- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Capital One Allowing CL Reallocations Again?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Capital One Allowing CL Reallocations Again?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Allowing CL Reallocations Again?

This didn't work for me ![]() My card may totally be bucketed, if that really is a thing. I have a Williams Sonoma card with a limit of $27,000 (Comenity gave out limits like water on their store cards) and my grandfathered Savor Card is stilling at $11,300. I was hoping to really transfer the limit from the Williams Sonoma, which used once a year to keep the card open.

My card may totally be bucketed, if that really is a thing. I have a Williams Sonoma card with a limit of $27,000 (Comenity gave out limits like water on their store cards) and my grandfathered Savor Card is stilling at $11,300. I was hoping to really transfer the limit from the Williams Sonoma, which used once a year to keep the card open.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Allowing CL Reallocations Again?

@sto0pyd wrote:This didn't work for me

My card may totally be bucketed, if that really is a thing. I have a Williams Sonoma card with a limit of $27,000 (Comenity gave out limits like water on their store cards) and my grandfathered Savor Card is stilling at $11,300. I was hoping to really transfer the limit from the Williams Sonoma, which used once a year to keep the card open.

It's doubtful that any of the co-branded cards will be eligible, unfortunately. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Allowing CL Reallocations Again?

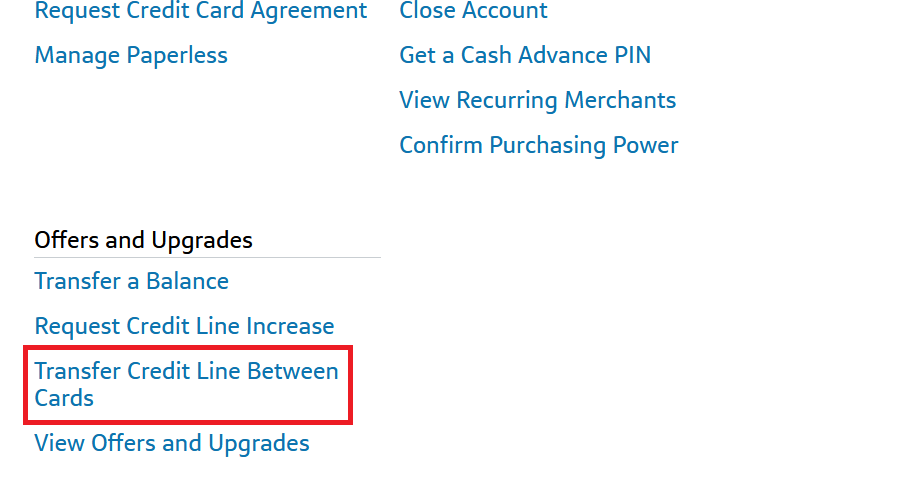

@UncleB wrote:I was poking around on Reddit and stumbled across this: https://www.reddit.com/r/CreditCards/comments/156cpft/capital_one_seems_to_be_offering_transfer_of/

Sure enough, when I checked my account I see the option as well:

Has anybody given this a try yet?

According to Reddit it's still glitchy for some, so I might wait a few days (assuming they don't withdraw the feature like before). I have a never-used Quicksilver Visa that would be a fantastic donor to my Savor WEMC that was lowered to $1500 a few years ago.

Wow, cool. thanks Uncle B

>/ nfcu platinum 15k, BABY NEEDS NEW SHOES !!!!!

closed-- reflex, applied bank, first digital, mission lane, ikea, fingerhut, big lots, valero gasoline, ollo, more to come

Rebuilding since September 2020

who i burned - chase, cap 1, TD bank, Sync, were the biggies

Income 40k

Total utilization around 20 pct depending on my current usage/needs

Ficos ,most are slightly above 700, the 9's slightly higher than the 8's

TCL - about 110k

Retired since 2017

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Allowing CL Reallocations Again?

are they HP whatsoever?

they ask me to send bank statements in order for completing

the transfer

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Allowing CL Reallocations Again?

Glad thy have it back fro you all.. Hopefully they don't do the hatchet job like they did on many of us back in the day when it was allowed then if you didn't spend a good portion of a CL they would cut you down. Think I was 50k on a QS then chopped to 10k and just closed it after that. Many people got hit while others didn't. Just be mindful of that as Cap1 evaluate their CL's of said cards often. Weird thing is has a William Sonoma Visa through cap1 that has a 40k CL likely could get higher and only do a 100-300 charge every 6 months or whatever and remains untouched.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Allowing CL Reallocations Again?

Bummer @Jccflat.

If you decide the effort is worth it and you want to proceed, I would call them to ask.

(While you are on the line with them, can you also ask

what determines their requirements are for having to leave $### or $#,### CL on the donor card?)

This CL reallocation option has been renewed from like 2017 and we forum members

have renewed geek-type 😊questions.

@NoMoreE46 wrote:So the minimum to leave on the donor/remaining card may depend on the tier of the card.

It showed that I had to leave at least $5,000 on my Quick Silver (formerly a Venture X and a Venture.)

Interesting. This all assumes you're just moving around limits between cards, though. This sounds like they might be open to combining limits in the process of closing an account, as I've been able to do with lenders like Chase or NFCU recently. I've been able to move 100% of my limits off a closed card under the right circumstances. You'd probably have to call customer service to do so, but it stands to reason they would do it. Would you be willing to make a phone call and inquire about options on that CL transfer, @NoMoreE46, so we'd have more data points about the possibilities?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Allowing CL Reallocations Again?

I just completed mine. It was instant. The screen popped up asking me to verify income, employment status, and mortgage amount.

I've been grumpy for a while b/c I could never get a decent CLI on my Cap 1 cards (QS, Savor, Venture). I like taking just one card on vacation and using that so everything is not spread out, and the low limits I had $3K and $3.6 (QS - Savor) precluded me from using either of them. But I just moved $3K from the QS to the Savor.

Now, to go a step further, since Cap 1 likes heavy spend, it might be time for me to move some of my monthly spend back to the QS (since the limit has been reduced to $600) and see if a few months of heavy spend (2-3x the limit per month) can get me a CLI in 90 days....

7/7/24:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Allowing CL Reallocations Again?

what member can i call ?to find out if i do send the bank statement if they will do a HP?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Allowing CL Reallocations Again?

This is interesting. I see the option in mine, but I'm unsure if I want to move anything around. I don't have high limits on my QS or S1 and my VX was a min approval. Maybe I'd consider taking $1000 or $1500 from the QS and putting it to the SavorOne since it gets more usage.

June 2022 FICO 8:

June 2022 FICO 9:

Oct 2024 FICO 8:

Oct 2024 FICO 9:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Allowing CL Reallocations Again?

Do you happen to recall what the Minimum amount was required to be left on that QS donor card @md_rebuild ?