- myFICO® Forums

- Types of Credit

- Credit Cards

- Chase CSR Letter - Threatened to Close Account b/c...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase CSR Letter - Threatened to Close Account b/c of refunds

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase CSR Letter - Threatened to Close Account b/c of refunds

@Anonymous I'm more than willing to burn a long term relationship over this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase CSR Letter - Threatened to Close Account b/c of refunds

@Anonymous wrote:@Anonymous I'm more than willing to burn a long term relationship over this.

that is good because maybe you just did when you hit that enter key. your interest lies in being right. this is to a large extent a re-builders forum and from what I gather once one comes back from the dead one will do anything to not lose what that have again. you would rather be right no matter the cost, simple as that. what are you hoping that happens, that someone at chase calls you up or sends a note to apologize? banks run on math, do you really think you ran across something that is incorrect to the point that it has never been detected before? not trying to incite or debate but really, what is the purpose in defusing a bomb that has already gone off.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase CSR Letter - Threatened to Close Account b/c of refunds

@Anonymous wrote:@Anonymous I'm more than willing to burn a long term relationship over this.

I think your Discover and City Cards work the same way.

You might need to go debit and give up CC's

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase CSR Letter - Threatened to Close Account b/c of refunds

Another point I like to make, as I'm sure was already made earlier. If it were me I'd consider myself lucky that I didin't get hit with two 30's or a 60 day late. Plus the win with having the CSR aknowledge the issue and your account being noted for why this happend. Seems to me that this is the all good moment.

At least Chase isn't going to add those two lates to your file as a parting gift for filing a cmplaint on them, as that would mean it's personal and it's not. Maybe they should anyways?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase CSR Letter - Threatened to Close Account b/c of refunds

@Anonymous wrote:@Anonymous I'm more than willing to burn a long term relationship over this.

Correct me if I'm wrong, but if Chase decides to shut the account down, won't they sever ties completely with the account holder? That means it's not just the CSR at risk, it risks the Freedom, Freedom Unlimited, Ritz Carlton, Hyatt, and United. Thats $47.4k according to the signature. Not to mention all the future points lost.

All for what? Principle?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase CSR Letter - Threatened to Close Account b/c of refunds

@Anonymous wrote:

@Anonymous wrote:@Anonymous I'm more than willing to burn a long term relationship over this.

Correct me if I'm wrong, but if Chase decides to shut the account down, won't they sever ties completely with the account holder? That means it's not just the CSR at risk, it risks the Freedom, Freedom Unlimited, Ritz Carlton, Hyatt, and United. Thats $47.4k according to the signature. Not to mention all the future points lost.

All for what? Principle?

you got it partner, its the whole enchilada. its fine, there will be lots of things we cannot begin to grasp this year, this will just be added to the list but you are right, that is a heck of a lot of exposure just to be proved right. the crux of the issue is actually thinking there is a `relationship' in play. nothing could be further from the truth

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase CSR Letter - Threatened to Close Account b/c of refunds

@Anonymous wrote:I'm literally speechless ... I can find the right words, but I'm not sure Chase wants to hear them. CFPB... CFPB... CFPB..

