- myFICO® Forums

- Types of Credit

- Credit Cards

- CapitalOne PC Questions

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

CapitalOne PC Questions

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CapitalOne PC Questions

After a 6-7 yearlong relationship with CapitalOne, I am finally jumping ship; of course, I plan to do my best to retain my cards and appreciable CL, but want to PC my best Venture card with the annual fee to one without, given I'll have a new *boo* that respects me and my spending in the not-too-distant future that I intend to care for and nurture into a beautiful relationship. ![]()

I currently have 3 Cap1 cards—the card in question has a $33K CL and an annual fee of $59 (I thought it was $60 at one point and the website says $95, so unsure what's going on there). Given I will be using it infrequently, I obviously would be better served with another card, sans AF.

Card 1: QS (NEVER a CLI; hate it)

Card 2: VentureOne MC (not much love here, either)

Card 3: Venture (my daily driver, for now), $59 AF

My questions are:

- Would there be a HP for a PC?

- Unsure of the CLs for other cards, but could I get into, say, a Savor and have my $33K CL remain intact?

- I read about a 'Product Change' page on CapitalOne for members to check if an 'upgrade' offer is available, but that was a couple of years ago. Any such link exist, or will this require a call to the mothership?

Anything special I need to know when calling to request a PC? I believe I have ~5 days before the annual fee hits and working on my exit-strategy now, so would be happy to avoid the fee, get into a different card w/ no AF, all while retaining my $30K+ CL on the new product.

Doable? I'm just trying to avoid doing a PC and then find out my CL was halved, albeit with no annual fee. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne PC Questions

Capital One's standard PC link doesn't seem to work any longer, however there is a back door way to check for PC offers. Use the desktop website to log in to your main page that displays your respective accounts. Click on one of your accounts to bring up the page specifically for that account. In the address bar, the web address should end with an = sign. After the = type /productupgrade and hit enter. It should display available PC options. Keep in mind that this is an unofficial way of doing this so it does not work perfectly at all times, and if you do not receive the desired results you will have to call and talk to a CSR. You should be able to PC between QS, Venture, and V1. The Savor family of cards is not an available option to change to at this time. No HP results from a PC, and all of your account information is retained. The only thing you are changing is the rewards structure for your card(s) and the AF.

FICO 8 Sep '23 EX 755 EQ 765 TU 739

TCL $199,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne PC Questions

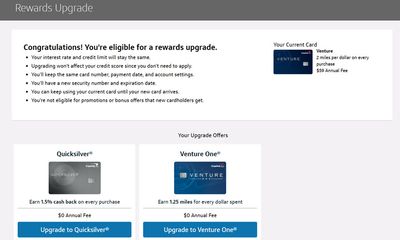

Great information, thanks...extremely helpful and exactly what I was looking for (and it worked)! ![]()

I already have a "VentureOne" MC (and the QS they offered), so believe this is a Visa and would check all the boxes. I'll sleep on the 'downgrade' upgrade...thanks again!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne PC Questions

@Fletcher2 wrote:Great information, thanks...extremely helpful and exactly what I was looking for (and it worked)!

I already have a "VentureOne" MC (and the QS they offered), so believe this is a Visa and would check all the boxes. I'll sleep on the 'downgrade' upgrade...thanks again!

You're welcome! I'm glad it worked for you. One thing to keep in mind, if your card is currently a MC, then it will remain a MC after you PC it. It does not matter what that particular card is being issued as to new applicants currently. Your account number will remain the same (hence staying within the same network,) however you will have a new expiration and CVV.

ETA: I re-read your post and realized that you are talking about your V1 that is a MC, my fault! So I assume you meant your Venture is a Visa and will remain a Visa after PC, which is exactly correct!

FICO 8 Sep '23 EX 755 EQ 765 TU 739

TCL $199,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne PC Questions

@Ficoproblems247 wrote:

Your account number will remain the same (hence staying within the same network,) however you will have a new expiration and CVV.

ETA: I re-read your post and realized that you are talking about your V1 that is a MC, my fault! So I assume you meant your Venture is a Visa and will remain a Visa after PC, which is exactly correct!

Thanks again...indeed a Visa and would stay Visa and the CL in the side-by-side comparison they showed (old vs new) remained the same, too.

Given the same account number, et al, I assume it won't get flagged/reported as a 'new account' or screw up my AAoA and the like.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne PC Questions

This is amazing info @Ficoproblems247

there should be a page dedicated to stuff like this

or a subreddit never mind

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne PC Questions

@Fletcher2 wrote:

@Ficoproblems247 wrote:

Your account number will remain the same (hence staying within the same network,) however you will have a new expiration and CVV.

ETA: I re-read your post and realized that you are talking about your V1 that is a MC, my fault! So I assume you meant your Venture is a Visa and will remain a Visa after PC, which is exactly correct!

Thanks again...indeed a Visa and would stay Visa and the CL in the side-by-side comparison they showed (old vs new) remained the same, too.

