- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Continuing to improve my score - looking for a...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Continuing to improve my score - looking for advice

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Continuing to improve my score - looking for advice

@Bman70 wrote:I would say get 3, let them age together. It will play hell with your AAoA, but that's a minor part of FICO scores and as a student you're building your future anyway so now is the time to do it.

Everyone seems to have the Chase Freedom and the Discover IT. Which are solid rewards cards and combine well together.

Freedom, IT and Sallie Mae would actually be an excellent card portfolio. No annual fees either. If you're wanting to venture into rented cards

, Chase Sapphire Preferred gets waitresses' numbers, according to reports.

HAHA! Also if you currently bank with chase I would APP for the Freedom and CSP together!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Continuing to improve my score - looking for advice

Awesome! Thank you for the suggestions! Am I safe applying for 2 at once or should I wait a certain time between applications?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Continuing to improve my score - looking for advice

@Anonymous wrote:Awesome! Thank you for the suggestions! Am I safe applying for 2 at once or should I wait a certain time between applications?

2-3 at same time and after that garden for at least 6 months

Have you done your research of the CC?

Does it fit your spending?

Do you have a plan for the bonus w/o going into debt?

Can you afford the AF?

Do you know the cards benefits? Is it worth the HP?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Continuing to improve my score - looking for advice

@Bman70 wrote:Freedom, IT and Sallie Mae would actually be an excellent card portfolio. No annual fees either. If you're wanting to venture into rented cards

, Chase Sapphire Preferred gets waitresses' numbers, according to reports.

haha! I don't think the gf would be happy about that!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Continuing to improve my score - looking for advice

You can't go wrong with the Cap1 Quicksilver, Chase Freedom, Discover It and Sallie Mae for cashback.

I think a great 1-2-3 punch would be the Discover It, Sallie Mae and Quicksilver. I kind of like the Quicksilver since it gives 1.5% on everything, its nice to have when the cards with rotating categories can only offer 1%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Continuing to improve my score - looking for advice

@fargobzn wrote:You can't go wrong with the Cap1 Quicksilver, Chase Freedom, Discover It and Sallie Mae for cashback.

I think a great 1-2-3 punch would be the Discover It, Sallie Mae and Quicksilver. I kind of like the Quicksilver since it gives 1.5% on everything, its nice to have when the cards with rotating categories can only offer 1%.

the qs card makes me wonder if discover or chase will ever try to compete with the 1.5%

Card Ring $5000 Chase Marriott $5000,Chase Hyatt $5000, Sallie Mae Mastercard $4400, Paypal smart connect $4000,Chase Freedom $3200, Capital one Quicksliver visa $3000, Chase IHG Rewards $2300, Chase Southwest Premier $2000, Citi Double Cash $1500, AMEX BCE $1000

Last app July 22nd 2015- No apps for two years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Continuing to improve my score - looking for advice

Yep on the occasions the purchase is not gas (Sallie Mae or rotating Freedom or IT), food (Freedom, IT or Sallie Mae), Amazon (Sallie Mae), or one of the rotating categories, a solid everything card is nice. Has Quicksilver really cornered that market at 1.5%? I like my Quicksilvers, but someone must have invented a higher everything card by now... Anyone?

EX 822

TU 834

EQ 820

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Continuing to improve my score - looking for advice

@Bman70 wrote:Yep on the occasions the purchase is not gas (Sallie Mae or rotating Freedom or IT), food (Freedom, IT or Sallie Mae), Amazon (Sallie Mae), or one of the rotating categories, a solid everything card is nice. Has Quicksilver really cornered that market at 1.5%? I like my Quicksilvers, but someone must have invented a higher everything card by now... Anyone?

Fidelity Amex is everything at 2%, and Barclay's Arrival + is everything at 2.2%.

For the Fidelity Amex you need to have a CMA account with Fidelity (to get that 2% CB deposited there) and for the Arrival + you need to shell out $89 AF and cash out the points as travel redemption.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Continuing to improve my score - looking for advice

@Ghoshida wrote:

@Bman70 wrote:Yep on the occasions the purchase is not gas (Sallie Mae or rotating Freedom or IT), food (Freedom, IT or Sallie Mae), Amazon (Sallie Mae), or one of the rotating categories, a solid everything card is nice. Has Quicksilver really cornered that market at 1.5%? I like my Quicksilvers, but someone must have invented a higher everything card by now... Anyone?

Fidelity Amex is everything at 2%, and Barclay's Arrival + is everything at 2.2%.

For the Fidelity Amex you need to have a CMA account with Fidelity (to get that 2% CB deposited there) and for the Arrival + you need to shell out $89 AF and cash out the points as travel redemption.

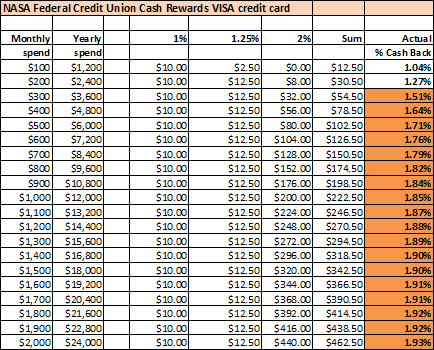

If you can spend an average of $300/month or more on your 'everything else' card, then the NASA federal credit union VISA card is another possibility.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Continuing to improve my score - looking for advice

@Ghoshida wrote:

@Bman70 wrote:Yep on the occasions the purchase is not gas (Sallie Mae or rotating Freedom or IT), food (Freedom, IT or Sallie Mae), Amazon (Sallie Mae), or one of the rotating categories, a solid everything card is nice. Has Quicksilver really cornered that market at 1.5%? I like my Quicksilvers, but someone must have invented a higher everything card by now... Anyone?

Fidelity Amex is everything at 2%, and Barclay's Arrival + is everything at 2.2%.

For the Fidelity Amex you need to have a CMA account with Fidelity (to get that 2% CB deposited there) and for the Arrival + you need to shell out $89 AF and cash out the points as travel redemption.

Fid amex would be nice. But having to open up the extra account and I think it takes a lot to get your rewards out plus its an amex so not everyone is gonna take it. Im sure for some the arrival is great I am hoping I made the right choice with a freedom/csp combo

Card Ring $5000 Chase Marriott $5000,Chase Hyatt $5000, Sallie Mae Mastercard $4400, Paypal smart connect $4000,Chase Freedom $3200, Capital one Quicksliver visa $3000, Chase IHG Rewards $2300, Chase Southwest Premier $2000, Citi Double Cash $1500, AMEX BCE $1000

Last app July 22nd 2015- No apps for two years.