- myFICO® Forums

- Types of Credit

- Credit Cards

- Barclays Uber Visa Refresh

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Barclays Uber Visa Refresh

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Barclays Uber Visa Refresh

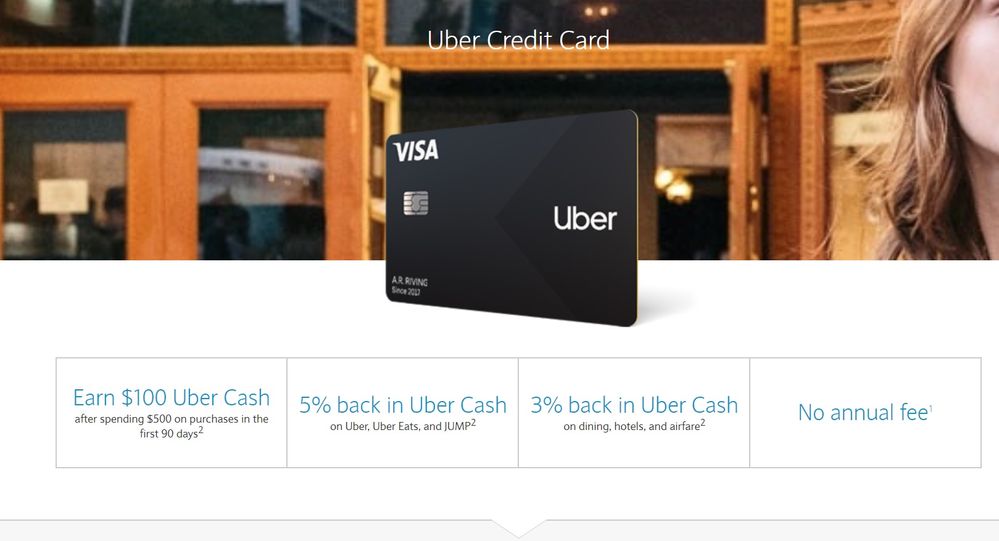

This refresh is a huge devaluation if you prefer cashback. This card only earn Uber Cash now.

The Good:

5% Uber Cash on all Uber purchases: Uber, Uber Eats and Jump

The Bad:

-Restaurant is 3% Uber Cash now

-No more $50 statement credit for online services after $5k spend

-No more 2% on Online Shopping

-No more Cash back

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays Uber Visa Refresh

Well, that just stinks. Can't say I'm surprised though. The Uber card was somewhat of a jewel among no AF cards.

It will probably be on the chopping block for me. I don't see as much value in Uber Cash as I do in cash back.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays Uber Visa Refresh

@Anonymous wrote:Well, that just stinks. Can't say I'm surprised though. The Uber card was somewhat of a jewel among no AF cards.

It will probably be on the chopping block for me. I don't see as much value in Uber Cash as I do in cash back.

Yeah, it was too good to be true for a no AF card. Mine will be sock drawer now.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays Uber Visa Refresh

Another bruise on Barclaycard.

- First, their cards seem to rotate in and out at random times.

- They had the Ring which had what, an 8.24% interest rate? Took it and nearly doubled the rate.

- Had a great card in the Uber Visa, which they now destroyed.

- Will eventually lose their Apple Card businessn entirely to Goldman Sachs, unless a card applicatant doesn't know any better.

- Failed at that one card where they offered airline transfer partners (forgot the name because it stunk anyways).

They just need to pack their bags and head back to the UK. It's obvlous Barclays can't compete in the American capitalist banking system.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays Uber Visa Refresh

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays Uber Visa Refresh

This is why I focus on big bonuses. If I get something great up front, I'm still comfortably ahead when the unpleasant refresh comes.

Our rigid long-term card strategies are a source of continual entertainment for the nerfing demons.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays Uber Visa Refresh

Unfortunate but not surprising considering number of people who have this card but do not use any of Uber services.

I really could not see how was Uber supposed to benefit from this partnership, while the benefits for Barclay were pretty obvious

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays Uber Visa Refresh

Luckily I did not apply for this card <whew>

I've never done uber and only wanted it for the %4 dining

Chase FU $19.6k

BOA Cash Rewards $36k

BJs Perks Plus M/C $22k

Cap1 QS $4,950 (AU)

Best Buy $4k

Wells Fargo Active Cash $11.3

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays Uber Visa Refresh

@PutThatMoneyOnTheTable wrote:Luckily I did not apply for this card <whew>

I've never done uber and only wanted it for the %4 dining

Savor (or Savor One) is a good alternative. 3-4% back on dining and entertainment, 2% back on groceries, and a good sign up bonus.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays Uber Visa Refresh

@Remedios wrote:Unfortunate but not surprising considering number of people who have this card but do not use any of Uber services.

I really could not see how was Uber supposed to benefit from this partnership, while the benefits for Barclay were pretty obvious

These changes may actually appeal to someone who uses Uber a lot.

2% on rides going to 5%. I always thought 2% was weirdly low for their primary service compared to 3x URs on CSR.

4% on Uber Eats going to 5%.

Uber cash is usually sold at a 5% discount ($95 for $100 of credit)...so more like 4.75% now than 5%.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select