- myFICO® Forums

- Types of Credit

- Credit Cards

- Delayed Systems

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Delayed Systems

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Delayed Systems

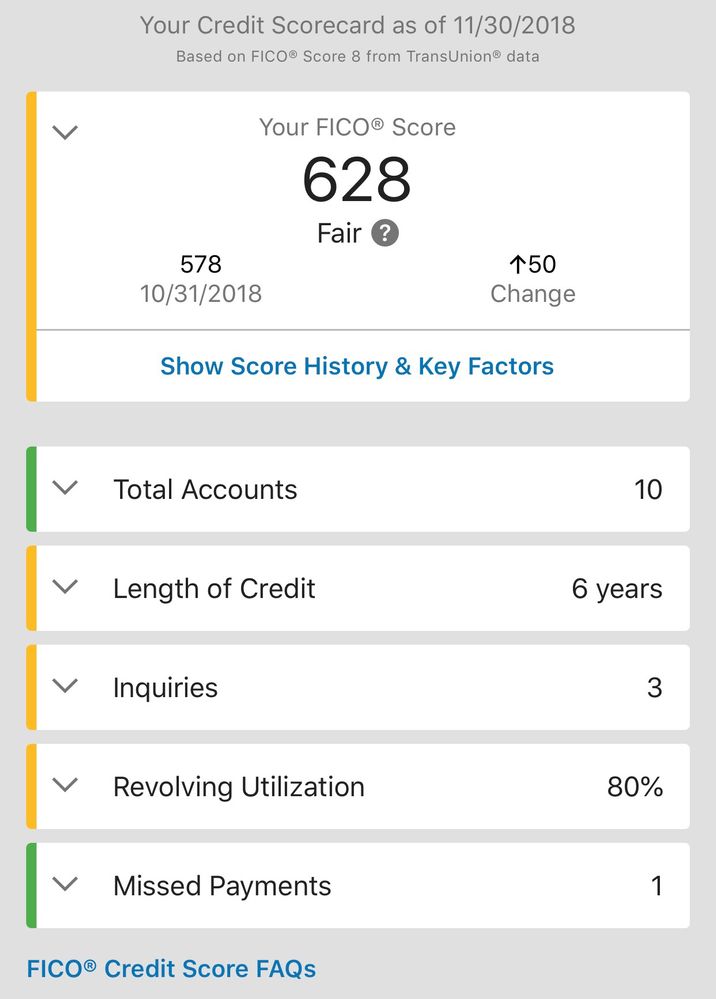

For weeks I have tried to get CLIs on my accounts. Recently my scores went over into the 600s (Finally). I have not received any CLIs for any accounts in over a year understandably.Today I received my CLI denial letters & noticed Kohls as well as Capital one are using my old scores.

Kohls is using Sept 18’ scores

Capital One is using Oct 18’ scores

Capital one is throwing the excuse, that the balances on all accounts are too high. My current scores and balances have been reduced this week. Unfortunately my Discover Scorecard updated Nov. 30th so my newly lowered balances did not reflect for that scorecard.

I was just approved for an HSN CC with a SL of $750 which pulled my most recent EQ FICO score.

I am hoping they use my updated scores soon. I really would love to bring down my UTL by increasing the limits on some if not all of my CCs while also paying down balances.

If anyone has experienced the same or has any information regarding this please comment!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Delayed Systems

If you call and ask, Capital One can probably tell you when you're up for an account review. I would think it'd be very soon.

But yeah, expect them to operate on an old pull. The only information that they're likely to have that's more recent is anything pertaining to your Capital One accounts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Delayed Systems

GL2U

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Delayed Systems

I'm glad it's not just me that is seeing my scores be slow to update and show up.

My scores have dramatically gone up in the last few days. (Big debt paid off, some positive changes that have resulted in 60-70 point rise.) Experian and Equifax FICOs have updated (according to CreditCheckTotal) but TransUnion is lagging behind. Today I got alerts that Transunion had updated! FAKO says it's updated 70-something points! Woo hoo! But when I get to CreditKarma (and other free services I use like NerdWallet), all I get is a new credit account (my humble little Green Dot secured card is reported) but no mention of the massive lowering of debt and the settled CC. I'm pretty sure that new card doesn't account for a 70 point rise in points, but this is FAKO, so who what do I know. I check my FICO scores in CreditCheckTotal, and Transunion (which has, remember, gone up 70 points in FAKO) is the same old same old 500-something score and has the big debt still listed.

Also, last night I did some pre-approval apps (for fun) to see if anyone was interested since my scores are now hovering around the lower end of "fair." I got a rejection from one who listed an Experian score in the mid-500s.

On the other hand, I've gotten a few pre-approvals from banks that (a few weeks ago) thought I was poison. (Most notably, Discover.)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Delayed Systems

| Total CL: $321.7k | UTL: 2% | AAoA: 7.0yrs | Baddies: 0 | Other: Lease, Loan, *No Mortgage, All Inq's from Jun '20 Car Shopping |

BoA-55k | NFCU-45k | AMEX-42k | DISC-40.6k | PENFED-38.4k | LOWES-35k | ALLIANT-25k | CITI-15.7k | BARCLAYS-15k | CHASE-10k