- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Balance Transfers

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Balance Transfers

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfers

@Aim_High wrote:@Brian_Earl_Spilner I did the Balance Transfer shuffle with some large five-figure debts for many years until I could pay them off. Sometimes when I rolled balances over, I got individual utilization up to 90%or more. I knew that wasn't good for my credit score but I also knew I needed to do it to be able to stay ahead of the rapidly-accruing interest charges. You do what you have to do. I didn't see any AA from my lenders over that as long as I was paying on time. I got BT offers from Chase, Bank of America, Discover, Capital One, and FNBO, if I'm not mistaken. And like @K-in-Boston posted, I think it may have led to higher credit lines. After it was all paid down, my Chase, BofA, and Discover lines have grown to some of my highest.

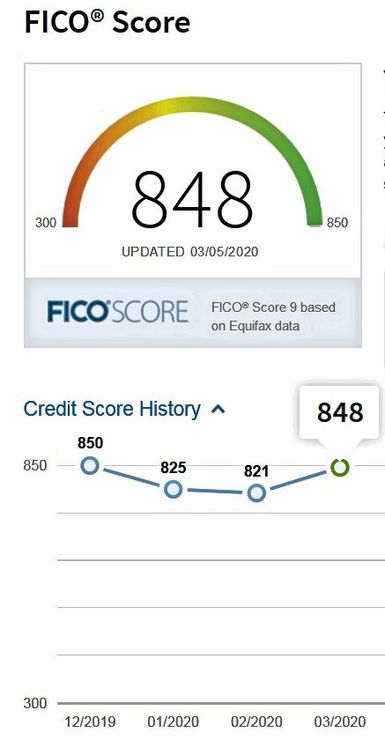

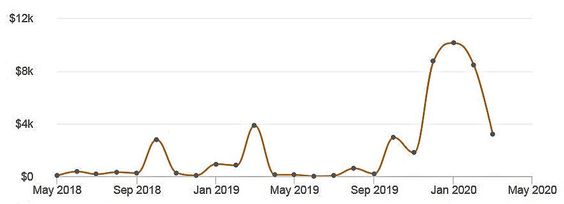

I recently took out a huge 98% utilization BT with Navy FCU that I didn't really need when I opened my Platinum card. I got the card for emergency use due to the low APR and frequent BT offers I had heard about. Since there were no rewards and I wanted to break in the card, I ran it up with BT's from my other cards instead of with new purchases. High balance was $9800 on a $10K line. But it was 0% interest and no BT fees, so it was free money. Then I made large payments over about three months to pay it off and build payment history. Navy rewarded me with an $8K CLI at four months, so it may have helped. No other lenders flinched, my scores dropped substantially but then rebounded right back as I paid it down. I thought it was interesting so I've shared these depictions on a couple of BT threads before. (See graphics below.)

Credit score during and after the BT:

Posted card utilization by month:

That's great and all, but your scores were at 850, meaning you had a buffer there. There are points above 850, which you will never seen represented in numerical format, but buffer exists.

You also had no negatives.

Someone who's in 600s doesnt have a luxury of a buffer, scores already indicate there are problems either with negatives or huge utilization across the board, and getting a few cards closed might pose a serious problem, leading to cascade of AA.

Telling them everything is going to be okay is as much of truth as is telling them "All your cards are getting shut down, including the ones you do not even have"

People at different stages of *crediting* will have different experiences, but some are more vulnerable than others.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfers

@wasCB14 wrote:

@simplynoir wrote:

@Brian_Earl_Spilner wrote:

@wasCB14 wrote:The only arguable BT abuse I've heard of was with Barclays Ring years ago, where people would BT sums in for a 1% cash bonus, and then almost immediately pay it off. A $50 or $100 bonus offset by maybe $1 of interest.

Otherwise, I don't see how it could be abused. Either the issuer allows a BT on a no-fee, 0% intro promo (wouldn't mind getting one of those)...or the issuer earns a BT fee and/or interest.

🤷♂️ It's listed as a reason for losing SUBs with amex. I don't see how you can abuse it other than constantly BTing your balances out. And, I still don't see how it matters as long as they're getting paid

For the AMEX reason for losing SUBs the only real way I can see that being an issue is if the balance is taken out immediately after SUB is attained to another card and it happens a lot. Doing it once I would like to think they would be okay with since they got the swipes and it got paid; maybe if the card sees little to no use after it might raise a flag but that's about it. But that's all profile dependent and how when AMEX softpulls your reports they interpret it

Why would Amex care whether they're being paid by a BT or a checking account transfer, so long as it's legitimate and not MS/stolen/laundered? I can see the risk of AA and closure/CLD if they think someone can't pay the bills...but why clawback the SUB?

