting 10% at Amazon, 6% Walmart and Target, and Supermarkets. The card also has a $200 SUB. It's best kept secret out there, IMO.

I had no idea! Now I am interested! Is CU membership hard to get?

No, not at all. Super friendly and great customer service

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Affinity FCU 1st quarter Hi5 bonus cats released

@Duke_Nukem wrote:

@JNA1 wrote:

I can't speak for why, but they don't broadcast the rotating categories. Right now (Oct - Dec) we are getting 10% at Amazon, 6% Walmart and Target, and Supermarkets. The card also has a $200 SUB. It's best kept secret out there, IMO.Actually, Supermarkets (and every Walmart I've tried in store because they code as Supermarket for some reason) get 2% on this card. So they are actually getting 7% this quarter!

There is also that addtional $200 SUB after hitting $20,000 spend in the first year. Sadly, I hit that mark too!

Why sadly? We ran almost 80K through our cards this year, lol. Unfortunately for most of the year, we only had the BECU card at 1.5% back. Next year will be much better ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Affinity FCU 1st quarter Hi5 bonus cats released

Can anyone here tell me if Amazon Fresh and Amazon Pantry purchases get the 5% back on Amazon purchases? I know Whole Foods does not.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Affinity FCU 1st quarter Hi5 bonus cats released

You may try a small purchase and check the way that it gets coded.

Does cable refer to cable TV? Does it cover internet e.g. xfinity?

Fico8: EX~EQ~TU~840 (12 month goal~850).

Fico8: EX~EQ~TU~840 (12 month goal~850).BOA (CCR, UCR), Chase (CFF, CSP, Amazon, CIC, CIU), US Bank (Cash+, AR, Go, Ralphs), Discover, Citi (CCC, DC, SYW), Amex (BCP, HH, Biz Gold, BBC, BBP), Affinity CR, Cap1(Walmart), Barclays View.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Affinity FCU 1st quarter Hi5 bonus cats released

I am so happy to have this card. It is one of the best kept secrets in credit cards I think! I just got the card in December after signing up for the checking account a couple of weeks before. I do the direct deposit to get the bonus for the checking account. It works out anyway because for the credit card it's better to pay it with your existing checking account. And since it was 10% cashback last month on Amazon I spent a whole bunch of money there for Christmas presents and such. This quarter I will use it for gas as well as Cable and Internet services has between all of this and Amazon spending I will meet does a $3000 requirement for spending on the card for the credit card bonus.

I really think the credit union offers some great products as well. Their auto loan rates are really good and I'm going to use them when I purchase my new car in the summer.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Affinity FCU 1st quarter Hi5 bonus cats released

I'm loving this credit union more and more, and IMO this is the best cashback card out there.

The auto loan rates were the best I could find from all lenders I have access to (USAA, NFCU, PenFed, Chase, USBank, etc), but when I called a few weeks ago about how long it took to get an approval... the rep said the UW dept was backed up and an approval may take 14 days! ![]() So we had to forego the auto loan app through them for my wife (we were able to use their rates to negotiate better APR though).

So we had to forego the auto loan app through them for my wife (we were able to use their rates to negotiate better APR though).

We only have their hi-APR savings accounts (no checking), and the pulls and pushes from AFCU are next day even to/from typical slower banks. I initiated a push transfer from AFCU to another bank around 3pm and it was deposited in the other bank when I checked around 9am the next day just last week.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Affinity FCU 1st quarter Hi5 bonus cats released

If you are in a rush for autoloan, you may try other places. The manual UW for CC was also taking ~2 weeks in December.

Fico8: EX~EQ~TU~840 (12 month goal~850).

Fico8: EX~EQ~TU~840 (12 month goal~850).BOA (CCR, UCR), Chase (CFF, CSP, Amazon, CIC, CIU), US Bank (Cash+, AR, Go, Ralphs), Discover, Citi (CCC, DC, SYW), Amex (BCP, HH, Biz Gold, BBC, BBP), Affinity CR, Cap1(Walmart), Barclays View.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Affinity FCU 1st quarter Hi5 bonus cats released

@Duke_Nukem wrote:AFCU has released their Hi5 categories for the 1st quarter of 2022.

ETA: actual cashback % when using the Cash Rewards card added below.

GAS = 7% (Gas is normally 2%, so Hi5 adds additional 5%)

CELLULAR / WIRELESS

CABLE / SATELLITE

Is it possible to see which categories are being offered on the website or through online banking? I am having no luck and I just got the cash rewards card.

Loans

Ford Credit Car Loan 2-year 6/22/2023 ($299/month)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Affinity FCU 1st quarter Hi5 bonus cats released

@ZackAttack wrote:

@Duke_Nukem wrote:AFCU has released their Hi5 categories for the 1st quarter of 2022.

ETA: actual cashback % when using the Cash Rewards card added below.

GAS = 7% (Gas is normally 2%, so Hi5 adds additional 5%)

CELLULAR / WIRELESS

CABLE / SATELLITE

Is it possible to see which categories are being offered on the website or through online banking? I am having no luck and I just got the cash rewards card.

I have bookmarked this link but seems to be not updated yet for current quater. But you will get an email for the Hi5 categories for the upcoming quarter

https://www.affinityfcu.com/Credit-Cards/hiFive.aspx