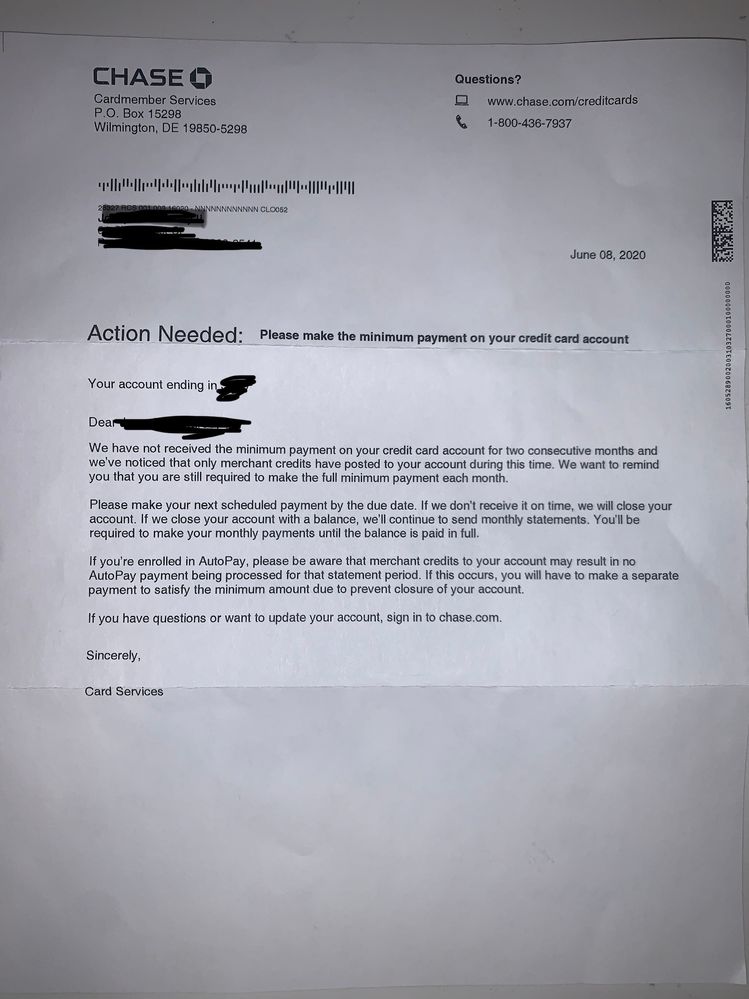

So today I recieved a letter in the mail from Chase. Thought it was the usual balance transfer checks or prviacy updates. Nope! "We have not recevied the minimum payment on your credit card account for two consecutive months and we've noticed that only merchant credits have posted to your account during this time. We want to remind you that you are still required to make the full minimum payments each month". WTH!!!?!?!?!?!? We use Chase for almost everything with credit cards and have always paid in full every single month for the past ten years (since we became Chase customers). Excellent credit and income. This letter was on my CSR account.

So, I call up Chase ... The rep reiterates that letter and tells me that I am misunderstanding and that I still must pay my statement balance even if a refund from a previous transaction results in a credit on my account. What the heck!? So, now, I'm actually livid... I pour over my past few statements and all of my refunds have been from cancelled, prepaid travel from months ago! One from Delta, one from Priceline, Hawiian Airlines, American, you get it. All cancelled because of COVID 19. Again, I already paid Chase for these transactions in full usually months ago!

So I finally had a statement balance ($900ish) this June. I went ahead and paid it when I was on the phone with Chase. The manager I got was very apologetic and agreed that he couldn't understand why Chase would send me this letter, and that the credits were clearly from already paid for and cancelled travel. That my account doesn't have any history of refunds other than this travel. He escalted it and apparently someone from management will call me back in 3-7 days.

Cardmember agreement: I reviewed the cardmember agreement and no where can I find anything about how Chase classifies return or return credit. To me it is a payment, which counts towards your balance and amount due.

$0 statement balance in App/Online: For the past two months the online account in both chase.com/app showed a $0 minimum payment and $0 remaining statement balance. $0 balance subject to interest. I've never carried a balance with Chase. If Chase had told me I owed something, I would have immeditately paid it. But apprently they want me to pay something that I don't owe?

Anyone else get a letter like this? I'm truly livid, I mean livid.

Chase: "Sorry, late april fool's joke"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase CSR Letter - Threatened to Close Account b/c of refunds

@Anonymous

😳! I've heard of bureaucratic incompetence (and not for lack of a better suited word) but this the craziest I've heard so far!😳

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase CSR Letter - Threatened to Close Account b/c of refunds

RESOLUTION

On the 17th, Chase called me and told me that my account was in good standing and that the letter should not have been issued. It was a quick and curt call. This happened prior to my payment posting to the account (push from bank). Today I got their follow up letter which essentially said the same thing.

So while this isn't an apology, all I wanted was my file to note that my account was not past due, in essence to have the first letter rescinded. That more or less has happened, so I'm happy. I also learned a lesson, always pay the minimum payment on your card even if a credit after the statement cuts puts your account in the negative. I still don't agree with this "policy" but at least I know what they expect.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase CSR Letter - Threatened to Close Account b/c of refunds

@Anonymous wrote:RESOLUTION

On the 17th, Chase called me and told me that my account was in good standing and that the letter should not have been issued. It was a quick and curt call. This happened prior to my payment posting to the account (push from bank). Today I got their follow up letter which essentially said the same thing.

So while this isn't an apology, all I wanted was my file to note that my account was not past due, in essence to have the first letter rescinded. That more or less has happened, so I'm happy. I also learned a lesson, always pay the minimum payment on your card even if a credit after the statement cuts puts your account in the negative. I still don't agree with this "policy" but at least I know what they expect.

That's quite a climb down from your previous position.