- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Capital One Allowing CL Reallocations Again?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Capital One Allowing CL Reallocations Again?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital One Allowing CL Reallocations Again?

I was poking around on Reddit and stumbled across this: https://www.reddit.com/r/CreditCards/comments/156cpft/capital_one_seems_to_be_offering_transfer_of/

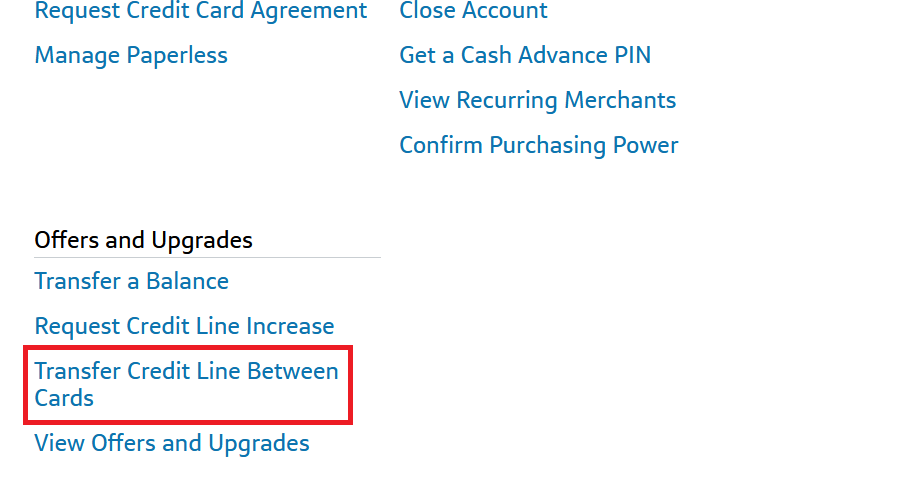

Sure enough, when I checked my account I see the option as well:

Has anybody given this a try yet?

According to Reddit it's still glitchy for some, so I might wait a few days (assuming they don't withdraw the feature like before). I have a never-used Quicksilver Visa that would be a fantastic donor to my Savor WEMC that was lowered to $1500 a few years ago.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Allowing CL Reallocations Again?

I've not gone through the steps myself yet (don't want to do anything that will gum-up the process when I'm ready to pull the trigger) but it looks like this is different from the previous "Account Combination" option they offered a few years ago.

Before the entire credit line was moved and the donor card was closed, but this time they're calling it a 'transfer' so it might be more like the Amex process where you can pick the dollar amount and possibly keep the old card open.

This is just speculation, though, until I (or someone else) goes through the process and can come back with a report. ![]()

I want to think about it a bit more, but I'm probably going to go through with it (or at least try). A few years ago my QS Visa was lowered from $17k to $5k, and my Savor WEMC was lowered from $5900 to $1.5k, both for lack of use (they weren't wrong). The QS Visa is pretty useless since I have the WF Active Cash 2% Visa (and Citi DC WEMC), but if I could shuffle some or all of that credit line to the Savor that would be nice. 🤔

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Allowing CL Reallocations Again?

I just signed into my Cap One accounts and I don't have that link on either card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Allowing CL Reallocations Again?

@ChargedUp wrote:I just signed into my Cap One accounts and I don't have that link on either card.

Well rats. ![]()

Maybe they're rolling it out in batches? <Fingers crossed> you get the option soon.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Allowing CL Reallocations Again?

Interesting thread and interesting timing...

Earlier this week I grew weary of a stagnate $2,000 credit limit on my SavorOne card and applied for a Chase Freedom Unlimited card (I took the bait from a pre-approval E-Mail I got from Chase) and was instantly approved with a SL of $23,600. As soon as I got the approval I started winding down all of my CapOne cards, however, had I known about this option, I might have stuck with my combination Quicksilver and SavorOne cards as my daily drivers.

FWIW, I just went to the CapOne web site and I do have the option to transfer credit lines between the two cards; given I'm winding them down I probably won't pull the trigger on the transfer.

Chapter 13:

- Burned: AMEX, Chase, Citi, Wells Fargo, and South County Bank (now Bank of Southern California)

- Filed: 26-Feb-2015

- MoC: 01-Mar-2015

- 1st Payment (posted): 23-Mar-2015

- Last Payment (posted): 07-Feb-2020

- Discharged: 04-Mar-2020

- Closed: 23-Jun-2020

I categorically refuse to do AZEO!

In the proverbial sock drawer:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Allowing CL Reallocations Again?

I just checked my account and it's there also. I have a $15k limit on my Savor card and $8.6K on the Venture. I don't use either card very much so I'm not sure there is a benefit for me to transfer anything but it's nice knowing I have the option if needed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Allowing CL Reallocations Again?

The hope that they would bring this back is why I've kept my qs1 open all this time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Allowing CL Reallocations Again?

I didn't pull the trigger but it looks much like how Amex does it but you have to keep at least $500 on the donor card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Allowing CL Reallocations Again?

@Brian_Earl_Spilner wrote:The hope that they would bring this back is why I've kept my qs1 open all this time.

You took the words right out of my mouth. ![]() I even said as much when the 'great haircut' took place:

I even said as much when the 'great haircut' took place:

I don't plan to do anything with the card... there's no need to 'rage close' and it's certainly not hurting anything just staying open. On the contrary, at some point in the future their PC policy might change and I might be able to do something 'interesting' with it.

This isn't exactly what I had in mind, but for me it's even better... since closing my Amex Gold I have reason to use the Savor again, and while technically $1500 is probably fine for my needs I'd like to have a little more breathing room.

Since I figured out that the Savor gives 4% for satellite and cable as well as restaurants I'll probably be using it more. (I have cable/satellite set as a category on one of my Cash+ cards, but it's worth losing 1% and freeing up that card for an additional 5% category.)

For what it's worth, both my QS Visa and Savor WEMC are bucketed, so neither will be doing much growth without significant spend which isn't likely. (Ironically, my QS WEMC is not bucketed, and has grown to $15k with very little use.)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Allowing CL Reallocations Again?

@Rogue46 wrote:I didn't pull the trigger but it looks much like how Amex does it but you have to keep at least $500 on the donor card.

Ah, good to know!

This is actually OK. My QS Visa was opened in 2015, so having an older card hang around (even with a $500 CL) definitely won't hurt anything and will help out the AAoA later on.