- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Cap One closure warning

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Cap One closure warning

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One closure warning

@ptatohed wrote:I think his last sentence is indicating he's ready to let 'er go.

Nah, it's a little too old, so I did an Amazon reload. I should have added, in case it's important, the mail also referenced unredeemed rewards.

So despite my statements here about redeeming rewards ASAP (except in very specific cases), I had left $0.02 with Capital One, and if the card had closed without prior warning...... well.

So as usual, do as I say and not as I do, and do it very quickly!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One closure warning

Why would any lender reserve for credit limits that are not being used. They had a bad quarter and must be window dressing for next quarter's earnings report.....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One closure warning

@Aim_HighBeen there done that. From the RIP below and moved on up. Even when times were bad. Got a auto loan couple yrs before BK. Just joking around. One thread on anything even remotely close to negative about Cap1 (which this one really isnt) pops up once a month and here they come! ^^^^^ I'll bet some wont even admit they had a Cap1 card. ![]()

@AnonymousLeast they were kind enough to send a reminder that hey we still exist in your wallet. We know who loves to slam the door in your face with no explanation and/or reasons. Thanks for posting. Need to pull the Savor out. I'm really close to the reminder note also.

BK Free Aug25

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One closure warning

@redpat wrote:Why would any lender reserve for credit limits that are not being used.

That's a valid point, but a whole other discussion. Why do lenders set limits much higher than consumers will use them or allow them to stay open? How many times have we been given $5K, $10K, 25K starting limits that don't drop after not using more than a few hundred or thousand on the cards? It is curious that it's allowed but most lenders seem to allow limits to stay in-place without CLD as long as the consumer profile (or the lender!) isn't in distress. I've only had limits decreased on cards a long time ago when I was carrying some higher balances and got balance-chased. Now I've got even higher limits with low utilization and they leave me alone; go figure. ![]() Lenders like to give you credit when you don't need it.

Lenders like to give you credit when you don't need it.

On the other hand, I don't feel the least bit guilty about keeping unused limits since I understand how FICO utilization penalties work.

