- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Cap 1 does it again & about to open a case wit...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Cap 1 does it again & about to open a case with CFPB

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap 1 does it again & about to open a case with CFPB

@AzCreditGuy wrote:I stopped using my Cap1 card for a while and started up again when my business needed to pay off some expenses and since Cap1 offers BT with no BT fees, I have been using this for 2 months now. Yes I know some of you will state Cap1 will frown on you or even close your account for repeated BT like this. Why though, if they dont like this, why dont they remove this feature on my account and others who have done the same thing?

Anyways last month on my 1st BT I took out the BT after my statement closed to avoid any interest and pay it off on the following month which would give me a month give or take some days.

Cap 1 ended up charging me a INTEREST CHARGE

PECIAL TRANS for $2.97, yes this is a small charge but there was no reason. I was within in my full month to pay off this BT, I called into Cap 1 to get this removed. They did and they could not explain how I was charged (SURE)

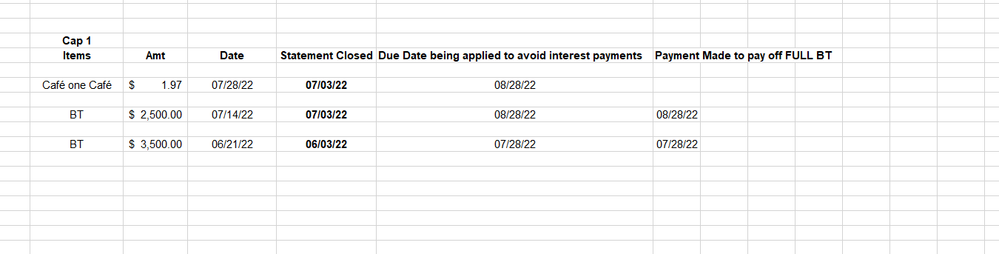

This month they have done it again for $43.37, even though I have timed it where 2 BT would not incure any interest. Let me know if I am in the wrong here... And I am pretty sure this for the BT I did in June 2022 as you can see below on my spreadsheet, no interest should have been added to the account since it was paid off within the timeframe to avoid interest. Cap1 also reported this interest as a balance to all 3 credit reports too.

If they don't like "that", they don't have to remove "that". It's easier to restrict or close accounts after it's done one time too many by a few individuals who are using loopholes, than be hyper reactive and change everything for everyone.

Those of "us" who said it, said it because accounts were either permanently restricted or closed altogether. Used to be a big "three week thing", then everyone got wiser because Cap One wasn't playing around.

Maybe you'll have a better luck than everyone else but I wouldn't hold my breath especially after you file complaint and force them to look even closer.

Those who got their cards closed, did it "right". They did BTs only to buy themselves a few weeks and paid in full before the statement, resulting in minimal interest (like the first one for you) but never went into subsequent cycle.

You didn't have a BT offer, you did it at full APR, so interest does accrue unless it's paid before the statement. That type of BT is treated as a purchase (same apr) but minus the grace period.

As to why the difference in the amount, time from when you did BT to first statement was shorter, so less interest.

Then you continued carrying that balance through the next statement, and you got full interest charge.

CSR isn't supposed to answer these questions, they aren't responsible for calculations, but they were kind enough to waive it for you, so yay for Cap One customer service.

Please update with results of your complaint to CFPB.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap 1 does it again & about to open a case with CFPB

Prevoius balances are always paid in full on the due dates

Here are the terms :

Balance TransferTransfer a balance at the same rate as your purchases, currently 24.4% variable, without paying a transfer fee.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap 1 does it again & about to open a case with CFPB

@Remedios wrote:

@AzCreditGuy wrote:I stopped using my Cap1 card for a while and started up again when my business needed to pay off some expenses and since Cap1 offers BT with no BT fees, I have been using this for 2 months now. Yes I know some of you will state Cap1 will frown on you or even close your account for repeated BT like this. Why though, if they dont like this, why dont they remove this feature on my account and others who have done the same thing?

Anyways last month on my 1st BT I took out the BT after my statement closed to avoid any interest and pay it off on the following month which would give me a month give or take some days.

Cap 1 ended up charging me a INTEREST CHARGE

PECIAL TRANS for $2.97, yes this is a small charge but there was no reason. I was within in my full month to pay off this BT, I called into Cap 1 to get this removed. They did and they could not explain how I was charged (SURE)

This month they have done it again for $43.37, even though I have timed it where 2 BT would not incure any interest. Let me know if I am in the wrong here... And I am pretty sure this for the BT I did in June 2022 as you can see below on my spreadsheet, no interest should have been added to the account since it was paid off within the timeframe to avoid interest. Cap1 also reported this interest as a balance to all 3 credit reports too.

