- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Credit one Amx Preapproved

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit one Amx Preapproved

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit one Amx Preapproved

1% cash back, $39 annual fee.

Must................. fight................... the.................. temptation...............

5% CB rotating:

;

;Everyday 3% CB:

;

;Everyday 5%:

;

;Companion Card:

;

;Everyday 2.2% CB:

;

;Retired to sock drawer after AOD (kept alive w/ 1 purchase every 6 mo):

;

;On my radar:

;

;Still Waiting for an Invite:

;

;No hope:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit one Amx Preapproved

@NoMoreDebt wrote:Ill admit, im unsure why AMEX would want their name attached to low end cards. I can only assume its beneficial to them monetarily with swipe fees and no risk of default?

I've always wondered that as well, are the swipe fees on subprime $700 CL cards really worth putting your name on?

they must have thought so

Current FICO 8:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit one Amx Preapproved

@NoMoreDebt wrote:Ill admit, im unsure why AMEX would want their name attached to low end cards. I can only assume its beneficial to them monetarily with swipe fees and no risk of default?

The only AMEX involvement with this card is to process the payment versus using the Visa or MasterCard networks. Other than the network used, this card is in no way, shape, or form an AMEX card.

Chapter 13:

- Burned: AMEX, Chase, Citi, Wells Fargo, and South County Bank (now Bank of Southern California)

- Filed: 26-Feb-2015

- MoC: 01-Mar-2015

- 1st Payment (posted): 23-Mar-2015

- Last Payment (posted): 07-Feb-2020

- Discharged: 04-Mar-2020

- Closed: 23-Jun-2020

I categorically refuse to do AZEO!

In the proverbial sock drawer:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit one Amx Preapproved

I know I'm going to be in the minority here but....

I got a Credit One Amex 5x card as my 2nd card after my BK DC on 3/22. I was approved via an offer from Experian's website for the card. After reading the terms, I noticed that I would be getting 5% back on Gas and Groceries up to 10k per year with a $95 af. Yes, the af stinks BUT, since getting the card back in May of 2022 they have sent me 3 months of additional 5% off Walmart and Amazon purchases for the month up to $500 of spend. That's an extra $75 in CB on top of $500 max cash back for year (which I will easily hit). So for $95 I get $480.

I was able to easily add my wife as an AU and other than their payments taking FOREVER to post and update available balance, I've had no issues with them at all.

I won't keep the card forever but, for the next 3-5 years I'll hold on.

