- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Comprehensive list of 5% rotators...Anything m...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Comprehensive list of 5% rotators...Anything missing?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comprehensive list of 5% rotators...Anything missing?

As a reminder, please ensure the discussion stays on track when discussing personal cards, not business cards. While any brief mention may be within the guidelines so that folks are aware of other factors or opportunities, if you wish to expand on business card in-depth comparisons, the Business Credit forums is the appropriate placement for such.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comprehensive list of 5% rotators...Anything missing?

Not sure if you saw this before, but I was looking at credit cards on google and came across this lol... If you ever do move to FL.

Addition Fi - 5x CB

The guy that got it says its 1cpp for statement credit and cashback so thats good but giftcard $50 for 6500 points.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comprehensive list of 5% rotators...Anything missing?

@TheBoondocks wrote:

Not sure if you saw this before, but I was looking at credit cards on google and came across this lol... If you ever do move to FL.

Addition Fi - 5x CB

The guy that got it says its 1cpp for statement credit and cashback so thats good but giftcard $50 for 6500 points.

Thanks for sharing this one @TheBoondocks, even though it's geo'd, I still love to know about everythig out there in the way of rotators/5%'ers. Think I just need to make one huge long-term road trip, establishing residency in Florida, Green Bay (PCM), and Arizona (VantageWest)!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comprehensive list of 5% rotators...Anything missing?

The Synovus Travel Rewards Signature VISA card offers 5% cash back on travel up to $5K per year, but it does have a $50 AF after the first year. It also unlimited 3% on dining, and a selectable 3% category of your choice up to $3K per quarter.

For us, it made sense because we spend slightly +/- $5K on travel yearly, so it was a way to earn $200 per year on travel, even after the AF kicks in. The points are worth 20% more when redeemed for travel rewards also. The card also has great travel related perks built in, so it made sense for us.

https://www.synovus.com/personal/charge/credit-cards/

- Get a head start on savings

Enjoy 0% APR for the first 6 months for purchases, balance transfers and overdraft protection.1 - Avoid high annual fees2

Pay no annual membership fee for the first year. Just $50 per year afterward. - Watch the rewards add up fast3

- 5x points on up to $5,000 annually in net spend for travel purchases, including hotel, airlines, car rental, and vacation packages

- 3x points on up to $3,000 in net spend quarterly for purchases in a Dynamic Earn4 category of your choice

- 1x points on all eligible purchases, with no limit on the points you can earn

- Rewards never expire, and you can transfer or gift rewards to other Synovus credit cardholders.

- Redeem your points online or by phone3

Book your travel or choose from merchandise, gift cards5 or cash back through My Synovus - Pay purchases off with points3

The Pay Me Back option lets you select specific transactions to pay off with points. - Use points to get you where you’re going5

Your points are worth 20% more when redeemed for travel rewards.

Hover over cards to see limits and usage. Total CL - $608,600. Cash Back and SUBs earned as of 5/31/24- $21,590.43

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comprehensive list of 5% rotators...Anything missing?

@JNA1 wrote:The Synovus Travel Rewards Signature VISA card offers 5% cash back on travel up to $5K per year, but it does have a $50 AF after the first year. It also unlimited 3% on dining, and a selectable 3% category of your choice up to $3K per quarter.

For us, it made sense because we spend slightly +/- $5K on travel yearly, so it was a way to earn $200 per year on travel, even after the AF kicks in. The points are worth 20% more when redeemed for travel rewards also. The card also has great travel related perks built in, so it made sense for us.

https://www.synovus.com/personal/charge/credit-cards/

- Get a head start on savings

Enjoy 0% APR for the first 6 months for purchases, balance transfers and overdraft protection.1- Avoid high annual fees2

Pay no annual membership fee for the first year. Just $50 per year afterward.- Watch the rewards add up fast3

- 5x points on up to $5,000 annually in net spend for travel purchases, including hotel, airlines, car rental, and vacation packages

- 3x points on up to $3,000 in net spend quarterly for purchases in a Dynamic Earn4 category of your choice

- 1x points on all eligible purchases, with no limit on the points you can earn

- Rewards never expire, and you can transfer or gift rewards to other Synovus credit cardholders.

- Redeem your points online or by phone3

Book your travel or choose from merchandise, gift cards5 or cash back through My Synovus- Pay purchases off with points3

The Pay Me Back option lets you select specific transactions to pay off with points.- Use points to get you where you’re going5

Your points are worth 20% more when redeemed for travel rewards.

Great info, thanks @JNA1

Seems like a better US Bank Connect, with 5x on travel. The no AF in the first year and only $50/year subsequent looks better as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comprehensive list of 5% rotators...Anything missing?

@PullingMeSoftly wrote:

@JNA1 wrote:The Synovus Travel Rewards Signature VISA card offers 5% cash back on travel up to $5K per year, but it does have a $50 AF after the first year. It also unlimited 3% on dining, and a selectable 3% category of your choice up to $3K per quarter.

