- myFICO® Forums

- Types of Credit

- Credit Cards

- Credit card UTIL for FICO Boost suggestion

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit card UTIL for FICO Boost suggestion

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit card UTIL for FICO Boost suggestion

Hi all,

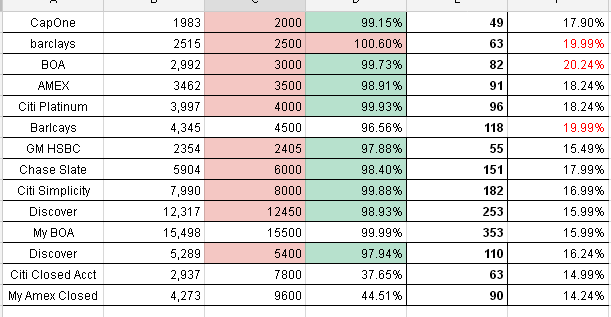

as you can see i've made some serious bad choices.

i have about 20k coming in from a loan. i'm trying to use that 20k in a way that would give me the biggest bang for bucks in terms of a FICO score boost.

any suggestions which ones to pay and at % would be very helpful.

Thanks in advance.

TU-793

EQ-801

EX-754

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit card UTIL for FICO Boost suggestion

May I ask if there is a reason you would like to prioritize your FICO score over prioritizing paying highest APR to lowest APR to save paying interest?

If you were prioritizing FICO, I would pay as many cards as I could to 10% but if I were prioritizing saving money, I would start with the highest APRs you have as red text in the table and pay down according to APR

Good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit card UTIL for FICO Boost suggestion

trying to boost my score past 700+ so that i could get a good mortgage rate and do a cash out refinance to pay off my debt. that way i would pay extra 200-400 in mortgage vs 1800 in credit card debt. and i could use the extra savings from the refinance towards my mortgage principal.

TU-793

EQ-801

EX-754

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit card UTIL for FICO Boost suggestion

@shorttough wrote:trying to boost my score past 700+ so that i could get a good mortgage rate and do a cash out refinance to pay off my debt. that way i would pay extra 200-400 in mortgage vs 1800 in credit card debt. and i could use the extra savings from the refinance towards my mortgage principal.

Don't want to be a downer but another card won't make a difference. First, you're going to have a very hard time getting approved for another card with that utilization across so many cards and second, any mortgage company will insist that those balances be paid down. Your best bet is to get your utilization down quite a bit and your score will rise accordingly. Any additional cards will not help. Use that 20K to pay your highest rate cards down first.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit card UTIL for FICO Boost suggestion

i'm not getting another card, but a p2p loan. already approved for 20k at 13% interest rate for 5 years.

the equity can be used to pay cards at closing to bring DTI under 45% for the loan. it doesn't have to be paid before closing.

TU-793

EQ-801

EX-754

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit card UTIL for FICO Boost suggestion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit card UTIL for FICO Boost suggestion

@Anonymous wrote:

@shorttough wrote:trying to boost my score past 700+ so that i could get a good mortgage rate and do a cash out refinance to pay off my debt. that way i would pay extra 200-400 in mortgage vs 1800 in credit card debt. and i could use the extra savings from the refinance towards my mortgage principal.

Don't want to be a downer but another card won't make a difference. First, you're going to have a very hard time getting approved for another card with that utilization across so many cards and second, any mortgage company will insist that those balances be paid down. Your best bet is to get your utilization down quite a bit and your score will rise accordingly. Any additional cards will not help. Use that 20K to pay your highest rate cards down first.

I didn't see where OP was requesting a new credit card. OP has money coming in and asked advice on the best way to pay down his/her highly utilized cards in a manner that will best boost his/her FICO score.

OP, me personally, knowing your stated goals, I'd pay off/down the cards with the highest monthly payments. Then take those payments and apply them to the next highest monthly payment and so on. As you pay down/off a card, request CLI's (only if they are SP's) to increase your limits and bring down your overall UTIL even more. The $20k you have coming in obviously won't cover all of your balances, spreading it out over the 14 accounts will still leave you with super high UTIL across the board. Having less cards reporting a balance, to me, seems the better route. If I was in your position and looking to boost my score, that would be my plan of attack. I'm sure others would do it differently (pay off lowest balance first/highest balance/highest APR).

Edited to add: My fear would be the lendor balance chasing you, lowering your limits as you pay down/off cards since your profile shows you close to maxed out.

CH 7 Filed 7/27/15 Discharged 11/16/15

Starting Score: EQ 620 TU 568 EX 593

Current Score (07/13/16): EQ 674 TU 649 EX 674 (FICO's 08)

Cap1 QS ($5350) (Combined QS and QS1) Discover It ($4100) MilStar ($8,600) Fingerhut ($800)

Off to the garden 05/01/16

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit card UTIL for FICO Boost suggestion

kjm79 wrote:

Edited to add: My fear would be the lender balance chasing you, lowering your limits as you pay down/off cards since your profile shows you close to maxed out.

humuhumunukunukuapua'a wrote:

Agreed. I was going to suggest paying the two Barclay's down as part of your overall strategy because they tend to be sensitive as a lender, but the above statement can come into play with them or with any lender. No lender is happy with that high of utilization.

I'm sorry you are in this situation but paying either the highest interest rate cards first or those with the highest monthly payments will afford you the most financial relief, it seems.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit card UTIL for FICO Boost suggestion

@shorttough wrote:i'm not getting another card, but a p2p loan. already approved for 20k at 13% interest rate for 5 years.

the equity can be used to pay cards at closing to bring DTI under 45% for the loan. it doesn't have to be paid before closing.

Ok, misread the title of your thread. If you get the loan focus on those with the highest interest rates first.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit card UTIL for FICO Boost suggestion

It looks to me you have smaller balances on the cards with the highest APR. You COULD pay those completely. With out doing the math, I don't know if that's the best move seeing as you have larger limits on other cards with interest rates that aren't THAT much better than your highest.

If you haven't already, I would contact every company and ask for an APR reduction before paying anything. If you have to recon and explain your situation, do it. All they can say is no. From there, pay down your highest balances to as close to 30%. So $10k on the BofA then maybe 4 or 5 on the Discover. Then at least something on every other card form there based on it's importance to you. If you have cards that could potentially grant a 0% BT offer after paying it off, bump those up the priority ladder.

If you were already going to make minimum payments, lump that amount up and pay off the next lowest cards that are due.

On another note, thank you for sharing this. Most members like to celebrate the great multiple approvals. You have shared what the reality is on the other end of the spectrum. Major Kudos to you.

*edit* Even if you throw $7.5k at the BofA, $3.5k at Discover that will leave you with $9 to split among the rest.