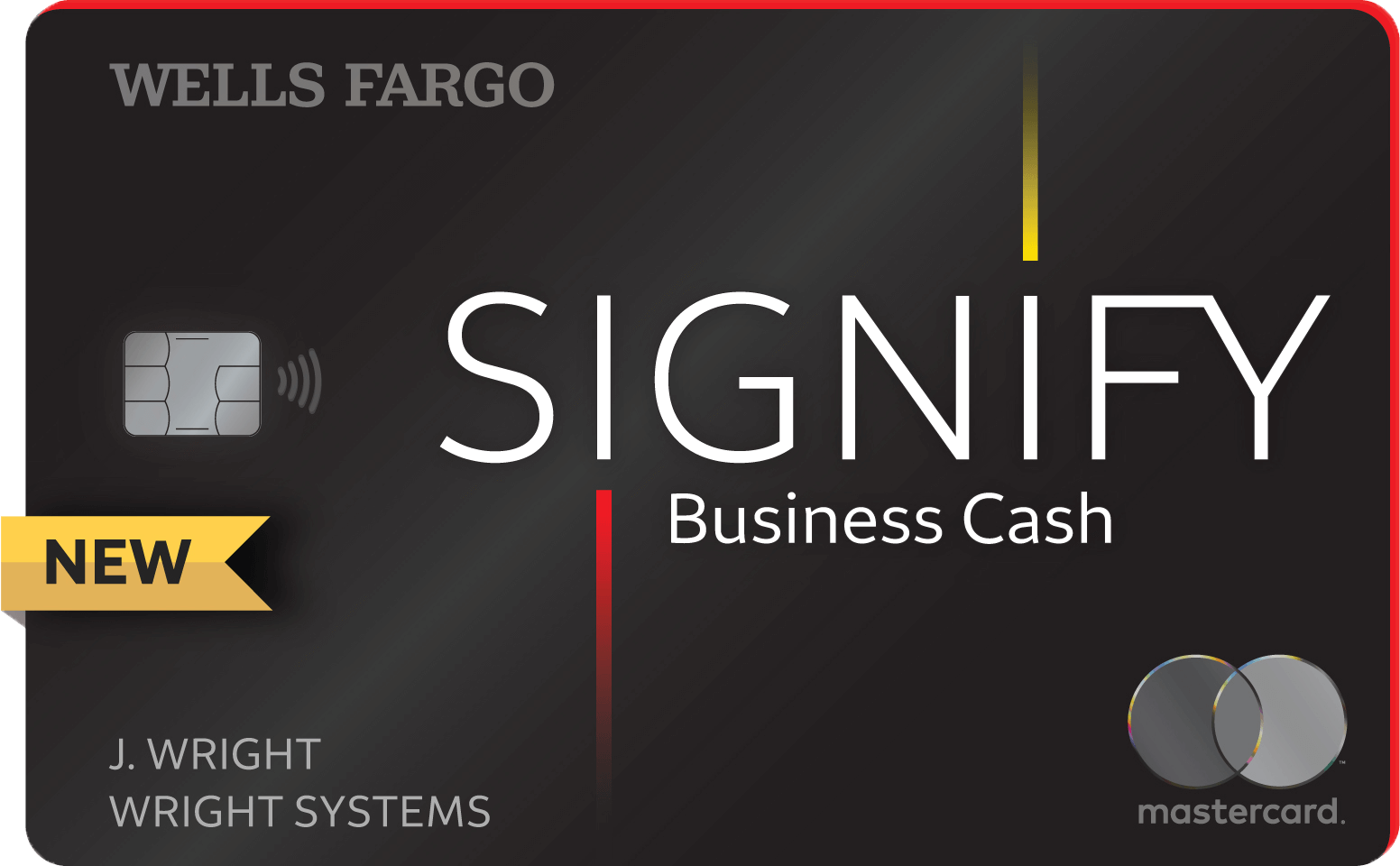

Business Cards: Total CL $43,800

FICO 8: Equifax - 686 / Transunion - 727 / Experian - 678

FICO 9: Equifax - 659 / Transunion - 776 / Experian - 673

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit one Amx Preapproved

True, but Amex also shills the Credit One card when they decline someone for one of their own cards. When Amex first tried out the SP approval I tried it knowing I'd be denied just to see what it would say since I wasn't past their 5yr1m milestone from BK. Just below the denial they were suggesting applying for a Credit One Amex with a link to them. I didn't go down that path and just waited out the period for a BCP (still getting Credit One offers from CK and in the mail though).

June 2022 FICO 8:

June 2022 FICO 9:

Apr 2025 FICO 8:

Apr 2025 FICO 9:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit one Amx Preapproved

Acting as a shill for CreditOne is logical following a denial. Why? AMEX would rather you put a card which uses the AMEX payment network in your pocket versus putting a Visa or MasterCard in it. To make this happen AMEX refers denied applicants to the lowest of the low cards on the AMEX network, yup, you guessed it, the card from Credit One.

Chapter 13:

- Burned: AMEX, Chase, Citi, Wells Fargo, and South County Bank (now Bank of Southern California)

- Filed: 26-Feb-2015

- MoC: 01-Mar-2015

- 1st Payment (posted): 23-Mar-2015

- Last Payment (posted): 07-Feb-2020

- Discharged: 04-Mar-2020

- Closed: 23-Jun-2020

I categorically refuse to do AZEO!

In the proverbial sock drawer:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit one Amx Preapproved

I understand what you are saying about credit one bank and the offer I got had no annual fee. 2 of my relatives have credit one Amx no annual fees and it is a good bank to help those who are rebuilding their credit. I was told by the 2 relatives there haven't been any issues .

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit one Amx Preapproved

@ptatohedSo did you fight the TEMPTATION OR DID YOU GIVE IN LOL 🤔

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit one Amx Preapproved

You are not in the FICO FORUMS MINORITY HERE ON THE SUBJECT OF CREDIT ONE BANK....But, I am glad you and DW are enjoying credit one bank and not having any issues. Enjoy!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit one Amx Preapproved

@GZG wrote:

@NoMoreDebt wrote:Ill admit, im unsure why AMEX would want their name attached to low end cards. I can only assume its beneficial to them monetarily with swipe fees and no risk of default?

I've always wondered that as well, are the swipe fees on subprime $700 CL cards really worth putting your name on?

they must have thought so

Money , name recognition .. reeling in Amex cardholder wannabes for the future