If they don't like "that", they don't have to remove "that". It's easier to restrict or close accounts after it's done one time too many by a few individuals who are using loopholes, than be hyper reactive and change everything for everyone.

Those of "us" who said it, said it because accounts were either permanently restricted or closed altogether. Used to be a big "three week thing", then everyone got wiser because Cap One wasn't playing around.

Maybe you'll have a better luck than everyone else but I wouldn't hold my breath especially after you file complaint and force them to look even closer.

Those who got their cards closed, did it "right". They did BTs only to buy themselves a few weeks and paid in full before the statement, resulting in minimal interest (like the first one for you) but never went into subsequent cycle.

You didn't have a BT offer, you did it at full APR, so interest does accrue unless it's paid before the statement. That type of BT is treated as a purchase (same apr) but minus the grace period.

As to why the difference in the amount, time from when you did BT to first statement was shorter, so less interest.

Then you continued carrying that balance through the next statement, and you got full interest charge.

CSR isn't supposed to answer these questions, they aren't responsible for calculations, but they were kind enough to waive it for you, so yay for Cap One customer service.

Please update with results of your complaint to CFPB.

Nope prev BT is always PAID IN FULL...I never let any BT cycle into the next period.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap 1 does it again & about to open a case with CFPB

@AzCreditGuy wrote:Prevoius balances are always paid in full on the due dates

Here are the terms :

Balance TransferTransfer a balance at the same rate as your purchases, currently 24.4% variable, without paying a transfer fee.

I'm still unclear what the issue is or why you feel the need to escalate to CFPB. It looks like you took a standard balance transfer and were charged your normal APR for the dates that the balance was on your card. That's how that works.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap 1 does it again & about to open a case with CFPB

FICO Scores (current as of November 24, 2020): Equifax: 740 | Experian: 751 | TransUnion: 732

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap 1 does it again & about to open a case with CFPB

@K-in-Boston wrote:

@AzCreditGuy wrote:Prevoius balances are always paid in full on the due dates

Here are the terms :

Balance TransferTransfer a balance at the same rate as your purchases, currently 24.4% variable, without paying a transfer fee.

I'm still unclear what the issue is or why you feel the need to escalate to CFPB. It looks like you took a standard balance transfer and were charged your normal APR for the dates that the balance was on your card. That's how that works.

[Mod cut: All posts on the myFICO Forums must be Friendly, Supportive, and Respectful. Please refer to the Terms of Service.] nor do you understand what I am doing with these BTs and the terms. The "special interest" trans was removed from my account as it should have never been there and was paid in full with the timeframe to avoid interest...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap 1 does it again & about to open a case with CFPB

@Matt9543 wrote:

@AzCreditGuyI would recommend checking the terms and conditions. According to Capital One's website (highlighted in blue) they will begin charging interest from the transaction date on Balance Transfers. The interest charge you are receiving is valid.

I did and I called in so they could explain the terms and they couldnt explain to me where the interest was coming since the full BT balance was paid off within the time frame to avoid interest and they removed it... [Mod cut: see above.]

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap 1 does it again & about to open a case with CFPB

They did and they could not explain how I was charged

And even after they credited the money and seemed to acknowledge something was odd about everything, you still want to open a CFPB case?

Of course, you're free to do what you will. But I have to tell you, that case will not give you what you want.

Cap 1 will say they credited the amount. CFPB will break their arm patting Cap1 on the back for taking care of the customer.

As for you, you will come off looking like a bitter curmodgeon out to torpedo Cap 1 via online complaint...even after they issued an account credit.

Trust me, I know that of which I speak. I submitted a CFPB case in a situation where the money was not so easily handed back...and though it took months for the company to pay, the CFPB wrote glowingly about the company's desire to "satisfy the customer" in their follow-up. ![]()

My advice to you is to ax them altogether, as it is abundantly clear that you are unsatisfied with them as a CCC. Cap 1 is a good lender, but hardly irreplaceable for most CC users. If their way of doing business dissatisfies you, LOSE THEM. If you're looking for true emplowerment as a credit user, dropping them like a hot potato is your best option.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap 1 does it again & about to open a case with CFPB

@AzCreditGuy this is a forum with many users well-versed in balance transfers and how interest is calculated by credit card issuers. If you are not open to responses from other users in order to help you, this thread will be closed to further replies.