For us, it made sense because we spend slightly +/- $5K on travel yearly, so it was a way to earn $200 per year on travel, even after the AF kicks in. The points are worth 20% more when redeemed for travel rewards also. The card also has great travel related perks built in, so it made sense for us.

https://www.synovus.com/personal/charge/credit-cards/

- Get a head start on savings

Enjoy 0% APR for the first 6 months for purchases, balance transfers and overdraft protection.1- Avoid high annual fees2

Pay no annual membership fee for the first year. Just $50 per year afterward.- Watch the rewards add up fast3

- 5x points on up to $5,000 annually in net spend for travel purchases, including hotel, airlines, car rental, and vacation packages

- 3x points on up to $3,000 in net spend quarterly for purchases in a Dynamic Earn4 category of your choice

- 1x points on all eligible purchases, with no limit on the points you can earn

- Rewards never expire, and you can transfer or gift rewards to other Synovus credit cardholders.

- Redeem your points online or by phone3

Book your travel or choose from merchandise, gift cards5 or cash back through My Synovus- Pay purchases off with points3

The Pay Me Back option lets you select specific transactions to pay off with points.- Use points to get you where you’re going5

Your points are worth 20% more when redeemed for travel rewards.Great info, thanks @JNA1

Seems like a better US Bank Connect, with 5x on travel. The no AF in the first year and only $50/year subsequent looks better as well.

No problem! It's been a good card so far. It's kinda like a BBVA ClearPoints card with a 5% travel category in the 3-2-1 rewards structure. They both use TSYS to handle rewards, and some of the rewards pages look identical.

Overall the app is nice, and they gave me good SL at $16K @ 12.99%

Hover over cards to see limits and usage. Total CL - $608,600. Cash Back and SUBs earned as of 5/31/24- $21,590.43

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comprehensive list of 5% rotators...Anything missing?

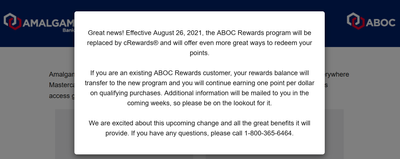

Just FYI......I have the ABoC MC and it's become one of my least favorite cards. I was a fan of it for a long time and advocated for it here on the forum.....my thought justification was 3.75% is still better than most of the 3% mainstream card/categories. But I just don't ever use it (and they gave me a crap-ball SL and require a HP to get any CLI). It's honestly the one single regret I have in my entire credit repetoir, which is why I don't even bother to list it in my siggy.

Also, they are no longer accepting apps for this card, so the point is moot anyway. Wipe this one off your whiteboard.

EDIT: I have also made the decision to close this card in Jan 2022. They are also changing their rewards structure to cRewards.

Sock Drawered

On Deck: No Plans Currently

On Deck: No Plans Currently

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comprehensive list of 5% rotators...Anything missing?

I really appreciate this thread and the hard work that you all have done to put these cards together. This is our philosophy of cashback.

Here's another card that will be in this category once it gets beefed up November 1:

Kroger Rewards World Mastercard from US Bank

5% Cashback on the first $3k spent annually on Apple Pay, Google Pay, Samsung Pay, Garmin Pay and LG Pay. Points are redeemable for statement credit, minimum 1000 points for $10. They expire if unused after 3 years. This looks like it could fill some gaps in people's spending. I really like that it allows the spend to be any time within the year. It could be a stopgap when the spend from another card is used up in a quarter or for spending that doesn't fit into other 5% categories. At 3k spend, the 5% cashback is at $150 per year. Also has 2% Kroger and 1% misc.

DOC writeup: https://www.doctorofcredit.com/changes-to-the-kroger-mastercard-5-cashback-on-mobile-wallet-on-up-to...

Apparently, (I may have this wrong) for the first year, if you put $100 spend on the card at Kroger, you get $2 cash back and 100 fuel points, redeemable for 25c off each gallon up to 35 gallons (up to $8.75 off) at participating gas stations, which is Shell in my area. The gas must be purchased on the card but doesn't earn the 1 point per dollar that general spend does. This looks worthwhile if you already shop at Kroger, especially if you have a two tanks to fill. Further fuel savings may be useful for people who will already be shopping at Kroger.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comprehensive list of 5% rotators...Anything missing?

Any strategy advice on how to get more than one USBank Cash+?

They seem to be pretty stingy with just the one. How long should one wait before applying for a second? Would it be easier to apply for something else and then PC?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comprehensive list of 5% rotators...Anything missing?

@MrDisco99 wrote:Any strategy advice on how to get more than one USBank Cash+?

They seem to be pretty stingy with just the one. How long should one wait before applying for a second? Would it be easier to apply for something else and then PC?

I think I've seen a number of folks around here with 2 Cash+s. IIRC, the main difficulty is gardening for the 1/12 limit for each of the cards.

But why not try for the (more common, and easier) combination of a Cash+ and an Elan MCP? You wouldn't need to garden to 1/12 for the Elan card, and if you wanted to use one or both of the Cash+-only categories that aren't found on the Elan MCP (i.e., Select Clothing or Ground Transportation), just set your Cash+ to those categories.