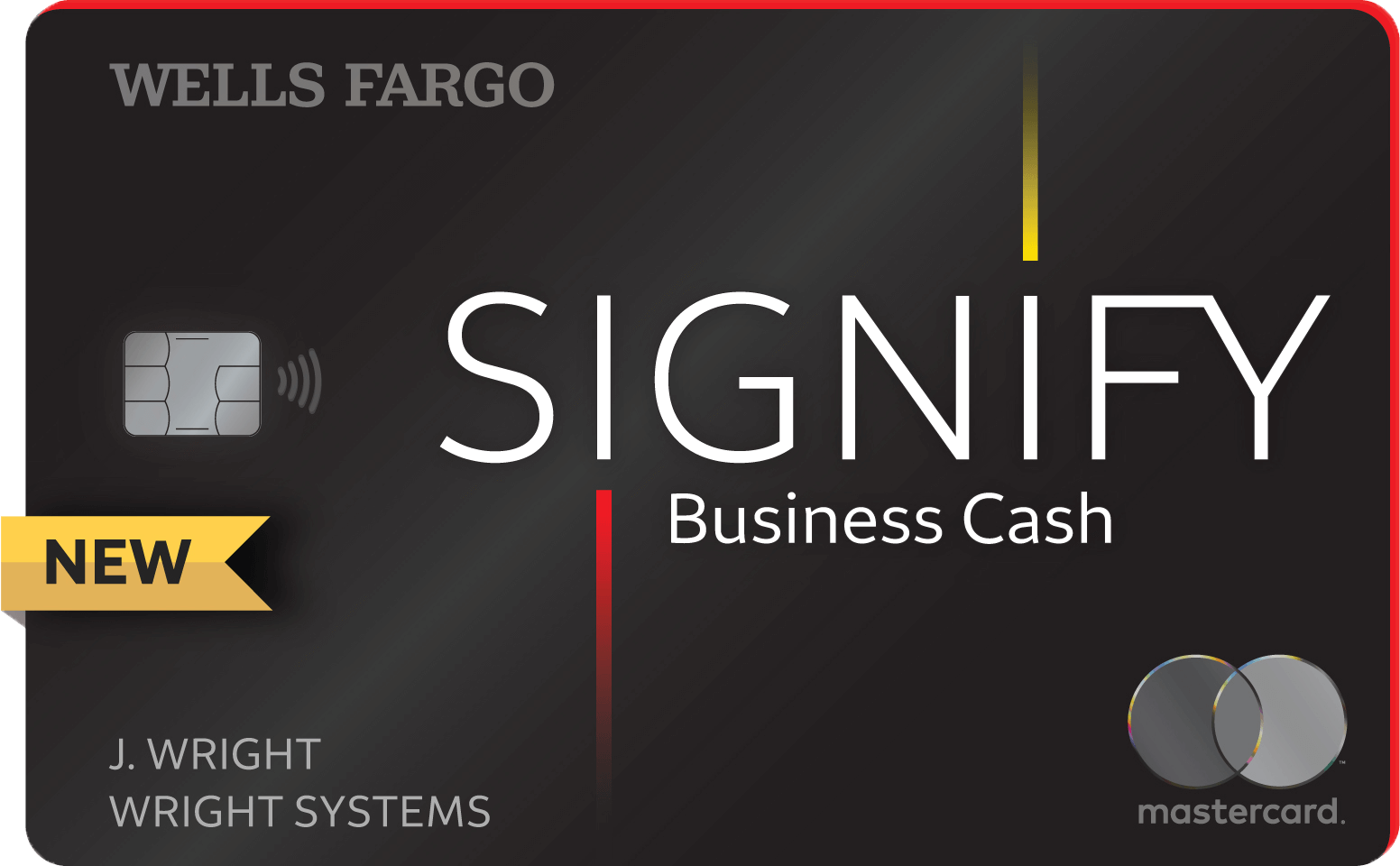

Business Cards

Length of Credit > 40 years; Total Credit Limits >$936K

Top Lender TCL - Chase 156.4 - BofA 99.9 - CITI 96.5 - AMEX 95.0 - NFCU 80.0 - SYCH - 65.0

AoOA > 31 years (Jun 1993); AoYA (Oct 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One closure warning

@Aim_High wrote:

@redpat wrote:Why would any lender reserve for credit limits that are not being used.

On the other hand, I don't feel the least bit guilty about keeping unused limits since I understand how FICO utilization penalties work.

Oh I agree there is no need to feel guilty, banks and CUs can certainly take care of themselves (with a few notable exceptions over the years) but then don't be surprised if there is a CLD when the lender feels the pinch

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One closure warning

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One closure warning

@Anonymous wrote:

@FireMedic1 wrote:

@Kforce wrote:

@OmarGB9 wrote:

@Remedios wrote:So, you gonna use it or let nature take its course?

This. Inquiring minds want to know.

I don't care

@Kforcethis didnt conrtibute in any way to what @Anonymous posted about. FSR please. Tx.

@Kforce made a (good) joke! Nothing non FSR IMO

Well, that's too bad because I was looking forward to a cage match.

Anyway, my QS has been inactive for over two years, limit until December was $6000.00, so maybe Cap One is more likely to send these notices to those with higher limits.

Now it's $9000.00 so maybe 6 more months before they want their fake money back.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One closure warning

@Aim_High wrote:

@redpat wrote:Why would any lender reserve for credit limits that are not being used.

Lenders like to give you credit when you don't need it.

On the other hand, I don't feel the least bit guilty about keeping unused limits since I understand how FICO utilization penalties work.

Lol, yes you can always get all the credit you want when you don't need it, that's the nature and the beast of credit.....Welcome to the jungle...

Has for CO, when I had their cards I never had a problem with them. I do think they get a bad rep here at times.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One closure warning

@Remedios wrote:

@Anonymous wrote:

@FireMedic1 wrote:

@Kforce wrote:

@OmarGB9 wrote:

@Remedios wrote:So, you gonna use it or let nature take its course?

This. Inquiring minds want to know.

I don't care

@Kforcethis didnt conrtibute in any way to what @Anonymous posted about. FSR please. Tx.

@Kforce made a (good) joke! Nothing non FSR IMO

Well, that's too bad because I was looking forward to a cage match.

Anyway, my QS has been inactive for over two years, limit until December was $6000.00, so maybe Cap One is more likely to send these notices to those with higher limits.

Now it's $9000.00 so maybe 6 more months before they want their fake money back.

I literally LOL'd.

Good to know that sometimes C1 will notify you of inactive accounts. I plan on sock drawering my QS next month.

Business Cards: Total CL $43,800

FICO 8: Equifax - 686 / Transunion - 727 / Experian - 678

FICO 9: Equifax - 659 / Transunion - 776 / Experian - 673