If AMEX is listing BTs as probable cause to deny a SUB on an application then it stands to reason they do care how they get paid. If the SP reports show the balance that was on their card showed up on another and then they try to get another card with AMEX, I can see their RAT telling themselves the churning behavior will continue and deny the SUB. Just because the balance is no longer their responsiblity doesn't mean they're not losing money. I'm just interpreting how that can be an issue

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfers

@Remedios wrote:

@Aim_High wrote:@Brian_Earl_Spilner I did the Balance Transfer shuffle with some large five-figure debts for many years until I could pay them off. Sometimes when I rolled balances over, I got individual utilization up to 90%or more. I knew that wasn't good for my credit score but I also knew I needed to do it to be able to stay ahead of the rapidly-accruing interest charges. You do what you have to do. I didn't see any AA from my lenders over that as long as I was paying on time. I got BT offers from Chase, Bank of America, Discover, Capital One, and FNBO, if I'm not mistaken. And like @K-in-Boston posted, I think it may have led to higher credit lines. After it was all paid down, my Chase, BofA, and Discover lines have grown to some of my highest.

I recently took out a huge 98% utilization BT with Navy FCU that I didn't really need when I opened my Platinum card. I got the card for emergency use due to the low APR and frequent BT offers I had heard about. Since there were no rewards and I wanted to break in the card, I ran it up with BT's from my other cards instead of with new purchases. High balance was $9800 on a $10K line. But it was 0% interest and no BT fees, so it was free money. Then I made large payments over about three months to pay it off and build payment history. Navy rewarded me with an $8K CLI at four months, so it may have helped. No other lenders flinched, my scores dropped substantially but then rebounded right back as I paid it down. I thought it was interesting so I've shared these depictions on a couple of BT threads before. (See graphics below.)

Credit score during and after the BT:

Posted card utilization by month:

That's great and all, but your scores were at 850, meaning you had a buffer there. There are points above 850, which you will never seen represented in numerical format, but buffer exists. You also had no negatives.

Someone who's in 600s doesnt have a luxury of a buffer, scores already indicate there are problems either with negatives or huge utilization across the board, and getting a few cards closed might pose a serious problem, leading to cascade of AA.

Telling them everything is going to be okay is as much of truth as is telling them "All your cards are getting shut down, including the ones you do not even have"

People at different stages of *crediting* will have different experiences, but some are more vulnerable than others.

That's true, and I didn't mean to imply everyone would have the exact same effect. Still, it's relative. And when I had high utilization before when I mentioned that five-figure debt earlier in my posting, my credit scores were much lower. I didn't check them often back then but they were in the mid-600's in the middle of my debt. And I experienced no AA from my high utilization. (My scores had been upper 700's before that period of debt and some late payments. Fortunately, that's now all in the distant past and I hope I never go back there again!)

The main point I make about the utilization diagrams I posted is that whether your score drops 30 points or 50 point or 80 points, it does come back quickly once you pay down the debt.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$936K

Top Lender TCL - Chase 156.4 - BofA 99.9 - CITI 96.5 - AMEX 95.0 - NFCU 80.0 - SYCH - 65.0

AoOA > 31 years (Jun 1993); AoYA (Oct 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfers

@simplynoir wrote:If AMEX is listing BTs as probable cause to deny a SUB on an application then it stands to reason they do care how they get paid. If the SP reports show the balance that was on their card showed up on another and then they try to get another card with AMEX, I can see their RAT telling themselves the churning behavior will continue and deny the SUB. Just because the balance is no longer their responsiblity doesn't mean they're not losing money. I'm just interpreting how that can be an issue

Interesting thought. While I've never BT any of the charges during SUB period, about a year after having said card I did BT a rather large amount from a medical proecedure that I couldn't PIF at the time. Granted those SUBs are meant to attract people who they hope will spend a lot in order to cover all those points. Though in a way this feels a bit nitpicky compared to all those people who get SUBs in a more severe manner, hence the recent article involving 7000 people. That to me is dishonst and wrong way to go about it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfers

@M_Smart007 wrote:Just received more Penfed BT checks today, Chase Last week and HSBC the week before that.

From my perspective, they have not dried up. I guess profile driven ...YMMV

Agree 100%, especially w/Disco. I barely get one BT paid off, and like clockwork, there's another batch of checks in my mailbox 🤣

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K