- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Best Credit Card

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Best Credit Card

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Best Credit Card

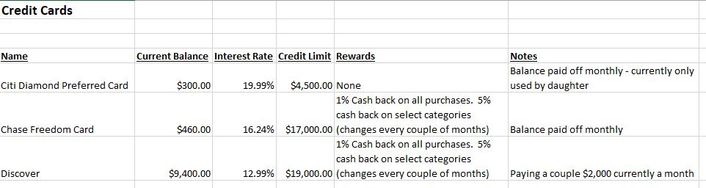

We currently have the following three major credit cards:

We also have a couple of store credit cards that we pay off monthly.

Ideally I would like to reduce our interest rates (possibly by transferring balances?). I would like to keep at least two major credit cards (one for my wife and I, and one for my daughter (under our name). A couple of other factors that could affect any credit card changes:

1. We have a family vacation planned this summer. We still owe a balance of about $3,000 which is due in the middle of May. We also need to book flights which will be an additional $3,000. We will be using one of the cards to pay both of these.

2. Our daughter will be going away to college this summer. She hasn't made a decision as to where yet but right now she leaning toward a college about 600 miles away. If she does chose this school I would assume she will be flying there and back a couple of times a year (we might also).

3. In the next few years I would like to start having an annual vacation that will involve flying.

So what would be the best plan for us? Apply for a new card a transfer balances? If so, what card(s) should we be looking at? Do cars with cash back offer more value or should we consider cards that offer miles. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Credit Card

With BT, I suggest AMEX Everyday. I applied it myself and easy breezy with the BT from my Discover so it's 0% APR and there were no BT fees.

With Travel Card, I always use my BofA Travel Rewards. Straight up 1.5% CB at anything but the credit only goes to Travel purchases. No Caps though and it never expires so you will really enjoy the CB once it piles up plus it has SUB of $250 (again, can only be redeemed thru travel purchases) oh and no foreign transactions fees ever.

Another good travel card is any Capital One card. They never have Foreign Transaction Fees and I have Quicksilver so another 1.5% CB.

Since you have Discover, have you tried asking them for 0% APR on your current balance or lower? They are easy to talk to online or on the phone.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Credit Card

Bt card can be bankofamericard, slate, or everyday from amex.

Travel card can be csp, csr, propel, gold/platinum, prestige.

More accurate recommendation depends on your annual spending break down, your airline preference, your fico score and account history.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Credit Card

@Anonymous wrote:Do cars with cash back offer more value or should we consider cards that offer miles.

If you find a CAR with cash back, please let me know ... ha ha ha ha

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Credit Card

Use the Freedom and Discover for their 5% categories.

What airline will you be flying?

Have you considered hotel loyalty?

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Credit Card

![Chase Southwest Premier 3K 10/17 [canceled]](https://i.imgur.com/66R5N3K.png)

![American Express Hilton Honors Ascend 3K 04/18 [canceled]](https://i.imgur.com/iJxp0t4.png)

![Petal Card 3.25K 07/18 [closed for inactivity 04/20]](https://i.imgur.com/rGjGptU.jpg?1)

![American Express Hilton Honors Card 3.6 K 11/18 [canceled]](https://i.imgur.com/jmINR11.jpg)

[2/2019]

[2/2019]

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Credit Card

Thanks for all the responses. To answer a couple of the questions brought up:

1. I have not recently talked to any of the companies for the cards we currently have. I believe I talked to all of them a couple of them a couple of years ago and was able to reduce APR a bit.

2. A breakdown of our spending for 2018 is as follows:

28% on Home (92% of that on Mortgage; Rest on Home Improvement, etc)

18% on Shopping (Food, clothes, dining, alcohol, home goods, gifts, entertainment, etc)

16% on Auto (One car loan which will be paid off this year, car maintenance, gas)

11% on Utilities and Loan (26% of that on a land loan; remaining on utilities such as electic, cell phone, cable, internet etc)

9% on Education (Student Loans, School Fees, College Applications, etc)

The remaining 18% is miscellaneous. A lot of this probably would get categorized as Shopping (kid's sports, gifts etc) but I didn't start using Mint seriously until later in 2018 so some of the earlier transactions ended up as Uncategorized or Other.

3. We will be flying United to Hawaii in July and staying in a condo booked through VRBO. We want to book our flights very soon to make sure our preferred flight doesn't fill up and to lock in prices.

4. The FICO score on our Discover bill is 822 and on our Citi bill 848. I ran my scores last year through CreditCheck and my scores ranged from 782 to 808 (depending on the reporting agency).

Thanks again!

Starting Score: 567

Starting Score: 567