- myFICO® Forums

- Types of Credit

- Credit Cards

- Grandfathered Venture X Card?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Grandfathered Venture X Card?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Grandfathered Venture X Card?

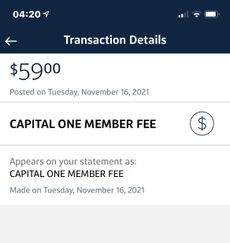

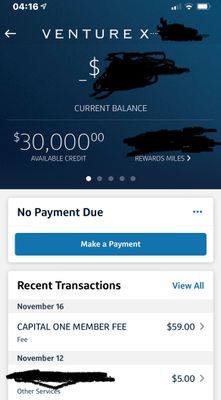

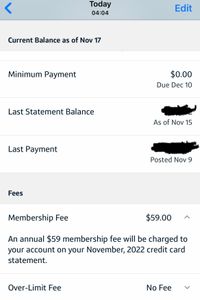

Did I get a Grandfathered Venture X?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Grandfathered Venture X Card?

Sounds like you really lucked out, at least for now! I really doubt if there can be an "official" policy about this, grandfathering usually will fix the AF (and/or rewards) for an existing card, not once you PC.

I would suggest you try to use the travel credit (if you have something to book of course) and see what happens. A $300 credit (+ other perks) for $59 would be very nice.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Grandfathered Venture X Card?

Very nice! Hopefully this sticks. I would love to try to PC one of my Cap One cards, but neither of them are near 10k limit lol.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Grandfathered Venture X Card?

@Yasselife wrote:@Anonymous What's considered a "grandfathered" card, how old?

I think he means grandfathered as in he's paying old AF on his Venture on the new Venture X after he PC'd it

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Grandfathered Venture X Card?

@jcooks wrote:

@Yasselife wrote:@Anonymous What's considered a "grandfathered" card, how old?

I think he means grandfathered as in he's paying old AF on his Venture on the new Venture X after he PC'd it

Right, basically the old conditions stay on your existing card, whereas new applicants for the same card get different (worse!) conditions. A good Capital One example was the Savor, those with it were allowed to get 4% with no AF, new applicants wanting that card had to pay an AF (or get the 3% free Savor one). In your case you PCd an existing card, and while that will often keep credit limit and APR, fees and rewards usually change.

And often there is no grandfathering at all, the new fees/conditions apply to all after the next renewal.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Grandfathered Venture X Card?

Good luck! Hope it stays that way.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Grandfathered Venture X Card?

@Anonymous wrote:

@jcooks wrote:

@Yasselife wrote:@Anonymous What's considered a "grandfathered" card, how old?

I think he means grandfathered as in he's paying old AF on his Venture on the new Venture X after he PC'd it

Right, basically the old conditions stay on your existing card, whereas new applicants for the same card get different (worse!) conditions. A good Capital One example was the Savor, those with it were allowed to get 4% with no AF, new applicants wanting that card had to pay an AF (or get the 3% free Savor one). In your case you PCd an existing card, and while that will often keep credit limit and APR, fees and rewards usually change.

And often there is no grandfathering at all, the new fees/conditions apply to all after the next renewal.

Right. I'd be very curious to see when the actual AF for Venture X will hit 🎯

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Grandfathered Venture X Card?

@FinStar Me too but I'm hoping to get lucky again. After all my Savor still has no annual fee and my Venture remaind at $59 for 4 years. In a way it's almost not totally crazy for Capital One to waive the fee increase since it's still costing them less than the SUB.