- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: FNBO massive credit line decrease

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FNBO CLD ****Master Thread****

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO massive credit line decrease

@Spotsy they cut the credit line from 15k to 500. I was the one that closed the account. I am fine with the situation. I agree with your interpretation of their "reasons". They are exactly my situation lol.

FNBO was a "flavor of the month" card last year on this board, and I got caught up in the hype. I use my Evergreen card, but could easily close that one as well since I have other 2% reward cards. I never used the Getaway card since with Covid restrictions and travel chaos, I don't fly nearly as much as I used to so I don't need travel rewards. The new $500 credit limit will probably report, but it will report as a closed line. I'll deal with any fall out from my other cards as they come.

My fico is strong, my debt is low, (except for student loans but that is another topic for another day lol) and my income is solid. I can withstand the loss of a few of my cards.

Moral of my story: Use your FNBO cards if you want to keep them. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO massive credit line decrease

@lgtwriter, Sorry for your CLD![]()

I like that you are keeping it reasonable and rational and not "FNBO is Trash"

I whole heartily agree with you on using ones FNBO cards.

It is going to be "use it or lose it" situation.

I believe they are proactively mitigating "risk" , not that specifically you are a risk.

We are entering an environment where credit card debt is escalating, and some lenders are starting to take action,

before they could have massive loses.

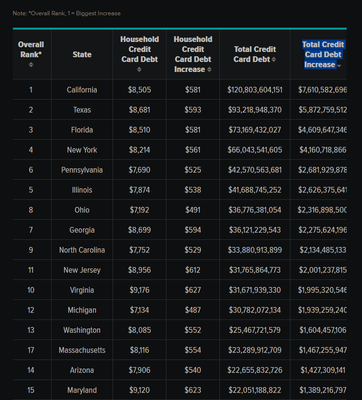

Some stats on current credit card debt:

https://wallethub.com/edu/cc/credit-card-debt-study/24400

Credit Card Debt Increase by State

Note: *Overall Rank, 1 = Biggest Increase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO massive credit line decrease

@lgtwriter wrote:Hi all,

I posted this in another thread as a reply yesterday, but I just wanted to raise awareness by starting a thread of my own. I received a letter in the mail yesterday from FNBO. I have two credit cards with them, the Evergreen Visa with a 15k credit line, and the Getaway Mastercard with a 15k credit line. They cut my credit line on the Getaway card from 15k to 500 dollars. I called and closed the card immediately upon receiving the letter. Here are my data points:

I never used it much (about two or three under $50 purchases in a year I think).

My FICO is 791 and my utilization is 2% with no more than 7% utilization on any card.

I have about 6-8 inquiries on each credit bureau and have been in the garden (except for credit line increases) for about 8-10 months.

The reasons they gave for the credit line decrease (these are taken directly from the letter they sent) are:

Length of time since account opened

Pattern of account use

Current balance as % of recent balances.

I had the card around ten months, my pattern of use was no use really lol. And my current balance was zero.

My other FNBO card, the evergreen card was left at its original 15k limit. I use that for doordash, online purchases, etc so they get a lot of swipes from me. I pay it off most months but sometimes leave a small balance (under $500) and pay it off the next month. I currently have a balance of about $500 on the Evergreen card that will be paid off when it's due the first week of October.

Anyway, I would be careful to make sure you use all your FNBO cards. This is just a data point. I have nothing on any report that would have caused FNBO to cut my limit like that except non-use. As I said, I closed the getaway card. For now I am keeping the Evergreen card open, but I am going to cut down on usage. Since I have gotten credit line increases on several cards in the last couple of months this will result in about a net $5k loss in overall credit for me, but I have way too much credit anyway (over $250k of credit limits)

Since my credit line decrease is non-use based, it might not affect anyone else here, but I just wanted to post this thread as an FYI.

I think it's ridiculous when a bank does something like that to a customer like you, who is basically gold.

If they want to reduce unused credit lines, they should have given you a notice that your credit limit may be reduced if the usage level doesn't increase. And then, if the usage level didn't increase, to reduce the credit limit by 25%, not 97%.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO massive credit line decrease

@SouthJamaica wrote:I think it's ridiculous when a bank does something like that to a customer like you, who is basically gold.

If they want to reduce unused credit lines, they should have given you a notice that your credit limit may be reduced if the usage level doesn't increase. And then, if the usage level didn't increase, to reduce the credit limit by 25%, not 97%.

