- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FNBO

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO

@Anonymous wrote:

@B335is wrote:

@Anonymous wrote:

@wacdenney wrote:

@Anonymous wrote:

@daybreakgonesXe wrote:themanwhocan typically does a good review on it, but if you would like an FNBO card, the New York Life Rewards Visa is a good deal:

https://www.firstbankcard.com/newyorklife/001/personal.fhtml

If you get approved for the Visa Siggy, it's unlimited 1.5% back. However if you get approved for the Platinum Visa, it's only a vanilla 1%. The card also offers a free EX FICO.

Card looks nice as well, would love to know who they pull but I guess I could call and get that info.

Call and find out! I dare you!!

Just called and the lady said they pull Equifax which is tempting me because my score just gained about 30 points to 776. Hmmm....

Do you have a lot of new accts or inq on your EQ? They can be sensitive, but if I managed to get over that issue, pretty much anybody can.

I do, I have about 6-7 new inquiries. I also mentioned that i've had a savings account with FNBO DIrect and she said that can help approval chances as well.

I'm pretty sure they manually review around 99% of applications. I was expecting a flat out denial, but one of their CSR's called to ask why I had so many new accts. I said I was searching for lower APR. He forwarded my response to underwriting and it was approved about 2 hours later. I had fewer inq on my EQ, but didn't have any relationship to them prior. Not sure if that helps or not, but I'd say you have a good chance. My EQ Fico was also around 745 at the time I believe.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO

It says 1.5 points per 1 dollar spent if visa sig and 1 point per 1 dollar spent if platinum. Does anyone know how much is their 1 point worth? Can I get a check or credit back for their points?

@daybreakgonesXe wrote:themanwhocan typically does a good review on it, but if you would like an FNBO card, the New York Life Rewards Visa is a good deal:

https://www.firstbankcard.com/newyorklife/001/personal.fhtml

If you get approved for the Visa Siggy, it's unlimited 1.5% back. However if you get approved for the Platinum Visa, it's only a vanilla 1%. The card also offers a free EX FICO.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO

I'll add my take on what I know from all my research about FNBO before applying and I did a lot of research.

They will not approve an app unless:

1) you live in their banking foot print

2) or you receive an invitation to apply and in this case it doesn't matter what state your in......I'm in Florida

If you receive an invitation its as good as gold unless your profile has changed since receiving the invitation....

IE...went on a app spree, a baddie popped up on your CR's.....

Everything is manually reviewed but usually approved the same day if you apply early

In my months of research I did.... I didn't find any cases of forum members applying with the invitation not being approved. Every last one was approved.

I did see one denial after I was approved but that person had been on an app spree and was thus denied for new accounts.

SP CLI's I love them for that just call every 3-4 months HP if asking via computer

Great customer service

I have the Amex version which gives 2% on gas and groceries

Have you done your research of the CC?

Does it fit your spending?

Do you have a plan for the bonus w/o going into debt?

Can you afford the AF?

Do you know the cards benefits? Is it worth the HP?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO

Well here is a baffling response for ya. I think when you receive a preapproval that it is almost always a done deal from my own experience as well as countless others i've read on here and other forums. I received a pre approval in June for their Amex. I live in Kentucky so def not in their service area. My scores during pre approval were 665 685 and 708. I checked my reports and saw they'd SP'd EX around the first of June at which time I only had 2 new accounts from CapOne and BOA. At the end of June I went on an app spree and added several new accounts Chase, Citi, Amex, Discover, Wal-Mart, PPSC, and Barclays. I had several inquiries from Car shopping back last October and then a total of 9 or 10 new credit inquiries for cards. After my spree I decided to go ahead and accept their offer while I was at it so a couple days later I got online and put in my pre approval code and info. It said will receive something within 30 days. I called in and they said they manually review ALL applications and I would hear something within 10 days. I called and checked their auto line once a day after that and on the 4th day got the message "Congratulations...you've been approved with an initial CL of $2200". I was amazed to say the least after all the stuff I had read on here and other sites about their strict criteria against new accounts and inquiries. I may have been a one in a million, but honestly with my luck I highly doubt it lol. I just think that they are one of the very few left that you can still put good faith in their pre approvals! I might also add that that is the only way to get in with them without living in their banking area as the CSR told me you have to get an invite by mail if you do not live in their area.

Hope this helps![]() Good luck!

Good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO

Oh yeah...forgot to mention that they pulled EX for me for the app and the SP invite they sent me. Again in Kentucky. Also I don't know if it was just mine or if their offer has changed some but mine was just a flat 1% CB on all purchases and 1 point is 1%. In reality the CB is nothing special and certainly no reason on its own to go for the card especially since the points expire after 3 years from earning date and most other cards have better CB and no expiration on points, BUT for me the main reason for applying (besides thier fancy invite![]() lol was the fact that you can get SP CLI's so frequently without much hassel. Even though I don't necessarily need it I still like having the extra credit in case i did decide to make a large purchase or had a life emergency and needed it, I wouldn't have to worry about my utilization going down the drain.

lol was the fact that you can get SP CLI's so frequently without much hassel. Even though I don't necessarily need it I still like having the extra credit in case i did decide to make a large purchase or had a life emergency and needed it, I wouldn't have to worry about my utilization going down the drain.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO

Not sure why they hate georgia, I'm in Wisconsin and they approved me for thier discover card, with a 6k CL, that has since grown to 14.9k, never been to nebraska, they don't have any branches here that I know about.

Landmarkcu Personal Loan 10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO

Well... Since I have 18 INQs on EQ and 13 on EX and I don't live in their service area, I think I'm going to pass. As much as I would LOVE a monthly EX FICO I just don't think I stand much of a chance. I rarely get preapproval offers in the mail so I'm not going to hold my breath for that either.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO

Well don't lose all hope...I have had only 2 approval offers in the mail to this day that matters and that was FNBO and BOA. Both of which ppl said at the time shouldn't have fit into my CR at all with their criteria. I get the crappy first premier and credit one mailers all the time, but those are the only 2 prime mailers i've ever gotten. All the rest of my cards/apps were cold apps. So hears to giving you back some hope....you just never know what may happen![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO

@jamesdwi wrote:Not sure why they hate georgia, I'm in Wisconsin and they approved me for thier discover card, with a 6k CL, that has since grown to 14.9k, never been to nebraska, they don't have any branches here that I know about.

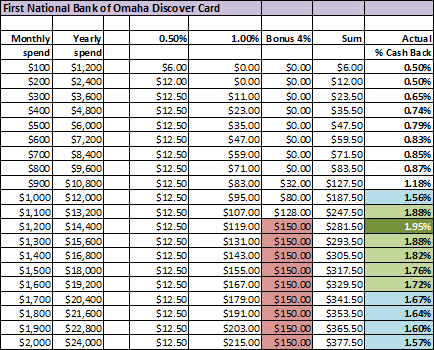

I hope thats not the FNBO Discover card with the 5% cash back, but it starts at 1/2 % then 1% and finally 5% (but only very briefly)...

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO

@Themanwhocan wrote:

@jamesdwi wrote:Not sure why they hate georgia, I'm in Wisconsin and they approved me for thier discover card, with a 6k CL, that has since grown to 14.9k, never been to nebraska, they don't have any branches here that I know about.

I hope thats not the FNBO Discover card with the 5% cash back, but it starts at 1/2 % then 1% and finally 5% (but only very briefly)...

Thanks. You always seem to serve up some good meat to bite into for us Stat Junkies ![]()