Given the same account number, et al, I assume it won't get flagged/reported as a 'new account' or screw up my AAoA and the like.

+1 to everything @Ficoproblems247 said. I've done it, going from Platinum to QS. A PC will not create a new account on your credit reports, nor will it harm your aging metrics. It's the same tradeline, just with different rewards. I wouldn't wait any longer; the PC offers you see one day might not be there the next.

EDIT: LOL. Didn't realize until after posting that this thread is four months old. My bad!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne PC Questions

+1 to everything @Ficoproblems247 said. I've done it, going from Platinum to QS. A PC will not create a new account on your credit reports, nor will it harm your aging metrics. It's the same tradeline, just with different rewards. I wouldn't wait any longer; the PC offers you see one day might not be there the next.

EDIT: LOL. Didn't realize until after posting that this thread is four months old. My bad!

I would second that the offers you see might not be there later. I have a Capital One Platinum MC that I've had for almost 19 years and I finally got two CLIs to bring it up to $12.5K and a Capital One Platinum Visa that was at $750 for 16 years or so and I was able to use this upgrade link to convert to a QuicksilverOne and get a $100 CLI up to $850. I have never ever seen any other upgrade offers. Maybe I'm not using the cards enough but both of these have irritating annual fees. The Platinum has a $5 monthly fee and the QuicksilverOne has a $49 annual fee I believe. They both have really low interest rates but I would love to convert to at least a Quicksilver or, ideally, a Venture and have had no luck with the link and calling in every month or so. I really would like them to be a Venture and Savor to keep my oldest cards alive but getting a PC seems unlikely anytime soon.

AOD Visa Signature | Curve Card | X1 Credit Card | Target RedCard | Venmo Card

AMEX: Schwab Platinum | 2 x Gold | Green | 2 x Business Platinum | 2 x Business Gold | Blue Business Plus

AMEX: Amazon Business Prime | Delta Reserve | Delta Reserve Business | Marriott Bonvoy Business

Chase: Aeroplan | Amazon Prime | World of Hyatt | World of Hyatt Business | Marriott Bonvoy Boundless

Chase: Ink Business Cash | Ink Business Preferred | Southwest Performance Business

BofA: Alaska Airlines Business | Business Advantage Customized Cash Rewards

Citi AAdvantage Executive | Barclays AAdvantage Aviator Business

U.S. Bank Business Triple Cash Rewards | U.S. Bank Business Platinum | GM Business Card

Apple Card | Navy Federal Flagship Rewards | PenFed Gold | PenFed Platinum Rewards

Capital One Platinum | Capital One QuicksilverOne | FNBO Evergreen Business

Player 2: Delta Platinum AMEX | Chase Freedom | 2 x Chase Freedom Flex | Apple Card

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne PC Questions

@Ficoproblems247 wrote:Capital One's standard PC link doesn't seem to work any longer, however there is a back door way to check for PC offers. Use the desktop website to log in to your main page that displays your respective accounts. Click on one of your accounts to bring up the page specifically for that account. In the address bar, the web address should end with an = sign. After the = type /productupgrade and hit enter. It should display available PC options. Keep in mind that this is an unofficial way of doing this so it does not work perfectly at all times, and if you do not receive the desired results you will have to call and talk to a CSR. You should be able to PC between QS, Venture, and V1. The Savor family of cards is not an available option to change to at this time. No HP results from a PC, and all of your account information is retained. The only thing you are changing is the rewards structure for your card(s) and the AF.

WOW, Thanks !!!!!

I just got upgraded to the qs no annual fee from the platinum. i've had the card 5 months, tiny crecit limit of 300 which stays the same but now i get 1.5 percent cash back.

>/ nfcu platinum 15k, BABY NEEDS NEW SHOES !!!!!

closed-- reflex, applied bank, first digital, mission lane, ikea, fingerhut, big lots, valero gasoline, ollo, more to come

Rebuilding since September 2020

who i burned - chase, cap 1, TD bank, Sync, were the biggies

Income 40k

Total utilization around 20 pct depending on my current usage/needs

Ficos in the 680 - 690 range, the 9's slightly higher than the 8's

My vantage scores 708 - 711

TCL - about 110k

Retired since 2017

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CapitalOne PC Questions

@SUPERSQUID wrote:WOW, Thanks !!!!!

I just got upgraded to the qs no annual fee from the platinum. i've had the card 5 months, tiny crecit limit of 300 which stays the same but now i get 1.5 percent cash back.

For a starter credit card, cash back is insignificant. Maxing out a $300 credit limit credit card every month with 1.5% cash back means $4.50/month cash back. $4.50/month seems insignificant compared to the FICO score ramifications of maxing out the credit line.

Credit Cards (newest to oldest): NFCU VISA Platinum $25,000 | BECU Cash Back VISA $10,000 | American Express BCE $9000 | Simmons Bank VISA $7500 | Capital One Quicksilver VISA Platinum (PC/upgrade from No Hassle Miles Rewards VISA Platinum) $500