- myFICO® Forums

- Types of Credit

- Credit Cards

- Cap1 Savor One vs PNC Cash Rewards - Restaurant an...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Cap1 Savor One vs PNC Cash Rewards - Restaurant and Grocery over 6K

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cap1 Savor One vs PNC Cash Rewards - Restaurant and Grocery over 6K

Hi all,

I would like to add another card for restaurant and grocery over 6K (BCP rewards for first 6K). I spend a bit over $400 a month on take out/delivery. I have the following cards already:

- Amex BCP - opened 11/06/2018 hard pull - Grocery 6% up to 6K, Gas and transit 3%

- Amex CM - opened 11/23/2019 soft pull - 1.5% everything

- LL Bean Visa - opened 7/2008 - Bean bucks

Right now I am using the Amex CM for restaurant, but Savor One and PNC Cash Rewards cards earn double that, which would net me just under $75 more in rewards per year. Right now I see the following plus and minus with each card - can anyone add plusses or minus of these cards or have an opinion one way or the other mostly for restaurant and grocery spending over BCP 6K cap?:

PNC Cash Rewards:

Advantages:

- Have accounts with PNC

- Good luck with Customer Service

- Company has more favorable reviews than Cap1

- Easy to get Customer Service on phone the few times needed

- 1 HP, probably Experian

Disadvantages:

- 8K cap

- Not sure if grocery and restaurant cash back will work in as many places as Savor One

Cap1 Savor One:

Advantages:

- No cap

- Based on conversation with agent, sounds like many places included in Grocery Store and Restaurant categories, like meat market and bakeries

- $5 to $10 more in rewards per year based on my calculations

Disadvantages:

- Hold times if need to call are ridiculous

- Unfavorable reviews recently

- Concerned on what CL will be

- HPs on all 3 CRAs

Thanks for any insight

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap1 Savor One vs PNC Cash Rewards - Restaurant and Grocery over 6K

You pretty much hit the +/- of each card. PNC Cash Rewards also gives 4% on gas. Based on your estimates, you would spend about $5K/year on dining, and that would leave you with $3K/year for gas ($250/mo).

I have both cards. Assuming that you will not carry a balance on either card, the APR won't matter. PNC might offer a better SL than Capital One, but that might not matter if you expect to get a comfortable SL anyway.

8K should suffice for your needs, assuming 3K for gas a year is a good supplement to your current gas card.

I prefer the PNC Cash Rewards card over Capital One.

EDIT: fixed typos.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap1 Savor One vs PNC Cash Rewards - Restaurant and Grocery over 6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap1 Savor One vs PNC Cash Rewards - Restaurant and Grocery over 6K

@Anonymous wrote:

I have both cards. Assuming that you will not carry a balance on either card, the APR won't matter. PNC might offer a better SL than Capital One, but that might not matter if you expect to get a comfortable SL anyway.

8K should suffice for your needs, assuming 3K for gas a year is a good supplement to your current gas card.

I prefer the PNC Cash Rewards card over Capital One.

EDIT: fixed typos.

Thanks for the response.

I don't carry a balance, so APR is not a concern. Depending on if my son is at home for a while, I end up spending 1 - 2K past the 6K on groceries, and that doesn't include the meat market, since we have 3 adults at home even without my son, which that would chew up some of the 3K you mentioned.

Out of curiosity, why do you like the PNC Cash Rewards over the Savor One?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap1 Savor One vs PNC Cash Rewards - Restaurant and Grocery over 6K

@bergrides wrote:@Anonymous wrote:

I have both cards. Assuming that you will not carry a balance on either card, the APR won't matter. PNC might offer a better SL than Capital One, but that might not matter if you expect to get a comfortable SL anyway.

8K should suffice for your needs, assuming 3K for gas a year is a good supplement to your current gas card.

I prefer the PNC Cash Rewards card over Capital One.

EDIT: fixed typos.

Thanks for the response.

I don't carry a balance, so APR is not a concern. Depending on if my son is at home for a while, I end up spending 1 - 2K past the 6K on groceries, and that doesn't include the meat market, since we have 3 adults at home even without my son, which that would chew up some of the 3K you mentioned.

Out of curiosity, why do you like the PNC Cash Rewards over the Savor One?

Capital One for me, as well as several others in the forum, is getting the thumbs down lately by their practices. They cut CLs down significantly, for me 63%. Of course I didn't really need my entire CL, but it makes the card look smaller lol.

They make it more difficult to PC their products now, no more custom cards, CLs are almost impossible to get, customer service isn't as great.

PNC has offers that I use, Capital One does not. Capital One does allow immediate redemption of rewards and my standard rate is 6.9%, but those aren't too important to me. I use PNC mostly for gas and some for dining. So I prefer PNC over Capital One by a little bit, not a lot. Capital One has been good to me over the time I've had the card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap1 Savor One vs PNC Cash Rewards - Restaurant and Grocery over 6K

@Anonymous - Thanks for the input. I am leaning towards PNC.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap1 Savor One vs PNC Cash Rewards - Restaurant and Grocery over 6K

PNC imho as the 25 redemption threshold is a no brainer.. I actually use mine quite a bit out of my 30ish cards it is one that actually is in the wallet alot of the time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap1 Savor One vs PNC Cash Rewards - Restaurant and Grocery over 6K

Thanks for the feedback @CreditCuriosity

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap1 Savor One vs PNC Cash Rewards - Restaurant and Grocery over 6K

@Loquat - The minimum redemption on rewards doesn't bother me. I would wait until it is at least $25 to redeem anyway. Thanks for the feedback.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap1 Savor One vs PNC Cash Rewards - Restaurant and Grocery over 6K

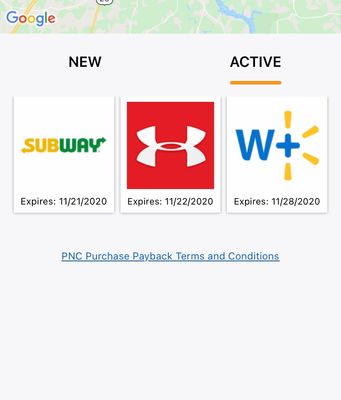

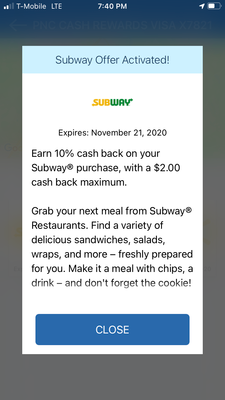

I have the PNC cash rewards card, and I really like it. On top of the 4% cash and 3% restaurants, it has some pretty good targeted 10% offers at different Restaurants, stores, Gas Stations, Big Lots, etc. They are usually 10% offers up to $2, $3, $5 or $6 but they are very useful if they you actually go those places.

I got one at for Circle K gas station last month for 10% cash back up to $3 on top of the 4% I was already getting, so it's a nice return

Hover over cards to see limits and usage. Total CL - $608,600. Cash Back and SUBs earned as of 5/31/24- $21,590.43

CU Memberships

Goal Cards: