- myFICO® Forums

- Types of Credit

- Credit Cards

- Barclays Uber Visa Refresh

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Barclays Uber Visa Refresh

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Uber Visa Cardholders: Be Careful! My Transition Date Just Changed From May to February!

@MachoHombre wrote:

@Anonymous wrote:

@firefox100 wrote:Lets do this again. I cash out on Uber visa had the cash sent to my checking account it was over 150 dollars. I may take the offer at some time to transfer cash to my checking account for 15 @ 0 percent with no transaction fee. I will not close out account who know what can ahppen later on.

A 3% BT fee is pretty much the equivalent of a 6% APR.

I agree that closing the card is like cutting off your nose to spite your face. Who knows what will happen in the future?

Qualifying for this card was not a slam dunk. Those that did can most certainly get better than 3% transfer and a handful of months at 0%.

3% transaction work in their favor, not yours when comparing options. I'd dare guess that if you called existing accounts they'd match that if not better it, -and there are dozens of cards offering equal or much better for new accounts.

....and IMO most all of these banks are better to partner with than Barclay.

Partners in your financial transactions are like dance partners, why not choose nice and loyal ones.

I made a poor decision taking Barclay to the dance, I'm certainly not taking her home. Not even too many beers could make it happen LOL.

After a few dances many dance partners get beer bellies, gray hair, have addiction issues and bad breath.

I would seldom recommend closing any card that has no AF. Aside from credit reporting issues, it's entirely possibly that Barclays could come up with a decent card in the future that could work for someone. As previously mentioned, Barclays can be tricky on approvals to begin with, so there's no guarantee you'd get approved for the new card. But holding onto the old Uber Card, it's pretty much a slam dunk getting approved. And they do allow reallocation of credit limits.

I have had once good lenders turn to garbage (e.g. Nationwide Bank) and have had garbage lenders turn gold (e.g. CapOne). That's all part of the credit game.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Uber Visa Cardholders: Be Careful! My Transition Date Just Changed From May to February!

@Anonymous wrote:i got my card on oct 21 and the email i got said it will be converted "starting with the may cycle," now they're saying it will be converted after the may cycle ends?

If you don't count on the worst case scenario, you aren't playing the game correctly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays Uber Visa Refresh

Steve891,

This is typical of Barclays. They go and change a good thing. I only see this change benefiting heavy Uber users.

If I had this card, I'd sock drawer it and just use a couple times a year.

Guyatthebeach

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Uber Visa Cardholders: Be Careful! My Transition Date Just Changed From May to February!

@Anonymous wrote:After a few dances many dance partners get beer bellies, gray hair, have addiction issues and bad breath.

Yep, and that's what happened to this dance partner, she has all the above you mention. Shame on me for asking her to dance in the first place. I should have seen it coming with Barclay track record and UBER financial issues. I'm leaving her out on the dance floor alone. I won't cancel my card, but unless there is an amazing immaculate conception, we've shared our last swipe together. I've cashed out my bonus and am moving on. No UberCASH in my future. Card will be used to scrape the bird poop from the bird cage.

||

||

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Uber Visa Cardholders: Be Careful! My Transition Date Just Changed From May to February!

One thing that Uber did which I did not like at all was when they sold their market in Southeast Asia to Grab. I frequently fly to SE Asia, and not being able to use Uber, their UberCash will have even less value for me, personally.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Uber Visa Cardholders: Be Careful! My Transition Date Just Changed From May to February!

This was my maincard since it came out since most of my spend is food and online purchases.

I am going to the Propel card in January since I dont do any travel.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays Uber Visa Refresh

Looks like this card is taking a big hit on value. I signed up for it less than 2 weeks before the card went "Uber Cash" on everything so I'm disappointed overall. True cash back is only worth its value if redeemed as cash, or second best as a statement credit or gift card. I am fortunate to have the Uber services in my region so I can still use the Uber Cash at times. It looks like with the Uber markets of transit and food, I think they are trying to get people on board with their branding by collecting data of their expenses through the platform. Still, it was a bait and switch to go from a cash back card to becoming an "Uber Credit" card. I'm not trying to get more hard inquiries just yet, like I did with this one. This was a rare dining spend gem for $0 annual fee.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays Uber Visa Refresh

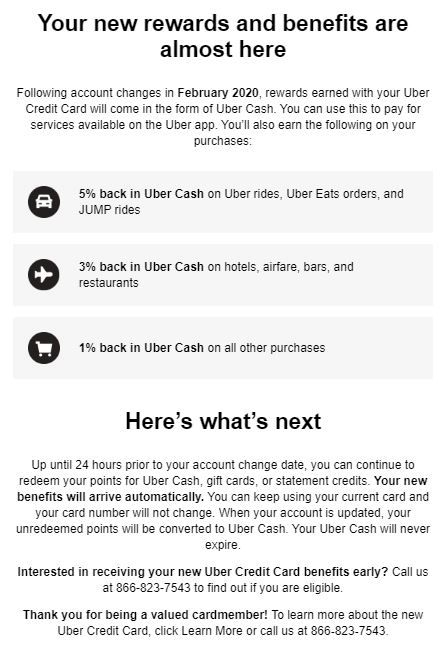

Got an updated email today, reminding me of the bait-and-switch.

* I cashed out all rewards shortly after hearing the news. Card is now parallel to a department store card

* Been many months since it's had a single swipe.

* Not in the sock drawer, instead next to the bird cage where it's used to scrape poop off the bottom. We'll see how long it takes Barclay.Bait.Switch to cancel it.

* I was **** to go with the double-loser team of Barclay/Uber. Lesson learned. Both companies very poor in the financial savy arena.

||

||

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays Uber Visa Refresh

@MachoHombre wrote:Got an updated email today, reminding me of the bait-and-switch.

* I cashed out all rewards shortly after hearing the news. Card is now parallel to a department store card

* Been many months since it's had a single swipe.

* Not in the sock drawer, instead next to the bird cage where it's used to scrape poop off the bottom. We'll see how long it takes Barclay.Bait.Switch to cancel it.

* I was **** to go with the double-loser team of Barclay/Uber. Lesson learned. Both companies very poor in the financial savy arena.

I am still going to keep mine around. Still useful card if you travel overseas since it is a chip and pin card. Useful for unmanned kiosh.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Uber Visa Cardholders: Be Careful! My Transition Date Just Changed From May to February!

@MachoHombre wrote:

@Anonymous wrote:After a few dances many dance partners get beer bellies, gray hair, have addiction issues and bad breath.

Yep, and that's what happened to this dance partner, she has all the above you mention. Shame on me for asking her to dance in the first place. I should have seen it coming with Barclay track record and UBER financial issues. I'm leaving her out on the dance floor alone. I won't cancel my card, but unless there is an amazing immaculate conception, we've shared our last swipe together. I've cashed out my bonus and am moving on. No UberCASH in my future. Card will be used to scrape the bird poop from the bird cage.

I keep my Uber card in my car, we don't get many icy windshield mornings here in southern Arizona, but when we do my Uber card works great for scraping off the ice.

I cashed out mine in Dec. for a statement credit, mine is supposed to change over in Feb. but I don't leave things until the last minute. I'd rather hang onto the $6k CL for awhile, so I'll toss it my Netflix sub a couple times a year to keep it active.