But IMO it's a big jump of faith for them to conclude that the customer is basically "gold" Sure, not a credit risk, but scores 790+ are hardly rare, and the OP hasn't shown a great deal of value on either card. Yes, in future things may change, but (probably more likely) they won't, and FNBO is reserving a fairly large credit line that could potentially go to other customers who would generate more swipe fees (or even low-risk interest, slobber slobber!) And the cut to $500 may have worked as intended, if the OP has wanted to "mend his/her ways" they could have put lots of charges on, cycling the limit. The fact they closed the card showed they were fine without it, and now FNBO has the whole CL back to do with as they need

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO massive credit line decrease

@Anonymous I think it's hyperbole to say that I am not showing "a great deal of value" on the Evergreen card. I swipe often and pay off what I charge. I am not sure why that is not "a great deal of value". For what it's worth, FNBO hasn't cut my limit on the Evergreen card so they must think I am providing some value. ![]() Not every card user is going to charge large purchases every month and pay them off quickly. I would think leaving large balances on a card in this economic climate is also perceived as a risk. As with anything credit related, YMMV.

Not every card user is going to charge large purchases every month and pay them off quickly. I would think leaving large balances on a card in this economic climate is also perceived as a risk. As with anything credit related, YMMV.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO massive credit line decrease

@lgtwriter wrote:@Anonymous I think it's hyperbole to say that I am not showing "a great deal of value" on the Evergreen card. I swipe often and pay off what I charge. I am not sure why that is not "a great deal of value". For what it's worth, FNBO hasn't cut my limit on the Evergreen card so they must think I am providing some value.

Not every card user is going to charge large purchases every month and pay them off quickly. I would think leaving large balances on a card in this economic climate is also perceived as a risk. As with anything credit related, YMMV.

I didn't mean "no value, "great deal" as in "large amount" @SouthJamaica used some term such as "basically gold" which, to me, implies of high value to the credit card issuer, giving them a LOT of income from swipes, fees etc, and from what you said, you weren't providing that "great deal of value" to justify the label.

And sure, the bank is happy enough with your spend on the still open card, but clearly not so overwhelmed that computer checks didn't trigger on the other cand saying "Oh, no AA on this customer's account"

I didn't mean to demean your spend, your credit or anything, just disagreeing with SJ that the bank should tread more lightly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO massive credit line decrease

Thanks for the data points on FNBO, @lgtwriter. I previously had a low-interest rate card with them but closed it when it was no longer needed. I like FNBO but didn't know that they were more sensitive to spending and usage patterns.

In general, though, this is a great reminder for the overall topic of credit card usage, not just for FNBO.

- Credit limits belong to the lender. They are just potential debt; they aren't part of a "portfolio" of value; and they are only loaned to us at the lender's discretion. Credit comes and credit goes. Consequently, diversification is an important quality when establishing a card lineup, not only for rewards diversity or payment network diversity but also to protect Total Credit Limits.

- Economic conditions may cause lenders to cut risks, as pointed out by @M_Smart007 and which we've seen in the past with other lenders such as Synchrony.

- Lenders often want to see significant usage of limits to grant increases but also may want to see significant usage just to keep those limits intact. While my own personal experience has been that many of my lenders have allowed my limits to stay intact with low-to-moderate usage, I've also had cards closed or CLD'd for low/no usage. On the other hand, I've had cards sometimes stay open for years without a single swipe, no questions asked. A strong profile may decrease the likelihood of becoming a target for CLD or closure, but in some cases even that doesn't matter.

- In keeping with the above point, 50-cent Amazon gift card reloads or buying a $2 candy bar once every six months may not be considered significant usage. It's not always a successful tactic to keep a card from CLD or closure. OP used his card for much more than that and still didn't satisfy FNBO's desire for usage. Personally, I don't want to have to manage many less-valuable and unused credit lines just to keep them open. That's why I prefer to try to focus spending (and CLIs) on fewer and higher value cards. IMO, having one $30K card that offers good overall value and ease of management is better than having to manage 10x $3K cards for the same TCL.

Business Cards

Length of Credit > 42 years; Total Credit Limits > $947K

Top Lender TCL - Chase 156.4 - BofA 99.9 - CITI 97.5 - AMEX 95.0 - NFCU 80.0 - SYCH - 65.0

AoOA > 32 years (Jun 1993); AoYA (Oct 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO massive credit line decrease

Definitely sounds like it was closed for non-usage. Thanks for the DPs.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO massive credit line decrease

Thank you, OP, for the data point. I have the Evergreen which doesn't get used due to the minimum redemption requirement. I got it for the 0% APR at the time and it served its purpose. I have been wondering how long it will take them to close for non-use.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO massive credit line decrease

@wingennis I had my card around ten months give or take. They cut the limit and I closed the card myself. some people might want to keep the card in those circumstances, and try to groom it back to growth. For me it was a "cut my losses and move on" experience and choice however.

I will probably close the Evergreen card as well once I pay off my balance on the due date the first week of October. I really don't want to have to charge a bunch of stuff on cards to keep them. In the tightening economy, I am willing to close some cards. I don't need the padding, and I don't use the cards, so I don't mind trimming my collection here and there.

I never needed either FNBO card to be truly honest lol. ![]() I got caught up on the "flavor of the month" hype re FNBO last year. I'm in the garden now and don't do "flavor of the month" anymore.

I got caught up on the "flavor of the month" hype re FNBO last year. I'm in the garden now and don't do "flavor of the month" anymore.![]()