- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Citi Prestige conversion with less than 5K CL

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Citi Prestige conversion with less than 5K CL

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Citi Prestige conversion with less than 5K CL

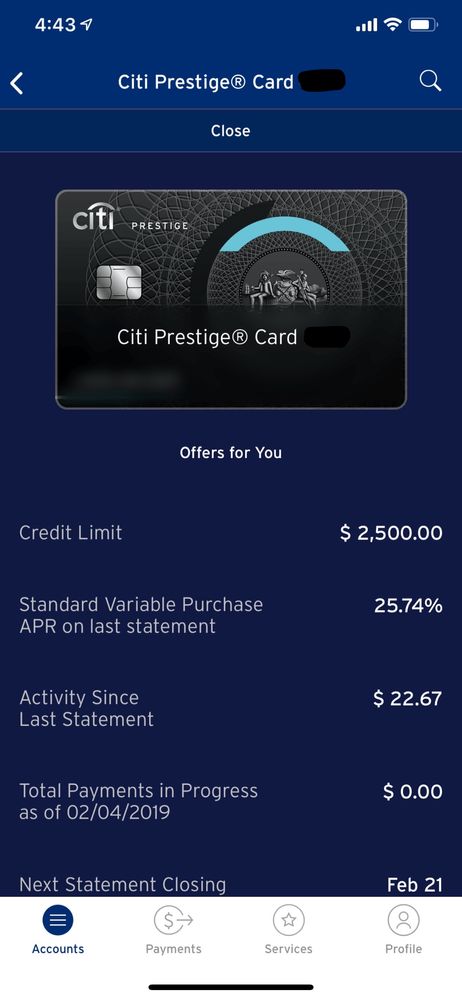

OK. So as a data point for all since i asked this question and the consensus seemed to be you needed at least a 5K limit to product change into this. You can convert to a citi prestige with only 2500 limit. It does not have to be at least 5K. Now, I didnt get a SUB of course but it was a point of whether i could get value now with the card vs waiting to be prequaled for the card later with a SUB. I have 3 trips planned this year where hotel avg night will be at least $300. that would be $900 expected value i would not have otherwise........well.....$450, yes $450 annual fee was quoted not the $495 annual fee....$450 minus $250 travel credit minus $900 equals $700 net gain. Ill count that as a SUB since I wouldnt have gotten it otherwise....... I know APR is crazy, but I always PIF.

..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Prestige conversion with less than 5K CL

good DP for people

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Prestige conversion with less than 5K CL

That'll be a nice datapoint going forward. Congrats on a successful PC!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Prestige conversion with less than 5K CL

Will they let upgraded customers book 4NF right away? Or can you not book for ~45 days?

We may see a trend of customers...myself possibly included...doing guerilla PCs when a 4NF opportunity approaches.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Prestige conversion with less than 5K CL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Prestige conversion with less than 5K CL

Thanks

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Prestige conversion with less than 5K CL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Prestige conversion with less than 5K CL

A big congrats, and enjoy the card.

|   |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Prestige conversion with less than 5K CL

should chat it up and ask for an APR decrease as well IMO that is an insane APR for a AF that high.. I betcha they would grant it. Even if you don't carry a balance citi is pretty good with lowering apr's. Just a principle thing for me personally.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Prestige conversion with less than 5K CL

Thanks for the suggestion I’ll call tomorrow and see if they can lower my apr. never thought about doing that actually. I still catch myself thinking that I’m lucky they even approved me, instead of now thinking they should treat me better for my business now that I think my scores and payment history should deserve better now......... even though I’m still in rebuild mode.